Answered step by step

Verified Expert Solution

Question

1 Approved Answer

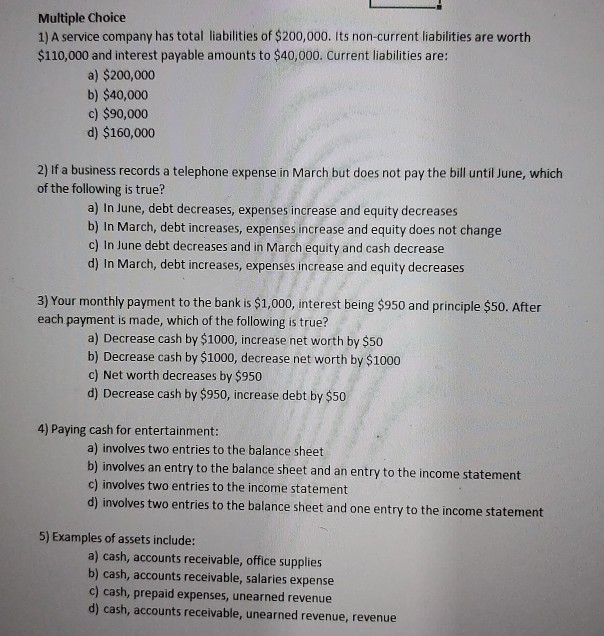

Multiple Choice 1) A service company has total liabilities of $200,000. Its non-current liabilities are worth $110,000 and interest payable amounts to $40,000. Current liabilities

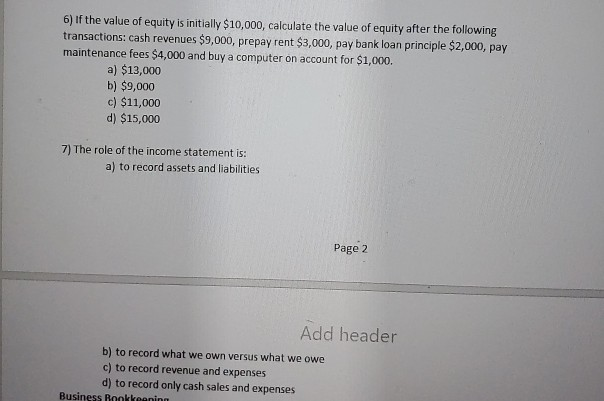

Multiple Choice 1) A service company has total liabilities of $200,000. Its non-current liabilities are worth $110,000 and interest payable amounts to $40,000. Current liabilities are: a) $200,000 b) $40,000 c) $90,000 d) $160,000 2) If a business records a telephone expense in March but does not pay the bill until June, which of the following is true? a) In June, debt decreases, expenses increase and equity decreases b) In March, debt increases, expenses increase and equity does not change c) In June debt decreases and in March equity and cash decrease d) In March, debt increases, expenses increase and equity decreases 3) Your monthly payment to the bank is $1,000, interest being $950 and principle $50. After each payment is made, which of the following is true? a) Decrease cash by $1000, increase net worth by $50 b) Decrease cash by $1000, decrease net worth by $1000 c) Net worth decreases by $950 d) Decrease cash by $950, increase debt by $50 4) Paying cash for entertainment: a) involves two entries to the balance sheet b) involves an entry to the balance sheet and an entry to the income statement c) involves two entries to the income statement d) involves two entries to the balance sheet and one entry to the income statement 5) Examples of assets include: a) cash, accounts receivable, office supplies b) cash, accounts receivable, salaries expense c) cash, prepaid expenses, unearned revenue d) cash, accounts receivable, unearned revenue, revenue 6) if the value of equity is initially $10,000, calculate the value of equity after the following transactions: cash revenues $9,000, prepay rent $3,000, pay bank loan principle $2,000, pay maintenance fees $4,000 and buy a computer on account for $1,000. a) $13,000 b) $9,000 c) $11,000 d) $15,000 7) The role of the income statement is: a) to record assets and liabilities Page 2 Add header b) to record what we own versus what we owe c) to record revenue and expenses d) to record only cash sales and expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started