Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Multiple Choice 1 1) Peter lives in Goroka and company provides accommodation and paid K 2000 per week rental directly by the company. What is

Multiple Choice 1

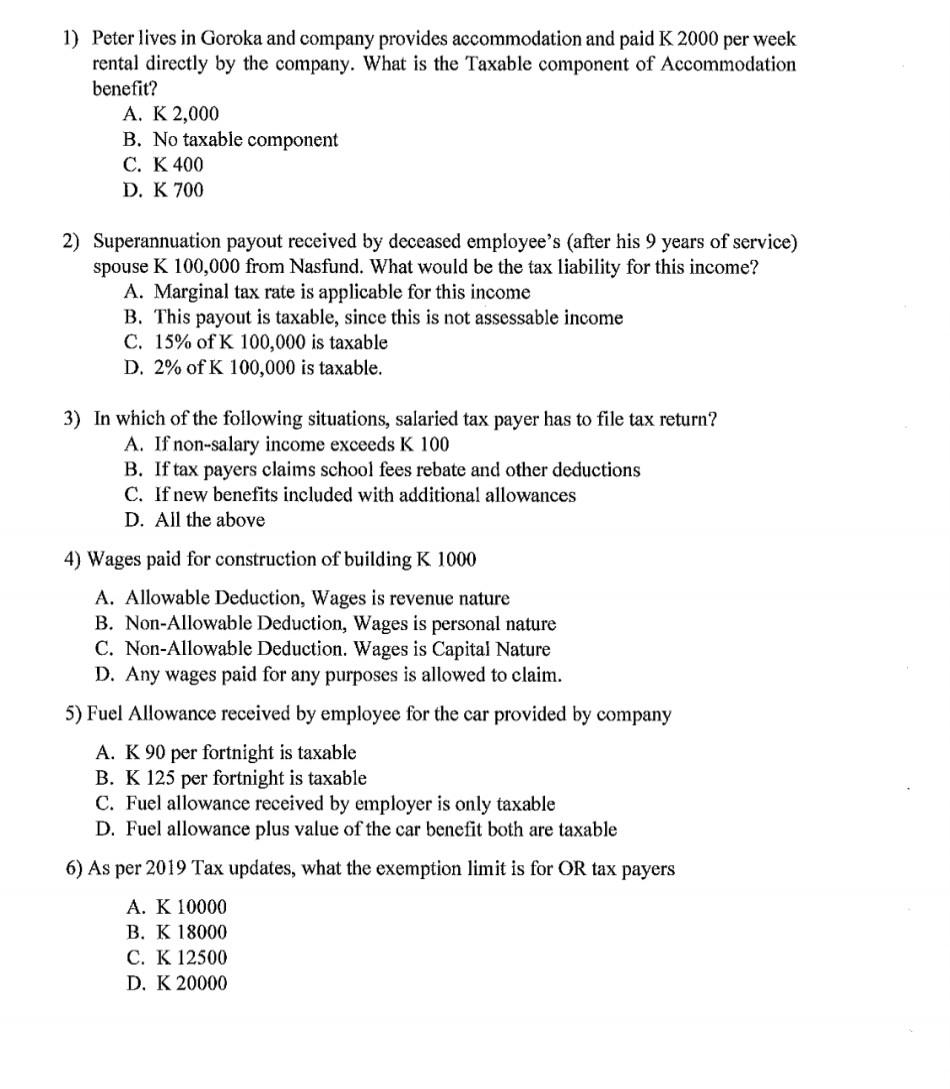

1) Peter lives in Goroka and company provides accommodation and paid K 2000 per week rental directly by the company. What is the Taxable component of Accommodation benefit? A. K 2,000 B. No taxable component C. K 400 D. K 700 2) Superannuation payout received by deceased employee's (after his 9 years of service) spouse K100,000 from Nasfund. What would be the tax liability for this income? A. Marginal tax rate is applicable for this income B. This payout is taxable, since this is not assessable income C. 15% of K 100,000 is taxable D. 2% of K100,000 is taxable. 3) In which of the following situations, salaried tax payer has to file tax return? A. If non-salary income exceeds K100 B. If tax payers claims school fees rebate and other deductions C. If new benefits included with additional allowances D. All the above 4) Wages paid for construction of building K1000 A. Allowable Deduction, Wages is revenue nature B. Non-Allowable Deduction, Wages is personal nature C. Non-Allowable Deduction. Wages is Capital Nature D. Any wages paid for any purposes is allowed to claim. 5) Fuel Allowance received by employee for the car provided by company A. K 90 per fortnight is taxable B. K 125 per fortnight is taxable C. Fuel allowance received by employer is only taxable D. Fuel allowance plus value of the car benefit both are taxable 6) As per 2019 Tax updates, what the exemption limit is for OR tax payers A. K10000 B. K 18000 C. K 12500 D. K 20000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started