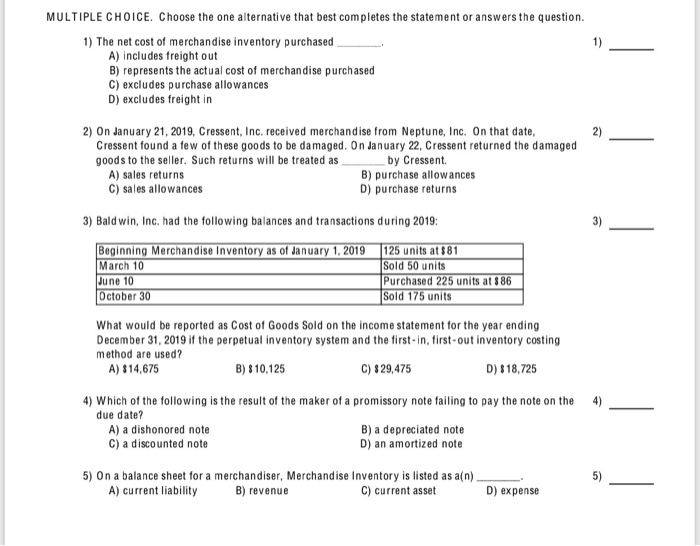

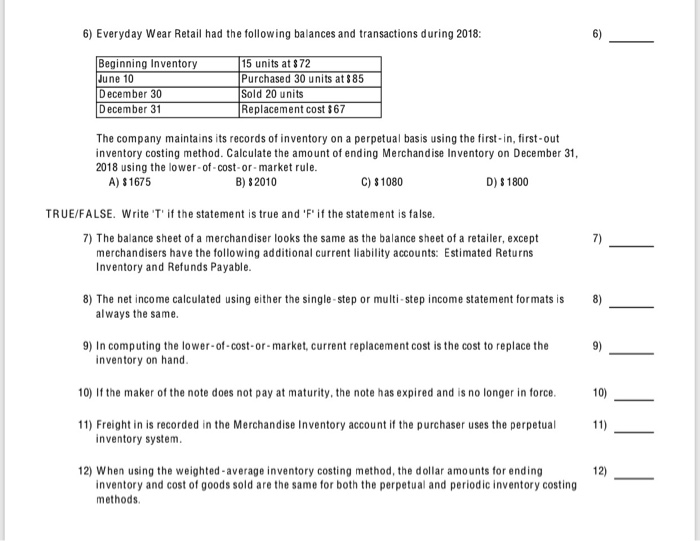

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) The net cost of merchandise inventory purchased A) includes freight out B) represents the actual cost of merchandise purchased C) excludes purchase allowances D) excludes freight in 2) 2) On January 21, 2019, Cressent, Inc. received merchandise from Neptune, Inc. On that date, Cressent found a few of these goods to be damaged. On January 22, Cressent returned the damaged goods to the seller. Such returns will be treated as by Cressent. A) sales returns B) purchase allowances C) sales allowances D) purchase returns 3) Baldwin, Inc. had the following balances and transactions during 2019: Beginning Merchandise Inventory as of January 1, 2019 March 10 June 10 October 30 125 units at $81 Sat 101 Sold 50 units Purchased 225 units at 886 Sold 175 units What would be reported as Cost of Goods Sold on the income statement for the year ending December 31, 2019 if the perpetual inventory system and the first-in, first-out inventory costing method are used? A) $14,675 B) 810,125 C) 829,475 D) $18,725 4)_ 4) Which of the following is the result of the maker of a promissory note failing to pay the note on the due date? A) a dishonored note B) a depreciated note C) a discounted note D) an amortized note 5) On a balance sheet for a merchandiser, Merchandise Inventory is listed as an) A) current liability B) revenue C) current asset D) expense D) expense 6) Everyday Wear Retail had the following balances and transactions during 2018: Beginning Inventory June 10 December 30 December 31 15 units at $72 Purchased 30 units at $85 Sold 20 units Replacement cost $67 The company maintains its records of inventory on a perpetual basis using the first in, first-out inventory costing method. Calculate the amount of ending Merchandise Inventory on December 31, 2018 using the lower-of-cost-or-market rule. A) $1675 B) 8 2010 C) 81080 D) $ 1800 TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 7) The balance sheet of a merchandiser looks the same as the balance sheet of a retailer, except merchandisers have the following additional current liability accounts: Estimated Returns Inventory and Refunds Payable. 8) 8) The net income calculated using either the single-step or multi-step income statement formats is always the same. 9) 9) In computing the lower-of-cost-or-market, current replacement cost is the cost to replace the inventory on hand. 10) If the maker of the note does not pay at maturity, the note has expired and is no longer in force. ||||| 11) Freight in is recorded in the Merchandise Inventory account if the purchaser uses the perpetual inventory system 12) 12) When using the weighted average inventory costing method, the dollar amounts for ending inventory and cost of goods sold are the same for both the perpetual and periodic inventory costing methods