Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jason and Kerri Consalvo, both in their 50 's, have $60,000 to invest and plan to retire in 10 years. They are considering two investments.

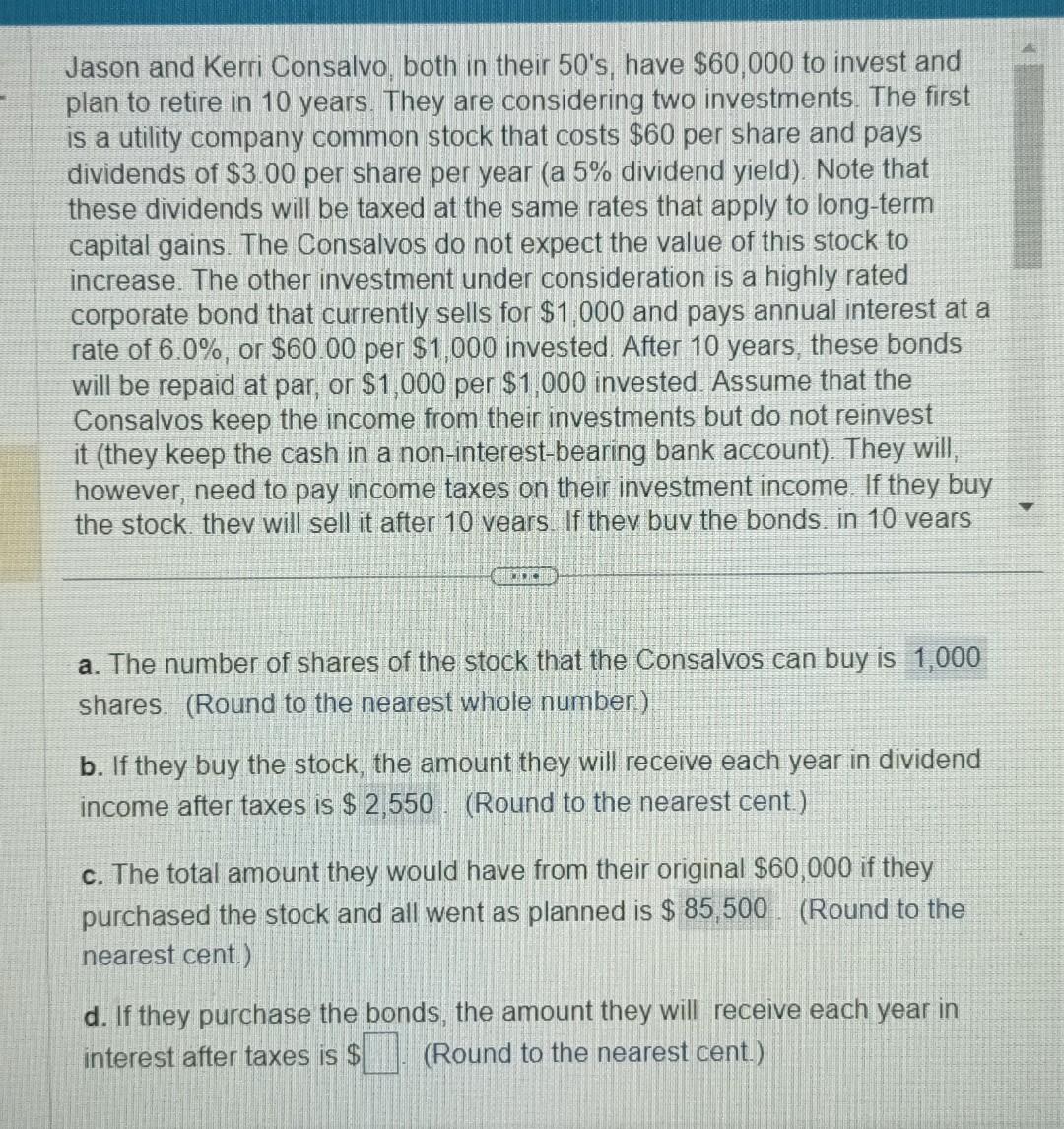

Jason and Kerri Consalvo, both in their 50 's, have $60,000 to invest and plan to retire in 10 years. They are considering two investments. The first is a utility company common stock that costs $60 per share and pays dividends of $3.00 per share per year (a 5% dividend yield). Note that these dividends will be taxed at the same rates that apply to long-term capital gains. The Consalvos do not expect the value of this stock to increase. The other investment under consideration is a highly rated corporate bond that currently sells for $1,000 and pays annual interest at a rate of 6.0%, or $60.00 per $1,000 invested. After 10 years, these bonds will be repaid at par, or $1,000 per $1,000 invested. Assume that the Consalvos keep the income from their investments but do not reinvest it (they keep the cash in a non-interest-bearing bank account). They will, however, need to pay income taxes on their investment income. If they buy the stock. thev will sell it after 10 vears. If thev buv the bonds. in 10 vears a. The number of shares of the stock that the Consalvos can buy is 1,000 shares. (Round to the nearest whole number.) b. If they buy the stock, the amount they will receive each year in dividend income after taxes is $2,550. (Round to the nearest cent.) c. The total amount they would have from their original $60,000 if they purchased the stock and all went as planned is $85,500. (Round to the nearest cent.) d. If they purchase the bonds, the amount they will receive each year in interest after taxes is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started