Answered step by step

Verified Expert Solution

Question

1 Approved Answer

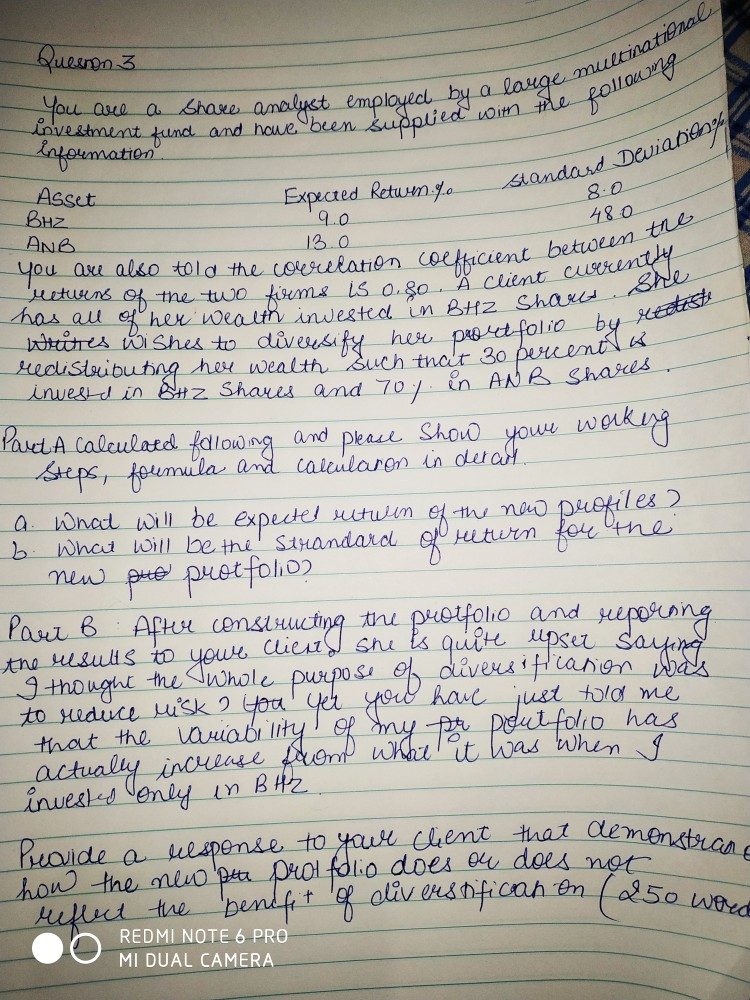

multinational following Quesnon 3 You are a Share analyst employed by a investment fund and have been supplied a Information he Deviani Asset BHZ Expected

multinational following Quesnon 3 You are a Share analyst employed by a investment fund and have been supplied a Information he Deviani Asset BHZ Expected Retwen.ro Igo told the core is o.8 Standard Deviane 8.0 48.0 between the lent currently ut she ? by Hestosti ANB 13.0 You are also told the correlation coefficient Meturns of the two firms is 0.80 Client car has all of her wealth investe Writes wishes to diversify her portfolio by redistributing her wealth such that 3o pe investe in st2 Shares and 70%. en ANB Share BHZ such that 30 percent a Part A calculaed following and please Show your working Steps, formula and calcularon in detail. a. What will be expected entwen of the new profiles ? b. What will be the Strandard of return for the new puo protfolio? Part B After constructing the protfolio and reporting the results to your clients she is quite upset sauna I thought the whole purpose of diversification was to reduce risk a you yer you have just told me that the variability of my er peutfolio has actually increase from what it was when I invested only in BH2 beovide a response to your client that demonet how the new pute prot folio does ou does not reflect the benefit of diversificah on (250 war REDMI NOTE 6 PRO MI DUAL CAMERA i demonstrane

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started