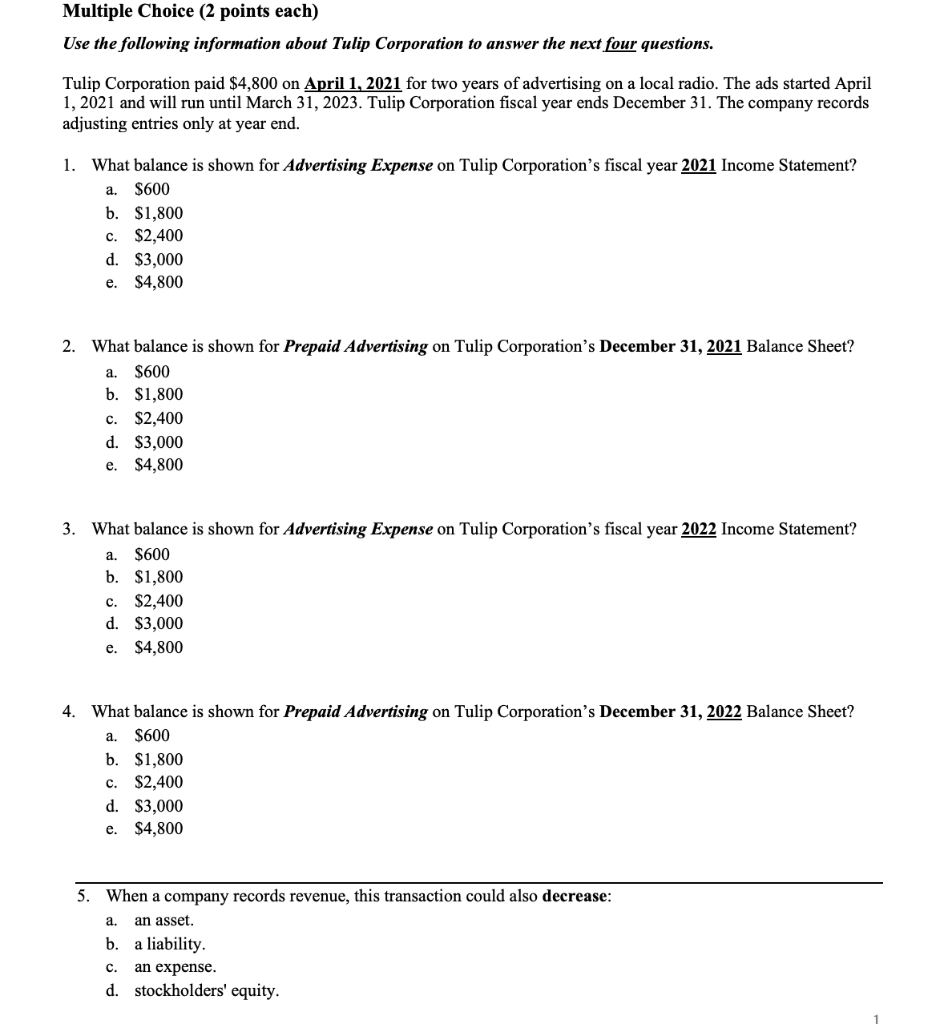

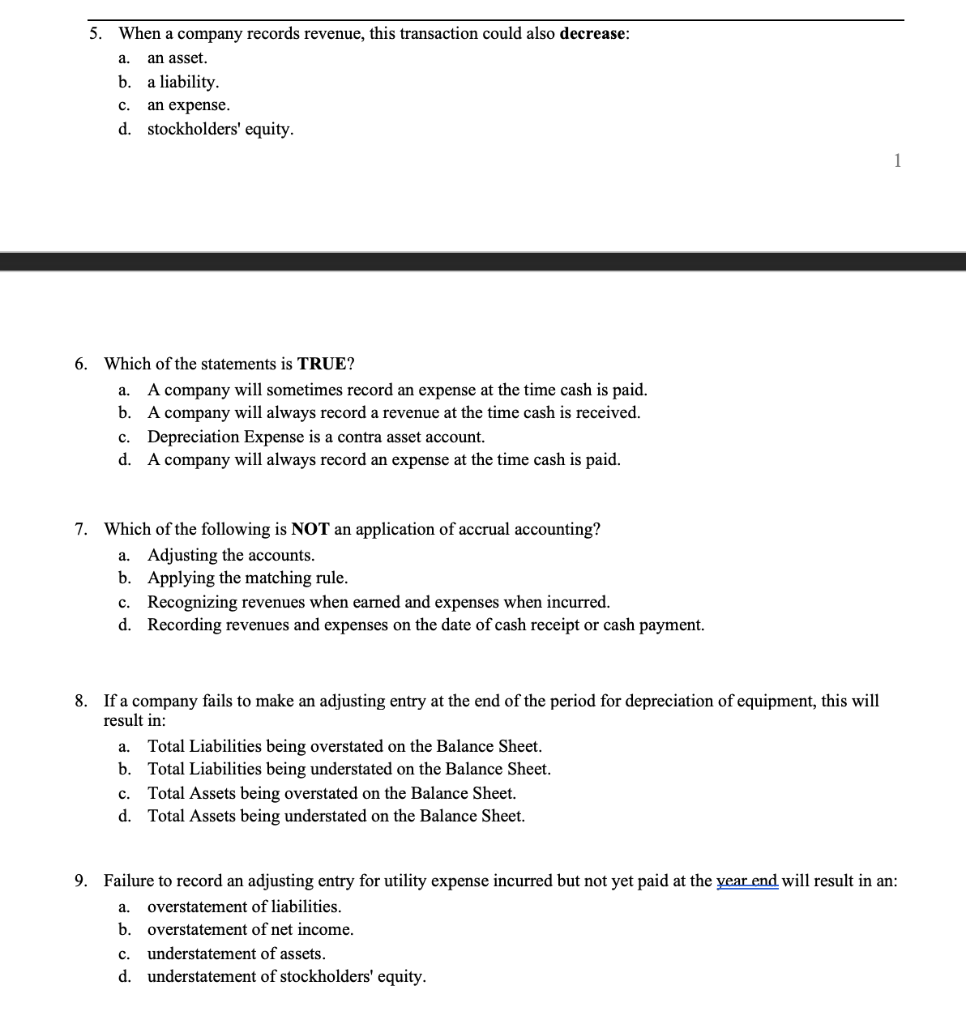

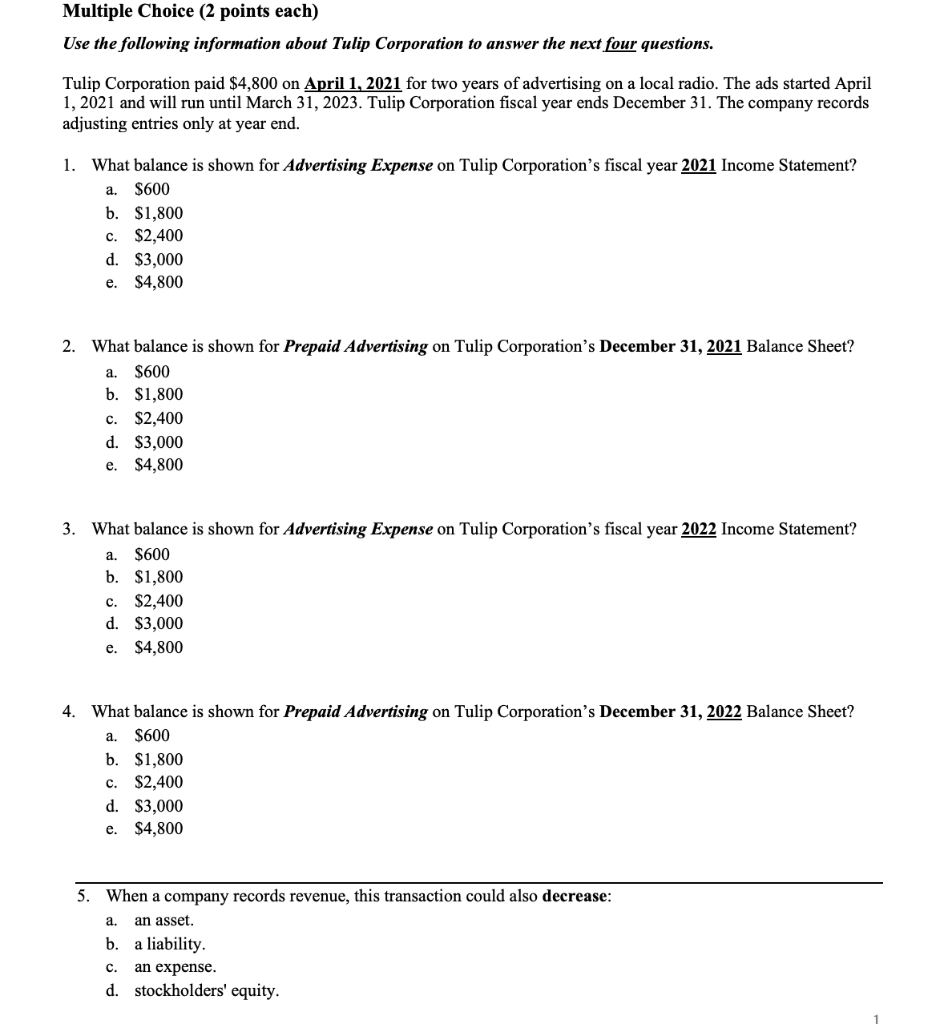

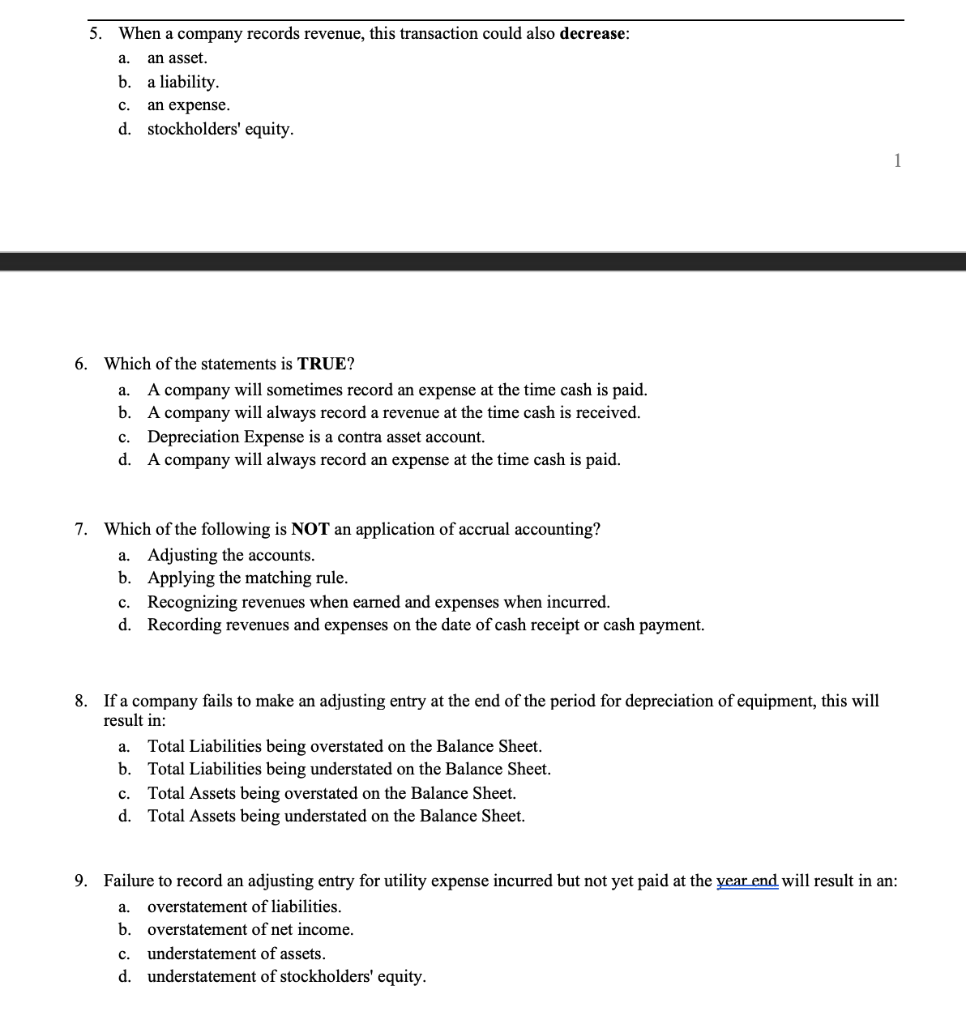

Multiple Choice (2 points each) Use the following information about Tulip Corporation to answer the next four questions. Tulip Corporation paid $4,800 on April 1, 2021 for two years of advertising on a local radio. The ads started April 1, 2021 and will run until March 31, 2023. Tulip Corporation fiscal year ends December 31. The company records adjusting entries only at year end. a. 1. What balance is shown for Advertising Expense on Tulip Corporation's fiscal year 2021 Income Statement? $600 b. $1,800 c. $2,400 d. $3,000 $4,800 e. a. 2. What balance is shown for Prepaid Advertising on Tulip Corporation's December 31, 2021 Balance Sheet? $600 b. $1,800 $2,400 d. $3,000 $4,800 c. e. 3. What balance is shown for Advertising Expense on Tulip Corporation's fiscal year 2022 Income Statement? a. $600 b. $1,800 c. $2,400 d. $3,000 $4,800 e. 4. a. What balance is shown for Prepaid Advertising on Tulip Corporation's December 31, 2022 Balance Sheet? $600 b. $1,800 c. $2,400 d. $3,000 e. $4,800 5. When a company records revenue, this transaction could also decrease: a. an asset. b. a liability an expense. d. stockholders' equity. c. a. 5. When a company records revenue, this transaction could also decrease: an asset. b. a liability. c. an expense. d. stockholders' equity. 1 a. 6. Which of the statements is TRUE? A company will sometimes record an expense at the time cash is paid. b. A company will always record a revenue at the time cash is received. c. Depreciation Expense is a contra asset account. d. A company will always record an expense at the time cash is paid. 7. Which of the following is NOT an application of accrual accounting? a. Adjusting the accounts. b. Applying the matching rule. c. Recognizing revenues when earned and expenses when incurred. d. Recording revenues and expenses on the date of cash receipt or cash payment. 8. If a company fails to make an adjusting entry at the end of the period for depreciation of equipment, this will result in: a. Total Liabilities being overstated on the Balance Sheet. b. Total Liabilities being understated on the Balance Sheet. Total Assets being overstated on the Balance Sheet. d. Total Assets being understated on the Balance Sheet. c. a. 9. Failure to record an adjusting entry for utility expense incurred but not yet paid at the year end will result in an: overstatement of liabilities. b. overstatement of net income. c. understatement of assets. d. understatement of stockholders' equity