Multiple choice hw

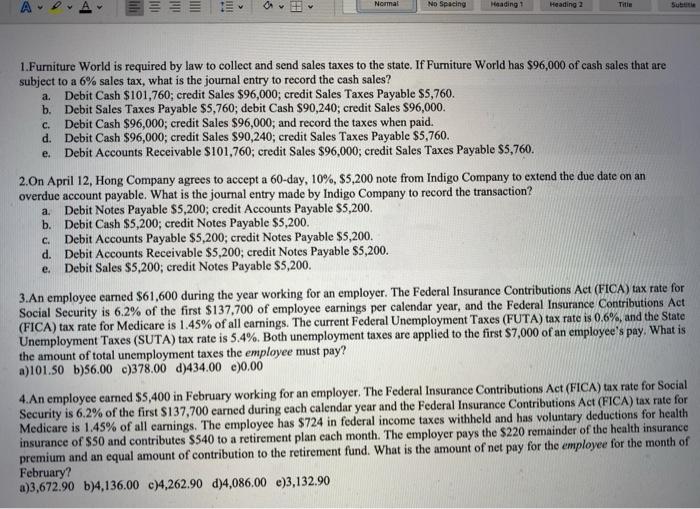

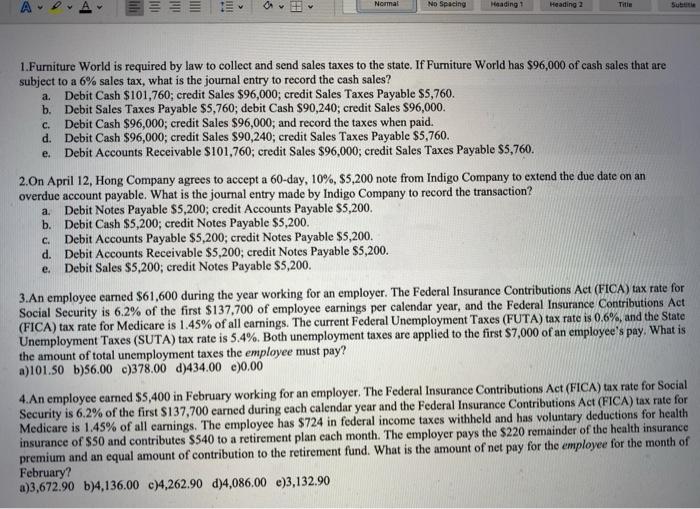

lili 0 ilil IMNI > Normal No Spacing Heading 1 Heading 2 Title Sub a. C. e. 1.Furniture World is required by law to collect and send sales taxes to the state. If Furniture World has $96,000 of cash sales that are subject to a 6% sales tax, what is the journal entry to record the cash sales? Debit Cash $101,760; credit Sales $96,000; credit Sales Taxes Payable $5,760. b. Debit Sales Taxes Payable $5,760; debit Cash $90,240; credit Sales $96,000. Debit Cash $96,000; credit Sales $96,000; and record the taxes when paid. d. Debit Cash $96,000; credit Sales $90,240; credit Sales Taxes Payable $5,760. Debit Accounts Receivable $101,760; credit Sales $96,000; credit Sales Taxes Payable $5,760. 2.On April 12, Hong Company agrees to accept a 60-day, 10%, 55,200 note from Indigo Company to extend the due date on an overdue account payable. What is the journal entry made by Indigo Company to record the transaction? Debit Notes Payable $5,200; credit Accounts Payable $5,200. b. Debit Cash $5,200; credit Notes Payable $5,200. Debit Accounts Payable $5,200; credit Notes Payable $5,200. d. Debit Accounts Receivable $5,200, credit Notes Payable $5,200. e. Debit Sales $5,200; credit Notes Payable $5,200. a. C. 3.An employee earned $61,600 during the year working for an employer. The Federal Insurance Contributions Act (FICA) tax rate for Social Security is 6.2% of the first $137,700 of employee earnings per calendar year, and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of total unemployment taxes the employee must pay? a)101.50 b)56.00 c)378.00 d)434.00 0.00 4.An employee earned $5,400 in February working for an employer. The Federal Insurance Contributions Act (FICA) tax rate for Social Security is 6.2% of the first $137,700 carned during each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all carnings. The employee has $724 in federal income taxes withheld and has voluntary deductions for health insurance of $50 and contributes $540 to a retirement plan each month. The employer pays the $220 remainder of the health insurance premium and an equal amount of contribution to the retirement fund. What is the amount of net pay for the employee for the month of February? a)3,672.90 b)4,136.00 c)4,262.90 d)4,086,00 e)3,132.90