Answered step by step

Verified Expert Solution

Question

1 Approved Answer

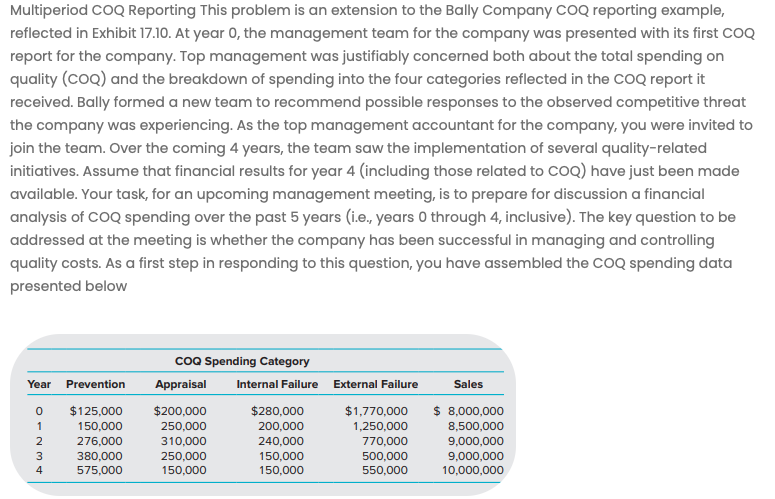

Multiperiod COQ Reporting This problem is an extension to the Bally Company COQ reporting example, reflected in Exhibit 17.10. At year 0, the management team

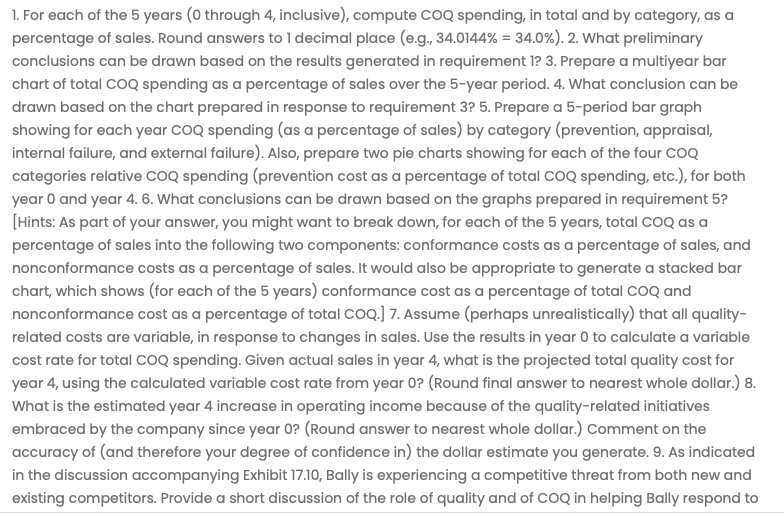

Multiperiod COQ Reporting This problem is an extension to the Bally Company COQ reporting example, reflected in Exhibit 17.10. At year 0, the management team for the company was presented with its first COQ report for the company. Top management was justifiably concerned both about the total spending on quality (COQ) and the breakdown of spending into the four categories reflected in the COQ report it received. Bally formed a new team to recommend possible responses to the observed competitive threat the company was experiencing. As the top management accountant for the company, you were invited to join the team. Over the coming 4 years, the team saw the implementation of several quality-related initiatives. Assume that financial results for year 4 (including those related to COQ ) have just been made available. Your task, for an upcoming management meeting, is to prepare for discussion a financial analysis of COQ spending over the past 5 years (i.e., years 0 through 4, inclusive). The key question to be addressed at the meeting is whether the company has been successful in managing and controlling quality costs. As a first step in responding to this question, you have assembled the COQ spending data presented below 1. For each of the 5 years ( 0 through 4 , inclusive), compute COQ spending, in total and by category, as a percentage of sales. Round answers to 1 decimal place (e.g., 34.0144%=34.0% ). 2 . What preliminary conclusions can be drawn based on the results generated in requirement 1? 3. Prepare a multiyear bar chart of total COQ spending as a percentage of sales over the 5-year period. 4. What conclusion can be drawn based on the chart prepared in response to requirement 3? 5. Prepare a 5-period bar graph showing for each year COQ spending (as a percentage of sales) by category (prevention, appraisal, internal failure, and external failure). Also, prepare two pie charts showing for each of the four COQ categories relative COQ spending (prevention cost as a percentage of total COQ spending, etc.), for both year 0 and year 4. 6. What conclusions can be drawn based on the graphs prepared in requirement 5 ? [Hints: As part of your answer, you might want to break down, for each of the 5 years, total COQ as a percentage of sales into the following two components: conformance costs as a percentage of sales, and nonconformance costs as a percentage of sales. It would also be appropriate to generate a stacked bar chart, which shows (for each of the 5 years) conformance cost as a percentage of total COQ and nonconformance cost as a percentage of total COQ.] 7. Assume (perhaps unrealistically) that all qualityrelated costs are variable, in response to changes in sales. Use the results in year 0 to calculate a variable cost rate for total COQ spending. Given actual sales in year 4 , what is the projected total quality cost for year 4, using the calculated variable cost rate from year 0 ? (Round final answer to nearest whole dollar.) 8 . What is the estimated year 4 increase in operating income because of the quality-related initiatives embraced by the company since year 0? (Round answer to nearest whole dollar.) Comment on the accuracy of (and therefore your degree of confidence in) the dollar estimate you generate. 9. As indicated in the discussion accompanying Exhibit 17.10, Bally is experiencing a competitive threat from both new and existing competitors. Provide a short discussion of the role of quality and of COQ in helping Bally respond to Multiperiod COQ Reporting This problem is an extension to the Bally Company COQ reporting example, reflected in Exhibit 17.10. At year 0, the management team for the company was presented with its first COQ report for the company. Top management was justifiably concerned both about the total spending on quality (COQ) and the breakdown of spending into the four categories reflected in the COQ report it received. Bally formed a new team to recommend possible responses to the observed competitive threat the company was experiencing. As the top management accountant for the company, you were invited to join the team. Over the coming 4 years, the team saw the implementation of several quality-related initiatives. Assume that financial results for year 4 (including those related to COQ ) have just been made available. Your task, for an upcoming management meeting, is to prepare for discussion a financial analysis of COQ spending over the past 5 years (i.e., years 0 through 4, inclusive). The key question to be addressed at the meeting is whether the company has been successful in managing and controlling quality costs. As a first step in responding to this question, you have assembled the COQ spending data presented below 1. For each of the 5 years ( 0 through 4 , inclusive), compute COQ spending, in total and by category, as a percentage of sales. Round answers to 1 decimal place (e.g., 34.0144%=34.0% ). 2 . What preliminary conclusions can be drawn based on the results generated in requirement 1? 3. Prepare a multiyear bar chart of total COQ spending as a percentage of sales over the 5-year period. 4. What conclusion can be drawn based on the chart prepared in response to requirement 3? 5. Prepare a 5-period bar graph showing for each year COQ spending (as a percentage of sales) by category (prevention, appraisal, internal failure, and external failure). Also, prepare two pie charts showing for each of the four COQ categories relative COQ spending (prevention cost as a percentage of total COQ spending, etc.), for both year 0 and year 4. 6. What conclusions can be drawn based on the graphs prepared in requirement 5 ? [Hints: As part of your answer, you might want to break down, for each of the 5 years, total COQ as a percentage of sales into the following two components: conformance costs as a percentage of sales, and nonconformance costs as a percentage of sales. It would also be appropriate to generate a stacked bar chart, which shows (for each of the 5 years) conformance cost as a percentage of total COQ and nonconformance cost as a percentage of total COQ.] 7. Assume (perhaps unrealistically) that all qualityrelated costs are variable, in response to changes in sales. Use the results in year 0 to calculate a variable cost rate for total COQ spending. Given actual sales in year 4 , what is the projected total quality cost for year 4, using the calculated variable cost rate from year 0 ? (Round final answer to nearest whole dollar.) 8 . What is the estimated year 4 increase in operating income because of the quality-related initiatives embraced by the company since year 0? (Round answer to nearest whole dollar.) Comment on the accuracy of (and therefore your degree of confidence in) the dollar estimate you generate. 9. As indicated in the discussion accompanying Exhibit 17.10, Bally is experiencing a competitive threat from both new and existing competitors. Provide a short discussion of the role of quality and of COQ in helping Bally respond to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started