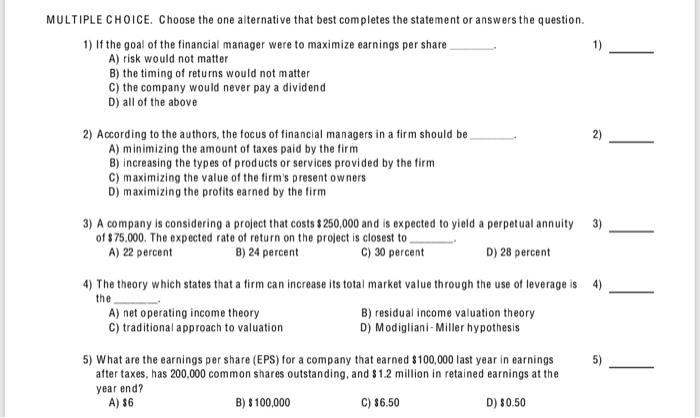

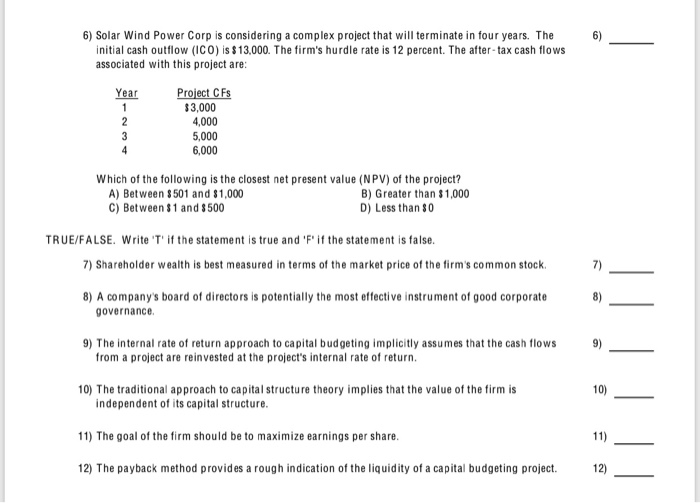

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) If the goal of the financial manager were to maximize earnings per share A) risk would not matter B) the timing of returns would not matter C) the company would never pay a dividend D) all of the above 2) According to the authors, the focus of financial managers in a firm should be A) minimizing the amount of taxes paid by the firm B) increasing the types of products or services provided by the firm C) maximizing the value of the firm's present owners D) maximizing the profits earned by the firm 3) 3) A company is considering a project that costs $ 250,000 and is expected to yield a perpetual annuity of $75,000. The expected rate of return on the project is closest to A) 22 percent B) 24 percent C) 30 percent D) 28 percent 4) 4) The theory which states that a firm can increase its total market value through the use of leverage is the A) net operating income theory B) residual income valuation theory C) traditional approach to valuation D) Modigliani-Miller hypothesis 5) 5) What are the earnings per share (EPS) for a company that earned $100,000 last year in earnings after taxes, has 200,000 common shares outstanding, and $1.2 million in retained earnings at the year end? A) 36 B) $100,000 C) $6.50 D) $0.50 6) 6) Solar Wind Power Corp is considering a complex project that will terminate in four years. The initial cash outflow (ICO) is $13,000. The firm's hurdle rate is 12 percent. The after-tax cash flows associated with this project are: Year Project CFS $3,000 4,000 5,000 6,000 Which of the following is the closest net present value (NPV) of the project? A) Between $501 and $1,000 B) Greater than $1,000 C) Between $1 and 8500 D) Less than 80 TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 7) Shareholder wealth is best measured in terms of the market price of the firm's common stock 8) A company's board of directors is potentially the most effective instrument of good corporate governance 9) The internal rate of return approach to capital budgeting implicitly assumes that the cash flows from a project are reinvested at the project's internal rate of return 10) The traditional approach to capital structure theory implies that the value of the firm is independent of its capital structure. 11) The goal of the firm should be to maximize earnings per share 12) The payback method provides a rough indication of the liquidity of a capital budgeting project