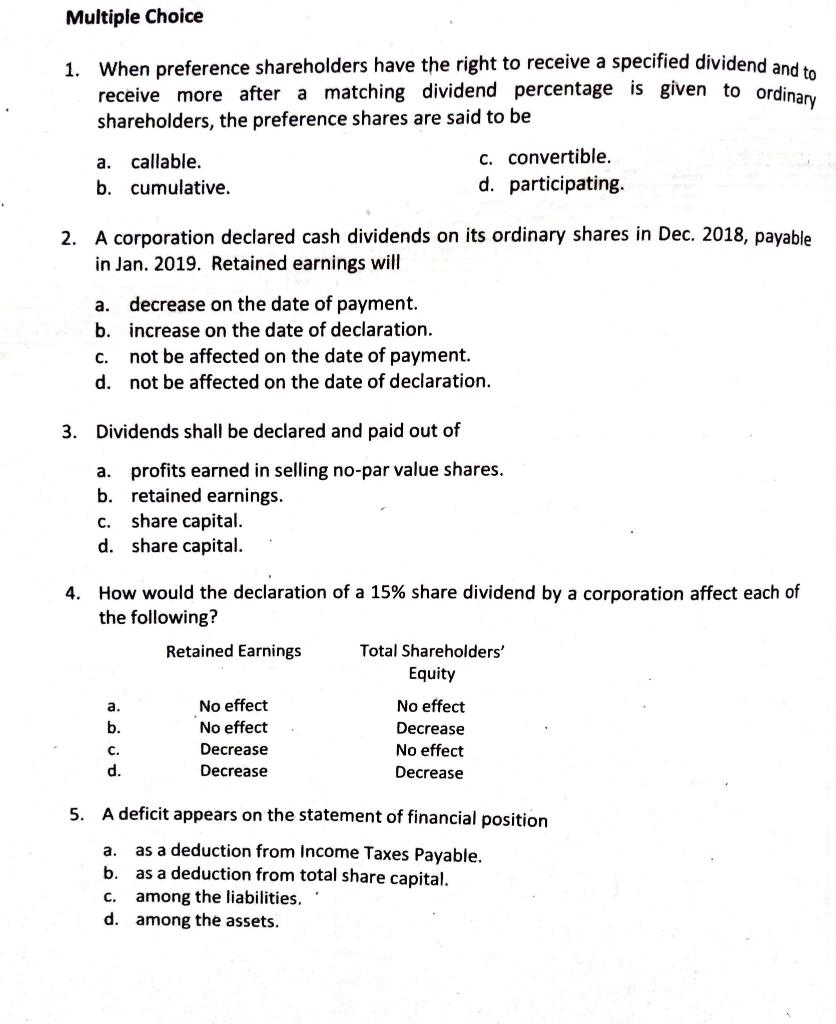

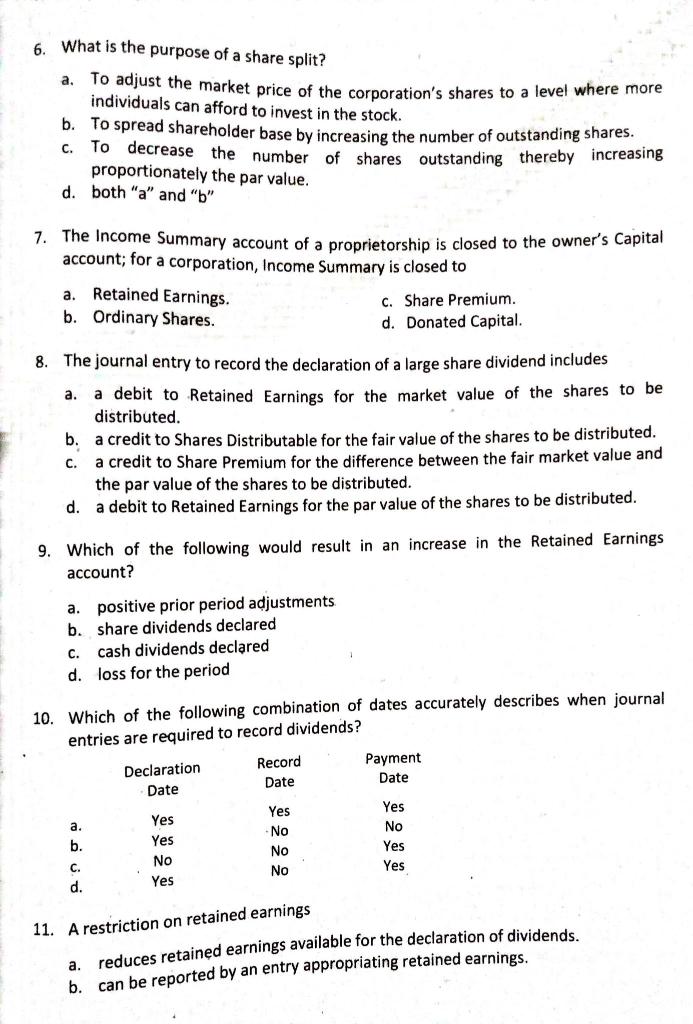

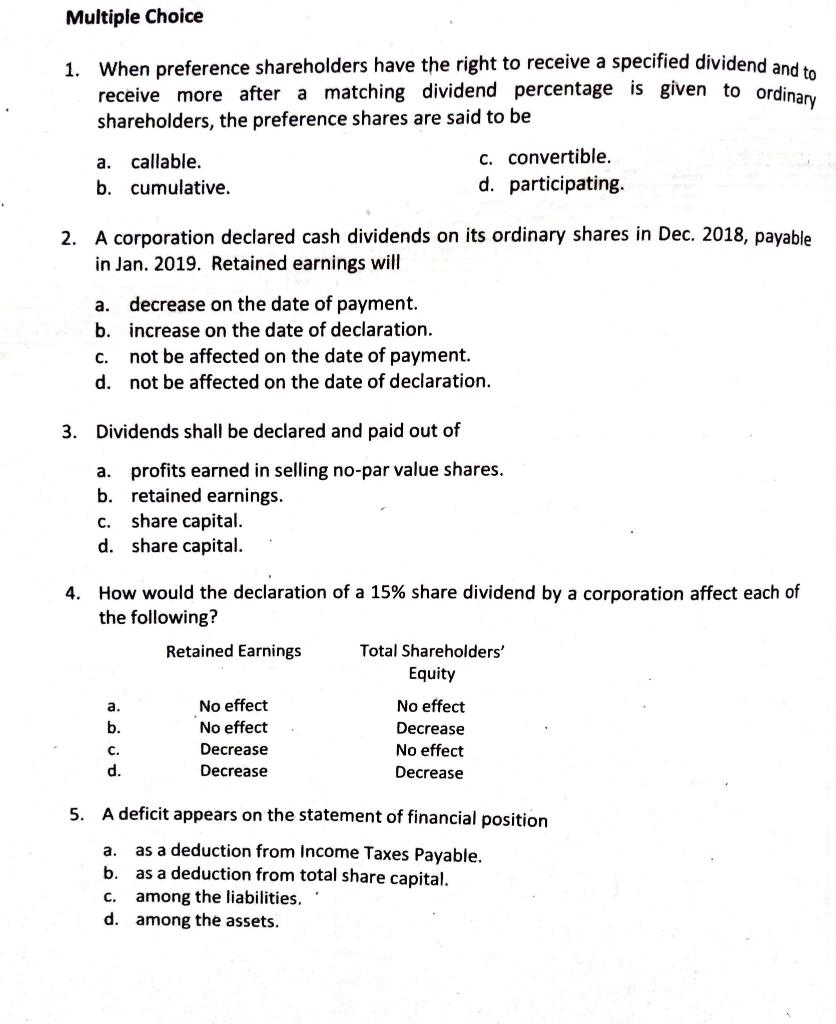

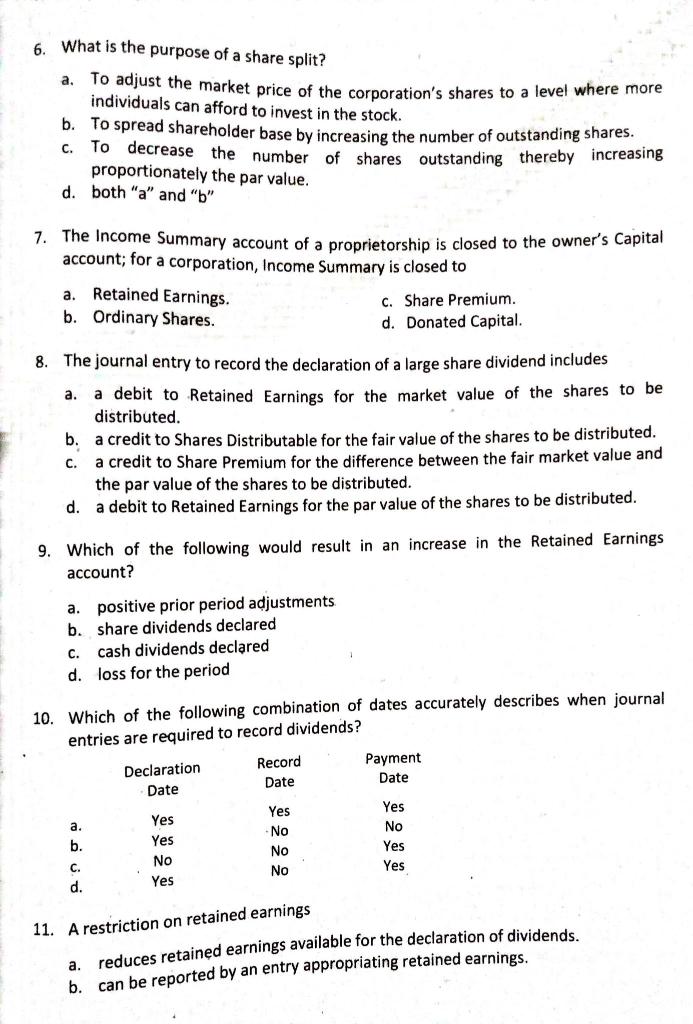

Multiple Choice 1. When preference shareholders have the right to receive a specified dividend and to receive more after a matching dividend percentage is given to ordinary shareholders, the preference shares are said to be a. callable. C. convertible. b. cumulative. d. participating 2. A corporation declared cash dividends on its ordinary shares in Dec. 2018, payable in Jan. 2019. Retained earnings will a. decrease on the date of payment. b. increase on the date of declaration. C. not be affected on the date of payment. d. not be affected on the date of declaration. 3. Dividends shall be declared and paid out of a. profits earned in selling no-par value shares. b. retained earnings. c. share capital. d. share capital. 4. How would the declaration of a 15% share dividend by a corporation affect each of the following? Retained Earnings Total Shareholders' Equity a. No effect No effect b. No effect Decrease C. Decrease No effect d. Decrease Decrease 5. A deficit appears on the statement of financial position as a deduction from Income Taxes Payable. as a deduction from total share capital. C. among the liabilities. d. among the assets. a. b a, 6. What is the purpose of a share split? To adjust the market price of the corporation's shares to a level where more individuals can afford to invest in the stock. b. To spread shareholder base by increasing the number of outstanding shares. C. To decrease the number of shares outstanding thereby increasing proportionately the par value. d. both "a" and "b" 7. The Income Summary account of a proprietorship is closed to the owner's Capital account; for a corporation, Income Summary is closed to a. Retained Earnings. C. Share Premium. b. Ordinary Shares. d. Donated Capital. 8. The journal entry to record the declaration of a large share dividend includes a. a debit to Retained Earnings for the market value of the shares to be distributed b. a credit to Shares Distributable for the fair value of the shares to be distributed. a credit Share Premium for the difference between the fair market value and the par value of the shares to be distributed. d. a debit to Retained Earnings for the par value of the shares to be distributed. 9. Which of the following would result in an increase in the Retained Earnings account? a. positive prior period adjustments b. share dividends declared C. cash dividends declared d. loss for the period 10. Which of the following combination of dates accurately describes when journal entries are required to record dividends? Declaration Date Record Date Payment Date a. Yes Yes No Yes b. Yes No No No Yes No Yes Yes C. d. 11. A restriction on retained earnings reduces retained earnings available for the declaration of dividends. b. can be reported by an entry appropriating retained earnings. a