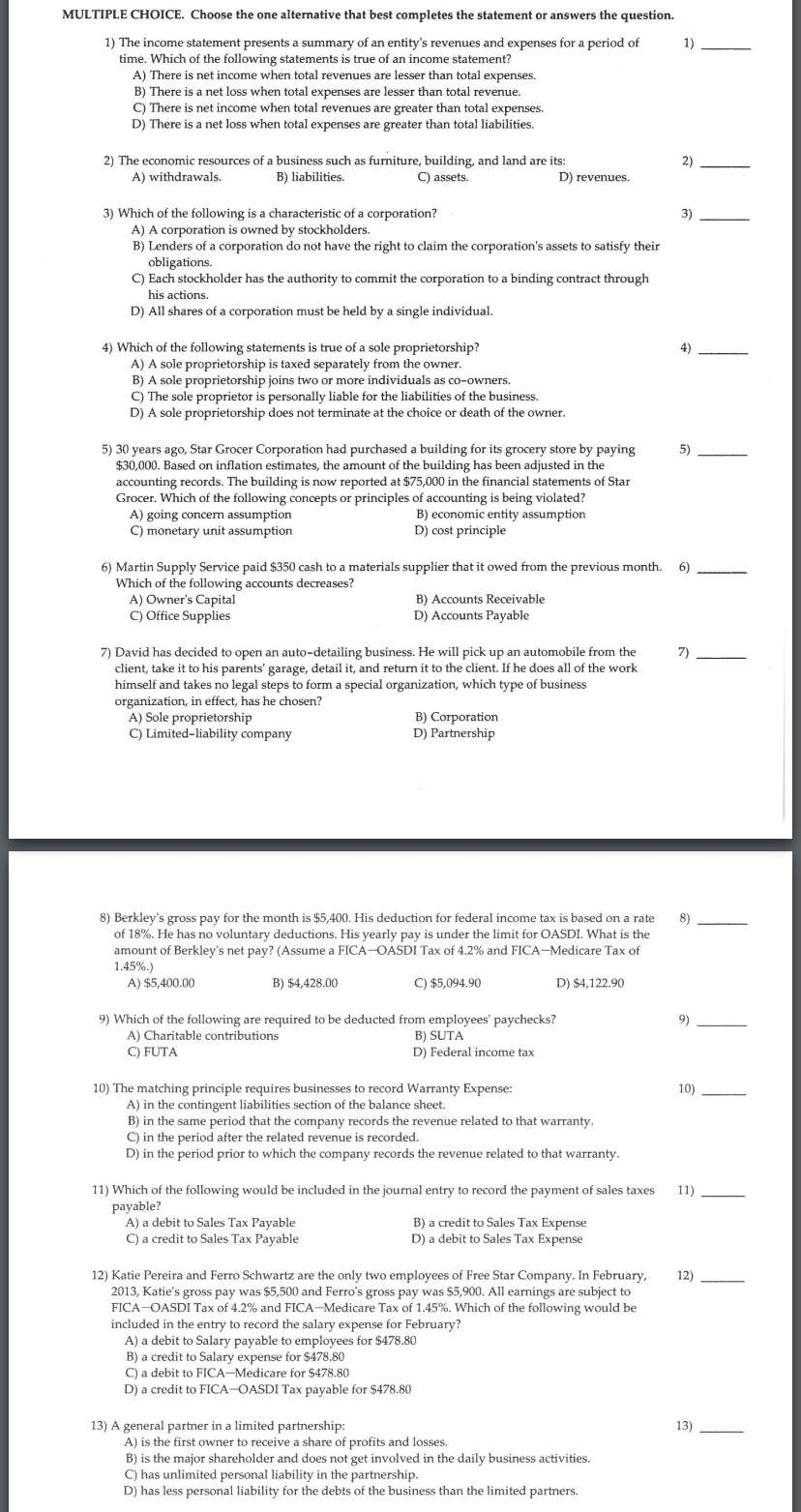

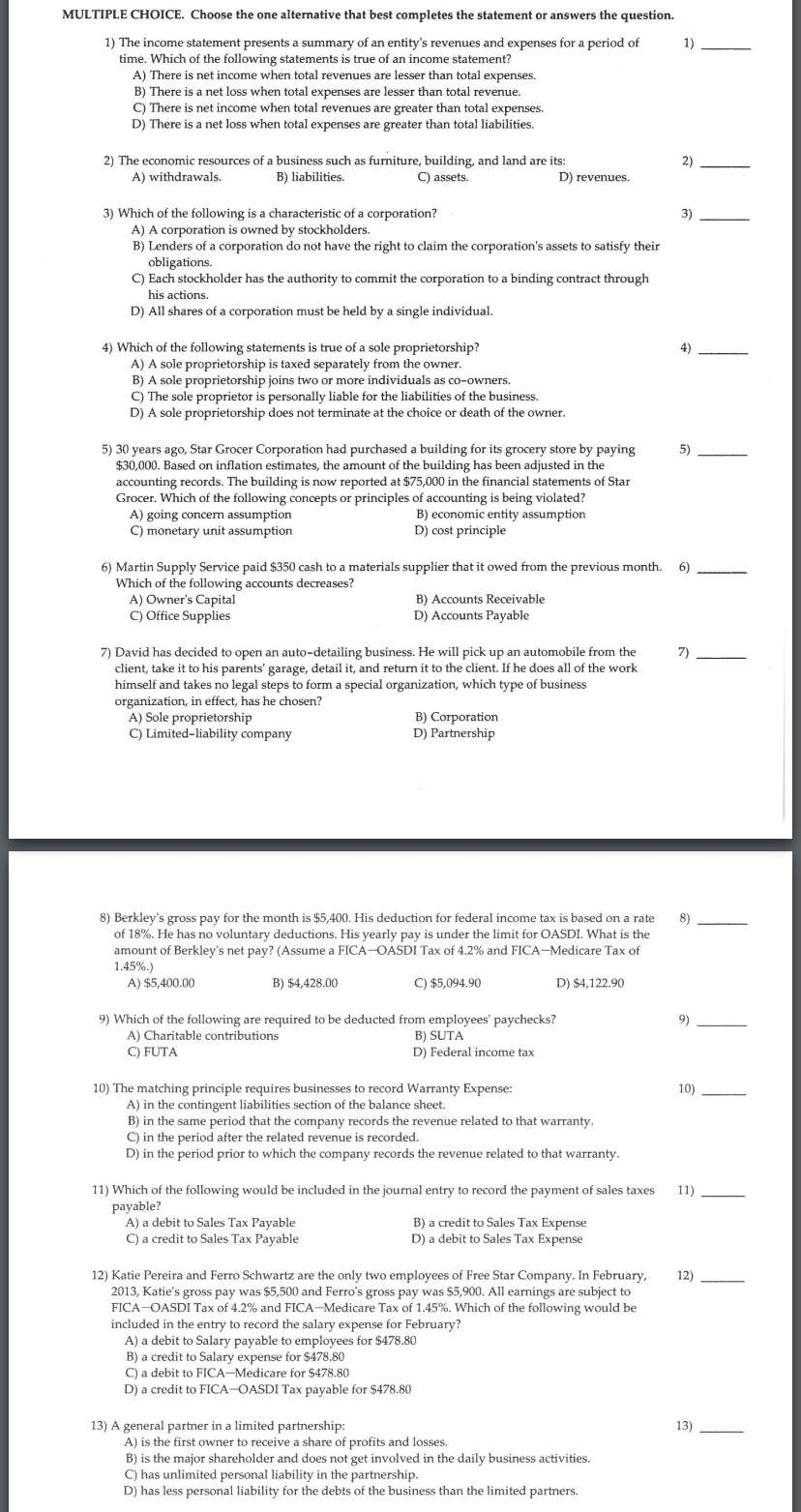

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) 1) The income statement presents a summary of an entity's revenues and expenses for a period of time. Which of the following statements is true of an income statement? A) There is net income when total revenues are lesser than total expenses. B) There is a net loss when total expenses are lesser than total revenue. C) There is net income when total revenues are greater than total expenses. D) There is a net loss when total expenses are greater than total liabilities, 2) The economic resources of a business such as furniture, building, and land are its: A) withdrawals. B) liabilities. C) assets. D) revenues. 3) Which of the following is a characteristic of a corporation? A) A corporation is owned by stockholders. B) Lenders of a corporation do not have the right to claim the corporation's assets to satisfy their obligations. C) Each stockholder has the authority to commit the corporation to a binding contract through his actions. D) All shares of a corporation must be held by a single individual. 4) Which of the following statements is true of a sole proprietorship? A) A sole proprietorship is taxed separately from the owner. B) A sole proprietorship joins two or more individuals as co-owners. C) The sole proprietor is personally liable for the liabilities of the business D) A sole proprietorship does not terminate at the choice or death of the owner. 5) 30 years ago, Star Grocer Corporation had purchased a building for its grocery store by paying $30,000. Based on inflation estimates, the amount of the building has been adjusted in the accounting records. The building is now reported at $75,000 in the financial statements of Star Grocer. Which of the following concepts or principles of accounting is being violated? A) going concem assumption B) economic entity assumption C) monetary unit assumption D) cost principle 6) 6) Martin Supply Service paid $350 cash to a materials supplier that it owed from the previous month. Which of the following accounts decreases? A) Owner's Capital B) Accounts Receivable C) Office Supplies D) Accounts Payable 7) 7) David has decided to open an auto-detailing business. He will pick up an automobile from the client, take it to his parents' garage, detail it, and return it to the client. If he does all of the work himself and takes no legal steps to form a special organization, which type of business organization, in effect, has he chosen? A) Sole proprietorship B) Corporation C) Limited liability company D) Partnership 8) 8) Berkley's gross pay for the month is $5,400. His deduction for federal income tax is based on a rate of 18%. He has no voluntary deductions. His yearly pay is under the limit for OASDI. What is the amount of Berkley's net pay? (Assume a FICA--OASDI Tax of 4.2% and FICA-Medicare Tax of 1.45%.) A) $5,400.00 B) $4,428.00 C) $5,094.90 D) $4,122.90 9) Which of the following are required to be deducted from employees' paychecks? A) Charitable contributions B) SUTA C) FUTA D) Federal income tax 10) The matching principle requires businesses to record Warranty Expense: A) in the contingent liabilities section of the balance sheet. B) in the same period that the company records the revenue related to that warranty C) in the period after the related revenue is recorded. D) in the period prior to which the company records the revenue related to that warranty. 11) 11) Which of the following would be included in the journal entry to record the payment of sales taxes payable? A) a debit to Sales Tax Payable B) a credit to Sales Tax Expense C) a credit to Sales Tax Payable D) a debit to Sales Tax Expense 12) 12) Katie Pereira and Ferro Schwartz are the only two employees of Free Star Company. In February, 2013, Katie's gross pay was $5,500 and Ferro's gross pay was $5,900. All earnings are subject to FICA-OASDI Tax of 4.2% and FICA-Medicare Tax of 1.45%. Which of the following would be included in the entry to record the salary expense for February? A) a debit to Salary payable to employees for $478.80 B) a credit to Salary expense for $478.80 C) a debit to FICA-Medicare for $478.80 D) a credit to FICA-OASDI Tax payable for $478.80 13) A general partner in a limited partnership: A) is the first owner to receive a share of profits and losses. B) is the major shareholder and does not get involved in the daily business activities. C) has unlimited personal liability in the partnership. D) has less personal liability for the debts of the business than the limited partners