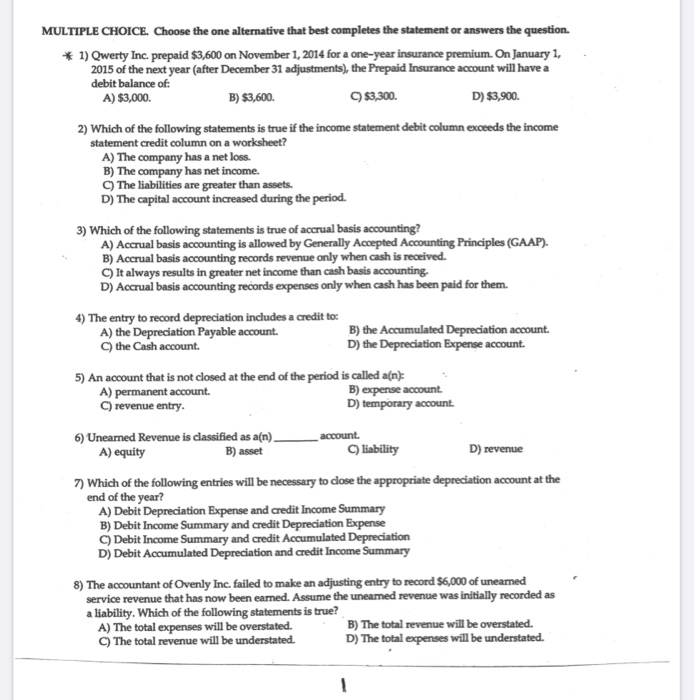

. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Qwerty Inc. prepaid $3,600 on November 1, 2014 for a one-year Insurance premium. On January 1, 2015 of the next year after December 31 adjustments), the Prepaid Insurance account will have a debit balance of: A) $3,000. B) $3,600 $3,300. D) $3,900. 2) Which of the following statements is true if the income statement debit column exceeds the income statement credit column on a worksheet? A) The company has a net loss. B) The company has net income. The liabilities are greater than assets. D) The capital account increased during the period. 3) Which of the following statements is true of accrual basis accounting? A) Accrual basis accounting is allowed by Generally Accepted Accounting Principles (GAAP). B) Accrual basis accounting records revenue only when cash is received. It always results in greater net income than cash basis accounting D) Accrual basis accounting records expenses only when cash has been paid for them. 4) The entry to record depreciation includes a credit to A) the Depreciation Payable account the Cash account. B) the Accumulated Depreciation account. D) the Depreciation Expense account 5) An account that is not closed at the end of the period is called a(n): A) permanent account. B) expense account revenue entry. D) temporary account 6) Uneamed Revenue is classified as a[n) A) equity B) asset account. liability D) revenue 7) Which of the following entries will be necessary to close the appropriate depreciation account at the end of the year? A) Debit Depreciation Expense and credit Income Summary B) Debit Income Summary and credit Depreciation Expense C) Debit Income Summary and credit Accumulated Depreciation D) Debit Accumulated Depreciation and credit Income Summary 8) The accountant of Ovenly Inc. failed to make an adjusting entry to record $6,000 of uneared service revenue that has now been eamed. Assume the uneared revenue was initially recorded as a liability. Which of the following statements is true? A) The total expenses will be overstated. B) The total revenue will be overstated. The total revenue will be understated. D) The total expenses will be understated