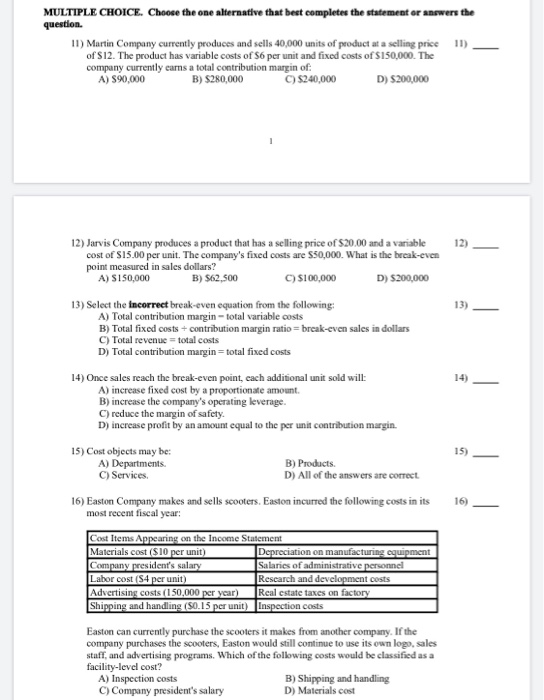

MULTIPLE CHOICE. Choose the one alternative that beet completes the statement or answers the question. 1) Martin Company currently produces and sells 40,000 units of product at a selling price of S12. The product has variable costs of $6 per unit and fixed costs of $150,000. The company currently earns a total contribution margin of: A) S90,000 11) ) 8240,000 B) $280,000 D) 5200,000 12) 12) Jarvis Company produces a product that has a selling price of $20.00 and a variable cost of S15.00 per unit. The company's fixed costs are S50,000. What is the break-even point measured in sales dollars? A) S150,000 c) S100,000 B) $62,500 D) 5200,000 13) Select the incorrect break-even equation from the following A) Total contribution margin-total variable costs B) Total fixed costs + contribution margin ratio break-even sales in dollars C) Total revenue total costs D) Total contribution margin total fixed costs 13) 14) Once sales reach the break-even point, cach additional unit sold will: A) increase fixed cost by a proportionate amount. B) increase the company's operating leverage. C) reduce the margin of safety D) increase profit by an amoumt equal to the per unit contribution margin. 14) 15) Cost objects may be A) Departments. C) Services 15) B) Products. D) All of the answers are correct 16) Easton Company makes and sells scooters. Easton incurred the following costs in its most recent fiscal year: 16) Cost Items Appearing on the Income Statement Materials cost ($10 per unit) Depreciation on manufacturing equipment Salaries of administrative personnel Rescarch and development costs Real estate taxes on factory Company president's salary Labor cost ($4 per unit) Advertising costs (150,000 per year) Shipping and handling (S0.15 per unit) Inspection costs Easton can currently purchase the scooters it makes from another company. If the company purchases the scooters, Easton would still continue to us staff, and advertising programs. Which of the following costs would be classified as a facility-level cost? A) Inspection costs C) Company president's salary its own lo sales B) Shipping and handling D) Materials cost