Question

Multinational corporation has closed on a 5-year floating rate loan for $10 million with a financial institution. Interest rate coupons are paid annually, and then

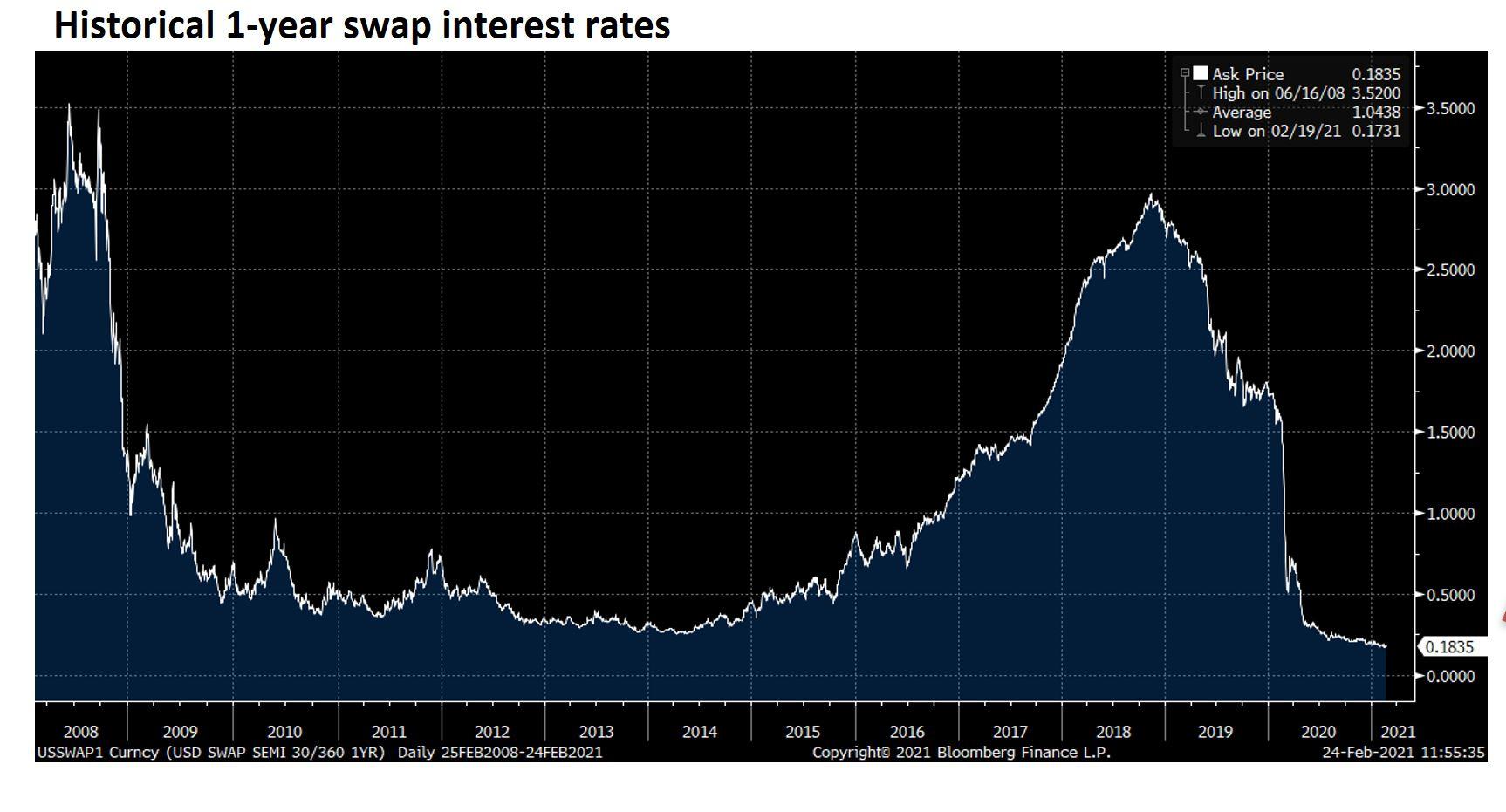

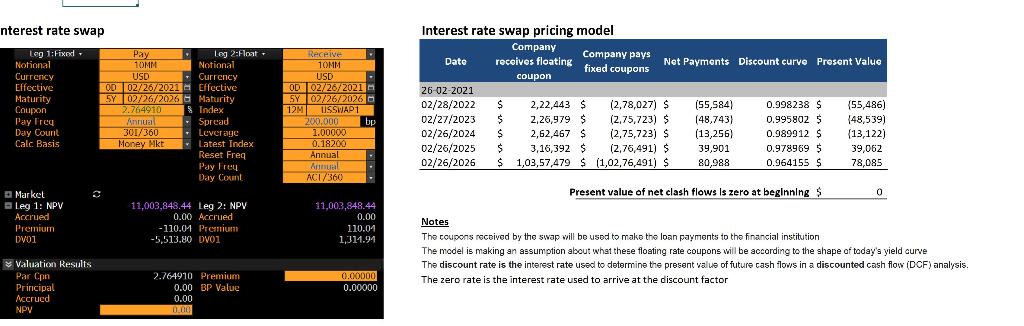

Multinational corporation has closed on a 5-year floating rate loan for $10 million with a financial institution. Interest rate coupons are paid annually, and then the $10 million is repaid at the end of 5-years. The coupon is a floating rate coupon that will be determined as follows. At the end of each year 200 basis points or 2.00% will be added to the prevailing 1-year swap interest rates (highlighted in the chart to the right).

The CFO of the company is worried that interest rates may rise in 2021 and beyond. If this happens, the company's borrowing costs will rise.

Questions:

1) 'Illustrate' the risk the company is exposed to using quantitative validation.

2) What can the company do to hedge against this risk? 3) What is the natural solution not involving derivatives?

4) What is the solution involving derivatives?

5) 'Illustrate' the value of hedging using quantitative validation.

6) What if interest rates go to zero? Show the economic outcome.

Historical 1-year swap interest rates Ask Price 0.1835 T High on 06/16/08 3.5200 Average 1.0438 I Low on 02/19/21 0.1731 3.5000 3.0000 2.5000 2.0000 1.5000 1.0000 0.5000 0.1835 -0.0000 2014 2019 2008 2009 2010 2011 2012 2013 USSWAP1 Curncy (USD SWAP SEMI 30/360 1YR) Daily 25FEB 2008-24FEB2021 2015 2016 2017 2018 Copyrights 2021 Bloomberg Finance L.P. 2020 2021 24-Feb-2021 11:55:35 nterest rate swap Notional receives floating fixed coupons Leg 1: Fixed Notional Currency Effective Maturity Coupon Pay Free Day Count Calc Basis Pay Leg 2:Float 10MM USD - Currency 00 02/26/2021 Effective 5Y 02/26/20266 Maturity 2.764910 Index Annua Spread 301/360 - Leverage Money Mkt Latest Index Reset Freq Pay Trey Day Count Receive 10MM USD OD 02/26/2021 SY02/26/2026 12M USSWAPI 200,000 bp 1.00000 0.18200 Annual ma ACT/360 Interest rate swap pricing model Company Date Company pays Net Payments Discount curvo Present Value coupon 26-02-2021 02/28/2022 $ 2,22,443 $ (2,78,027) $ (55,584) 0.998238 $ {55,486) 02/27/2023 $ 2,26,979 $ (2.75,723) $ (48,743) 0.995802 $ 148,539) 02/26/2024 $ 2,62,467 $ (2,75,723) $ (13,256) 0.989912 $ (13,122) 02/26/2025 $ 3,16,392 $ (2,76,491) $ 39,901 0.978969 $ 39,062 02/26/2026 $ 1,03,57,479 $ (1,02,76,491) $ 80,988 0.964155 $ 78,085 Present value of net clash flows is zero at beginning $ 0 Market leg 1: NPV Accrued Premium DV01 11,003,848.44 Leg 2: NPV 0.00 Accrued -110.01 Premium -5,513.80 D101 11,003,848.44 0.00 110.04 1,311.94 Notes The coupons received by the swap will be used to make the loan payments to the financial institution The model is making an assumption about what these floating rate coupons will be according to the shape of today's yield curve The discount rate is the interest rate used to determine the present value of future cash flows in a discounted cash flow (DCF) analysis. The zero rate is the interest rate used to arrive at the discount factor Valuation Results Par con Principal Accrued NPV 0.000 0.00000 2.764910 Premium 0.00 BP Value 0.00 0.00 Historical 1-year swap interest rates Ask Price 0.1835 T High on 06/16/08 3.5200 Average 1.0438 I Low on 02/19/21 0.1731 3.5000 3.0000 2.5000 2.0000 1.5000 1.0000 0.5000 0.1835 -0.0000 2014 2019 2008 2009 2010 2011 2012 2013 USSWAP1 Curncy (USD SWAP SEMI 30/360 1YR) Daily 25FEB 2008-24FEB2021 2015 2016 2017 2018 Copyrights 2021 Bloomberg Finance L.P. 2020 2021 24-Feb-2021 11:55:35 nterest rate swap Notional receives floating fixed coupons Leg 1: Fixed Notional Currency Effective Maturity Coupon Pay Free Day Count Calc Basis Pay Leg 2:Float 10MM USD - Currency 00 02/26/2021 Effective 5Y 02/26/20266 Maturity 2.764910 Index Annua Spread 301/360 - Leverage Money Mkt Latest Index Reset Freq Pay Trey Day Count Receive 10MM USD OD 02/26/2021 SY02/26/2026 12M USSWAPI 200,000 bp 1.00000 0.18200 Annual ma ACT/360 Interest rate swap pricing model Company Date Company pays Net Payments Discount curvo Present Value coupon 26-02-2021 02/28/2022 $ 2,22,443 $ (2,78,027) $ (55,584) 0.998238 $ {55,486) 02/27/2023 $ 2,26,979 $ (2.75,723) $ (48,743) 0.995802 $ 148,539) 02/26/2024 $ 2,62,467 $ (2,75,723) $ (13,256) 0.989912 $ (13,122) 02/26/2025 $ 3,16,392 $ (2,76,491) $ 39,901 0.978969 $ 39,062 02/26/2026 $ 1,03,57,479 $ (1,02,76,491) $ 80,988 0.964155 $ 78,085 Present value of net clash flows is zero at beginning $ 0 Market leg 1: NPV Accrued Premium DV01 11,003,848.44 Leg 2: NPV 0.00 Accrued -110.01 Premium -5,513.80 D101 11,003,848.44 0.00 110.04 1,311.94 Notes The coupons received by the swap will be used to make the loan payments to the financial institution The model is making an assumption about what these floating rate coupons will be according to the shape of today's yield curve The discount rate is the interest rate used to determine the present value of future cash flows in a discounted cash flow (DCF) analysis. The zero rate is the interest rate used to arrive at the discount factor Valuation Results Par con Principal Accrued NPV 0.000 0.00000 2.764910 Premium 0.00 BP Value 0.00 0.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started