Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Multiple Choice 4 Q20) A machine costing K10,000 is sold for K15,000. The WDV of the machine K7,000. What would be the result? A. Loss

Multiple Choice 4

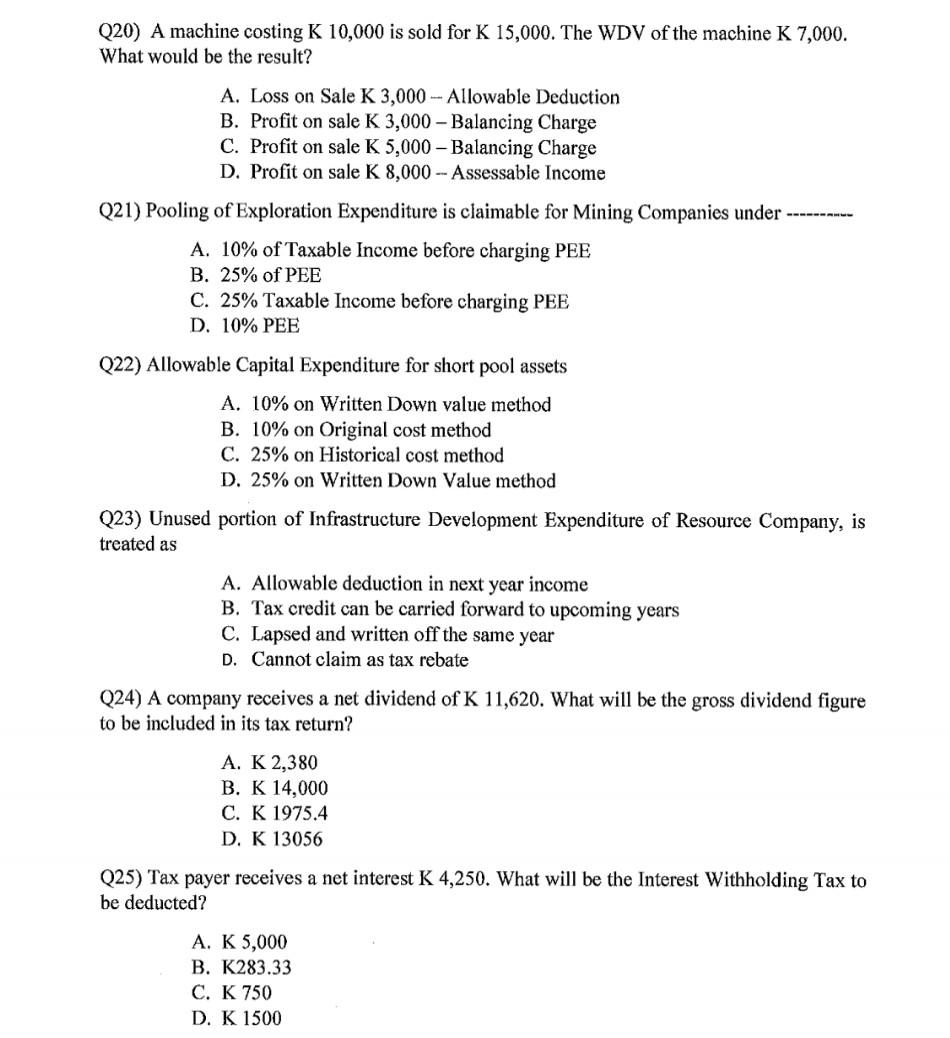

Q20) A machine costing K10,000 is sold for K15,000. The WDV of the machine K7,000. What would be the result? A. Loss on Sale K 3,000-Allowable Deduction B. Profit on sale K 3,000 - Balancing Charge C. Profit on sale K 5,000-Balancing Charge D. Profit on sale K 8,000-Assessable Income Q21) Pooling of Exploration Expenditure is claimable for Mining Companies under A. 10% of Taxable Income before charging PEE B. 25% of PEE C. 25% Taxable Income before charging PEE D. 10% PEE Q22) Allowable Capital Expenditure for short pool assets A. 10% on Written Down value method B. 10% on Original cost method C. 25% on Historical cost method D. 25% on Written Down Value method Q23) Unused portion of Infrastructure Development Expenditure of Resource Company, is treated as A. Allowable deduction in next year income B. Tax credit can be carried forward to upcoming years C. Lapsed and written off the same year D. Cannot claim as tax rebate Q24) A company receives a net dividend of K11,620. What will be the gross dividend figure to be included in its tax return? A. K 2,380 B. K 14,000 C. K 1975.4 D. K 13056 Q25) Tax payer receives a net interest K4,250. What will be the Interest Withholding Tax to be deducted? A. K5,000 B. K283.33 C. K750 D. K 1500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started