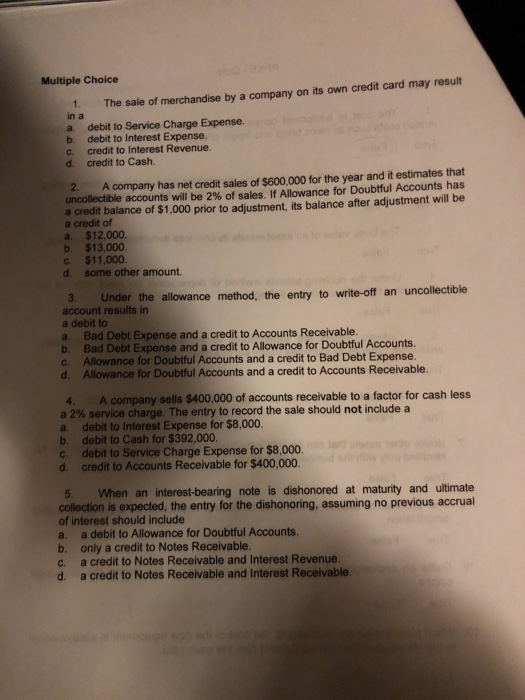

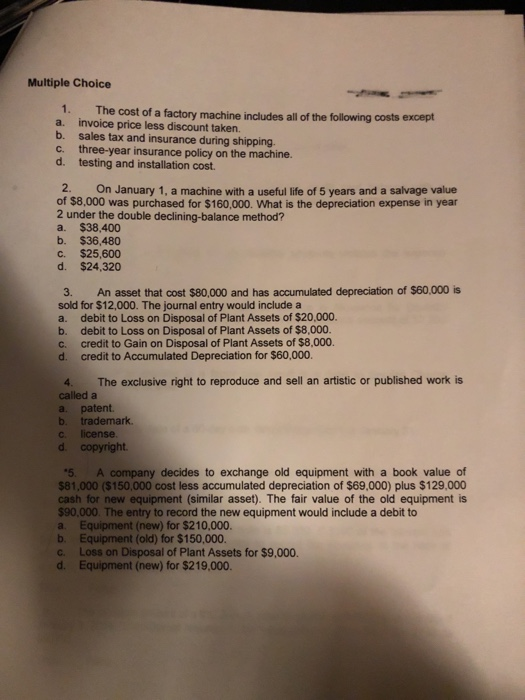

Multiple Choice 1. The in a a. debit to Service Charge Expense. b. debit to Interest Expense. c. credit to Interest Revenue. d. credit to Cash. sale of merchandise by a company on its own credit card may result 2. A company has net credit sales of $600,000 for the year and it estimates that uncollectible accounts will be 2% of sales. If Allowance for Doubtful Accounts has a credit balance of $1,000 prior to adjustment, its balance after adjustment will be a credit of a. $12,000 b. $13,000 c $11,000 d. some other amount Under the allowance method, the entry to write-off an uncollectible account results in a debit to a. Bad Debt Expense and a credit to Accounts Receivable. b. Bad Debt Expense and a credit to Allowance for Doubtful Accounts. c. Allowance for Doubtful Accounts and a credit to Bad Debt Expense. d. Allowance for Doubtful Accounts and a credit to Accounts Receivable. 4. A company sells $400,000 of accounts receivable to a factor for cash less a 2% service charge The entry to record the sale should not include a a. debit to Interest Expense for $8,000. b. debit to Cash for $392,000 c. debit to Service Charge Expense for $8,000. d credit to Accounts Receivable for $400,000. 5. When an interest-bearing note is dishonored at maturity and ultimate collection is expected, the entry for the dishonoring, assuming no previous accrual of interest should include a. a debit to Allowance for Doubtful Accounts b. only a credit to Notes Receivable. a credit to Notes Receivable and Interest Revenue. a credit to Notes Receivable and Interest Receivable. C. d. Multiple Choice 1. The cost of a factory machine includes all of the following costs except a. invoice price less discount taken. b. sales tax and insurance during shipping c. three-year insurance policy on the machine. d. testing and installation cost. 2. On January 1, a machine with a useful life of 5 years and a salvage value of $8,000 was purchased for $160,000. What is the depreciation expense in year 2 under the double declining-balance method? a. $38,400 b. $36,480 c. $25,600 d. $24,320 3. An asset that cost $80,000 and has accumulated depreciation of $60,000 is sold for $12,000. The journal entry would include a a. debit to Loss on Disposal of Plant Assets of $20,000. b. debit to Loss on Disposal of Plant Assets of $8,000. c. credit to Gain on Disposal of Plant Assets of $8,000. d. credit to Accumulated Depreciation for $60,000. 4. The exclusive right to reproduce and sell an artistic or published work is called a a. patent b. trademark. C. license d. copyright 5. A company decides to exchange old equipment with a book value of $81,000 ($150,000 cost less accumulated depreciation of $69,000) plus $129,000 cash for new equipment (similar asset). The fair value of the old equipment is $90,000. The entry to record the new equipment would include a debit to a. Equipment (new) for $210,000. b. Equipment (old) for $150,000. c. Loss on Disposal of Plant Assets for $9,000. d. Equipment (new) for $219,000