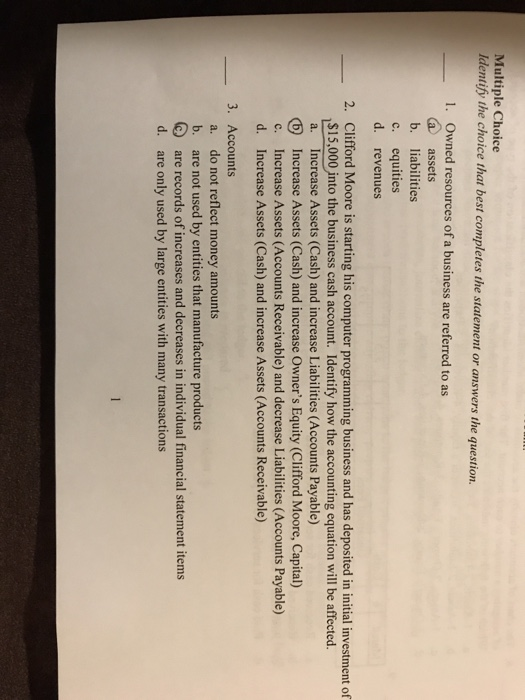

Question: Multiple Choice ldentify the choice that best completes the statement or answers the question Owned resources of a business are referred to as a assets

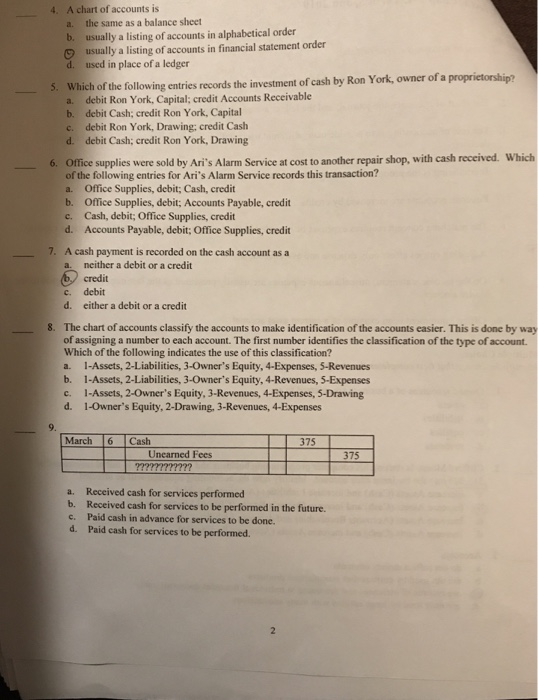

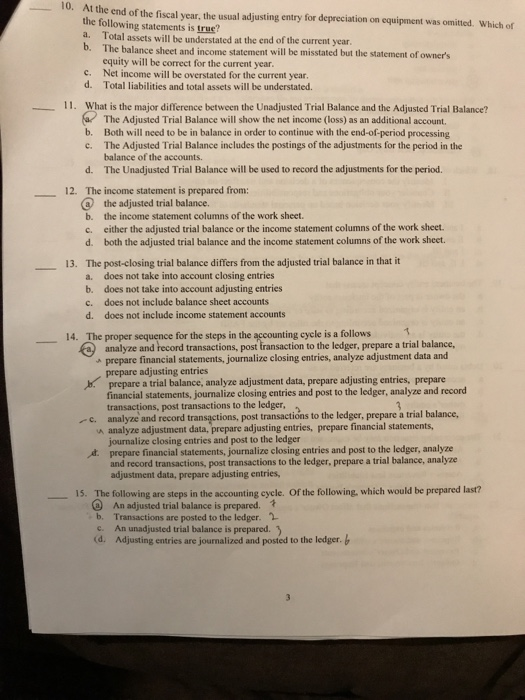

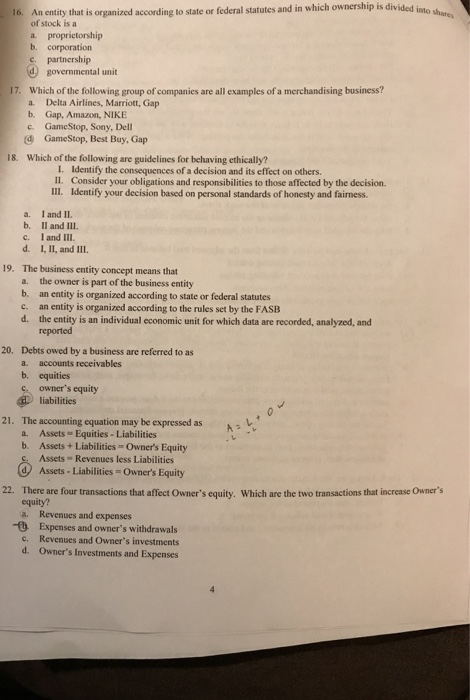

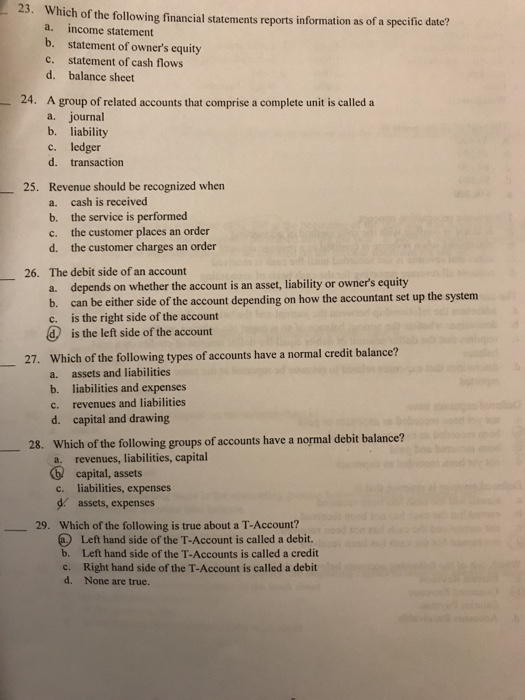

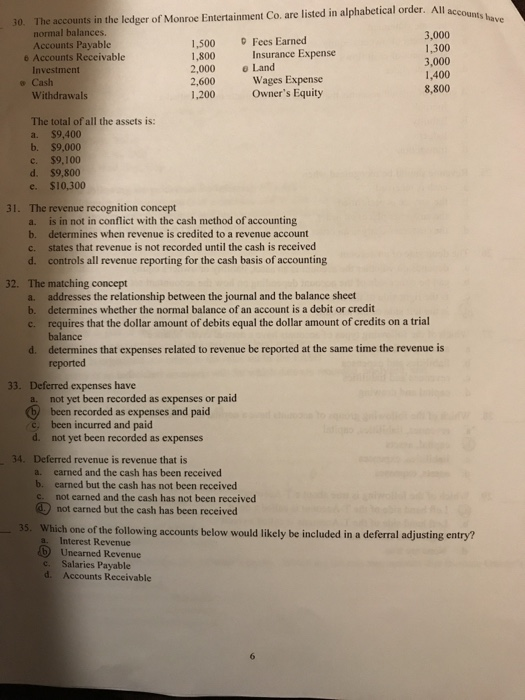

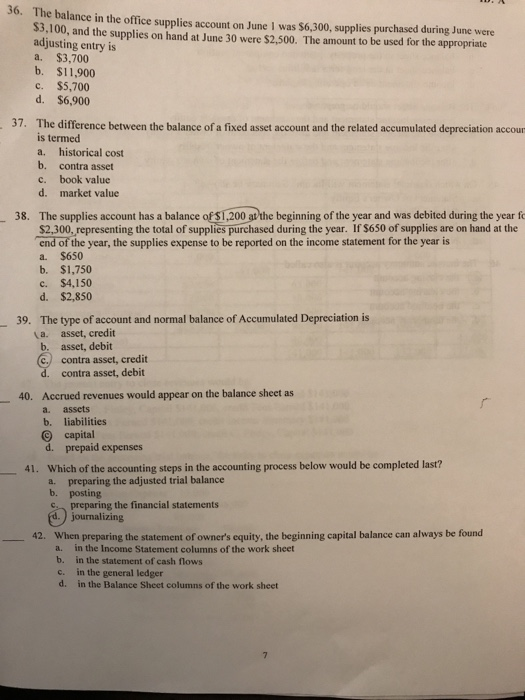

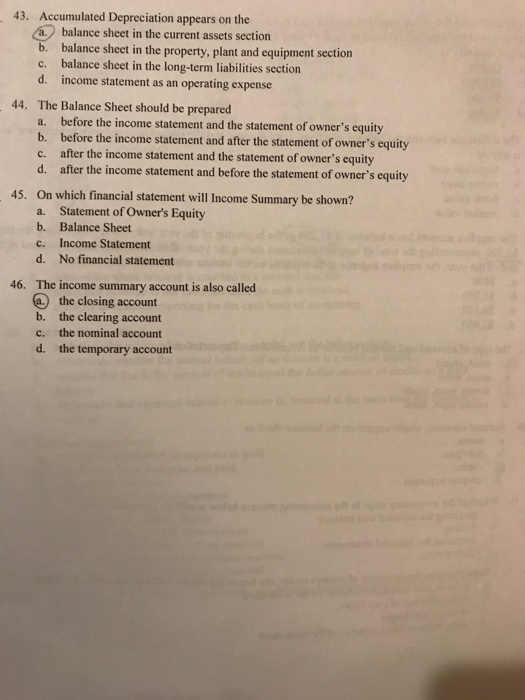

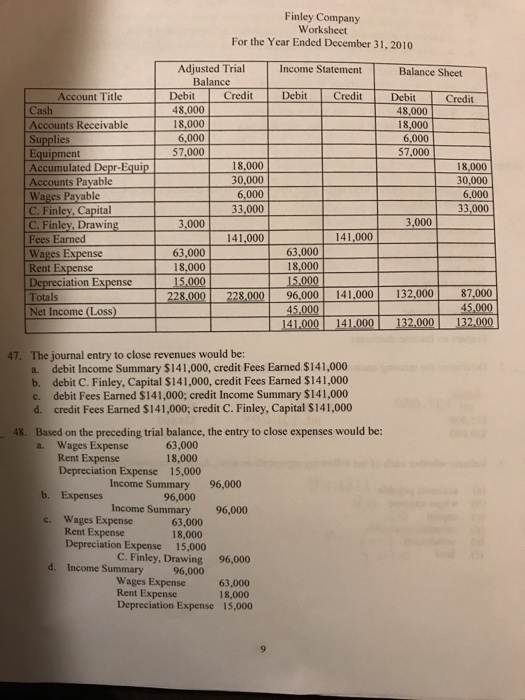

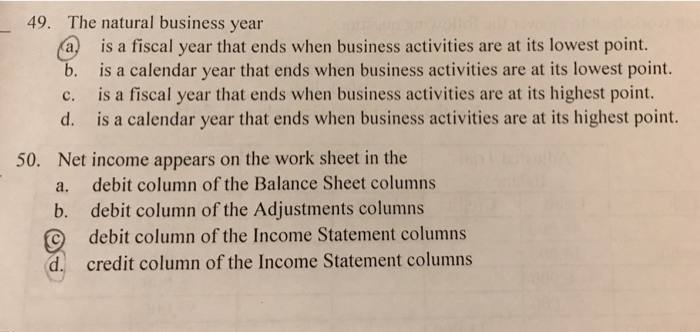

Multiple Choice ldentify the choice that best completes the statement or answers the question Owned resources of a business are referred to as a assets b. liabilities c. equities d. revenues 1. 2. Clifford Moore is starting his computer programming business and has deposited in initial investment of S15,000 jinto the business cash account. Identify how the accounting equation will be affected. a. Increase Assets (Cash) and increase Liabilities (Accounts Payable) D Increase Assets (Cash) and increase Owner's Equity (Clifford Moore, Capital) c. Increase Assets (Accounts Receivable) and decrease Liabilities (Accounts Payable) d. Increase Assets (Cash) and increase Assets (Accounts Receivable) 3. Accounts a. do not reflect money amounts b. are not used by entities that manufacture products Q are records of increases and decreases in individual financial statement items d. are only used by large entities with many transactions 4. A chart of accounts is a. the same as a balance sheet b. usually a listing of accounts in alphabetical order usually a listing of accounts in financial statement order d. used in place of a ledger 5. Which of the following entries records the investment of cash by Ron York, owner of a proprietorship? debit Ron York, Capital; credit Accounts Receivable a. b. debit Cash; credit Ron York, Capital debit Ron York, Drawing; credit Cash c. d. debit Cash; credit Ron York, Drawing 6. Office supplies were sold by Ari's Alarm Service at cost to another repair shop, with cash received. Which of the following entries for Ari's Alarm Service records this transaction? a. Office Supplies, debit; Cash, credit b. Office Supplies, debit; Accounts Payable, credit c. Cash, debit; Office Supplies, credit d. Accounts Payable, debit: Office Supplies, credit A cash payment is recorded on the cash account as a a. 7. neither a debit or a credit credit c debit d. either a debit or a credit 8. The chart of accounts classify the accounts to make identification of the accounts easier. This is done by way of assigning a number to each account. The first number identifies the classification of the type of account. Which of the following indicates the use of this classification? a. 1-Assets, 2-Liabilities, 3-Owner's Equity, 4-Expenses, 5-Revenues b. 1-Assets, 2-Liabilities, 3-Owner's Equity, 4-Revenues, 5-Expenses c. 1-Assets, 2-Owner's Equity, 3-Revenues, 4-Expenses, 5-Drawing d. 1-Owner's Equity, 2-Drawing, 3-Revenues, 4-Expenses March 6 Cash 375 375 a. b. c. d. Received cash for services performed Received cash for services to be performed in the future. Paid cash in advance for services to be done. Paid cash for services to be performed. the cnd of the fiscal year the usual djusting entry for depeciation on eignsent was comited. Which orf the following statements is true? a. T b. otal assets will be understated at the end of the current year. The balance sheet and income statement will be misstated but the statement of owner's equity will be correet for the current year Net income will be overstated for the current year c. d. Total liabilities and total assets will be understated. 11. What is the major difference between the Unadjusted Trial Balance and the Adjusted Trial Balance? The Adjusted Trial Balance will show the net income (loss) as an additional account. b. Both will need to be in balance in order to continue with the end-of-period processing c. The Adjusted Trial Balance includes the postings of the adjustments for the period in the balance of the accounts. d. The Unadjusted Trial Balance will be used to record the adjustments for the period. 12. The income statement is prepared from the adjusted trial balance. b. the income statement columns of the work sheet. c. either the adjusted trial balance or the income statement columns of the work sheet. d. both the adjusted trial balance and the income statement columns of the work sheet. The post-closing trial balance differs from the adjusted trial balance in that it a. b. c. d. 13. does not take into account closing entries does not take into account adjusting entries does not include balance sheet accounts does not include income statement accounts 14. The proper sequence for the steps in the accounting cycle is a follows a analyze and record transactions, post fransaction to the ledger, prepare a trial balance, * prepare financial statements, journalize closing entries, analyze adjustment data and prepare adjusting entries prepare a trial balance, analyze adjustment data, prepare adjusting entries, prepare financial statements, journalize closing entries and post to the ledger, analyze and record transactions, post transactions to the ledger, c analyze and record transctions, post transactions to the ledger, prepare a trial balance, a analyze adjustment data, prepare adjusting entries, prepare financial statements journalize closing entries and post to the ledger t. prepare financial statements, journalize closing entries and post to the ledger, analyze and record transactions, post transactions to the ledger, prepare a trial balance, analyze adjustment data, prepare adjusting entries, 15. The following are steps in the accounting cycle. Of the following, which would be prepared last? An adjusted trial balance is prepared. b. Transactions are posted to the ledger. 2 e. An unadjusted trial balance is prepared. d. Adjusting entries are journalized and posted to the ledger. n entity that is organized according to state or federal statutes and in which ownership is divided of stock is a 16. A into a proprictorship b. corporation partnership governmental unit 17. Which of the following group of companies are all examples of a merchandising business? a. Delta Airlines, Marriott, Gap b. Gap, Amazon, NIKE c. GameStop, Sony, Dell d GameStop, Best Buy, Gap Which of the following are guidelines for behaving ethically? 18. I. Il. III. Identify the consequences of a decision and its effect on others. Consider your obligations and responsibilities to those affected by the decision. Identify your decision based on personal standards of honesty and fairness. a. I and II b. II and III. c. I and III. d. I, II, and III. 19 The business entity concept means that a. the owner is part of the business entity b, an entity is organized according to state or federal statutes c. an entity is organized according to the rules set by the FASB d. the entity is an individual economic unit for which data are recorded, analyzed, and reported 20. Debts owed by a business are referred to as a. accounts receivables b. equities c owner's equity liabilities The accounting equation may be expressed as a. Assets Equities - Liabilities b. Assets+ Liabilities-Owners Equity 21. Assets Revenues less Liabilities dAssets-Liabilities- Owner's Equity 22. There are four transactions that affect Owner's equity. Which are the two transactions that increase Owner's equity? a. Revenues and expenses -t Expenses and owner's withdrawals Revenues and Owner's investments Owner's Investments and Expenses c. d. 23. Which of the following financial statements reports information as of a specifie date? a. income statement b. statement of owner's equity c. statement of cash flows d. balance sheet 24. A group of related accounts that comprise a complete unit is called a a. journal b. liability c. ledger d. transaction 25. Revenue should be recognized when a. b. c. d. cash is received the service is performed the customer places an order the customer charges an order 26. The debit side of an account a. depends on whether the account is an asset, liability or owner's equity b. can be either side of the account depending on how the accountant set up t c. is the right side of the account a is the left side of the account Which of the following types of accounts have a normal credit balance? a. b. c. d. 27. assets and liabilities liabilities and expenses revenues and liabilities capital and drawing 28. Which of the following groups of accounts have a normal debit balance? revenues, liabilities, capital capital, assets a. 6 liabilities, expenses c. d assets, expenses Which of the following is true about a T-Account? 29. Left hand side of the T-Account is called a debit b. Left hand side of the T-Accounts is called a credit c. Right hand side of the T-Account is called a debit d. None are true. 30. The accounts in the ledger of Monroe Entertainment Co. are listed in alphabetical order. All accounts normal balances. Accounts Payable 1,500 Fees Earned 1,800 2,000 Land 2,600 Wages Expense 1,200 3,000 1,300 3,000 1,400 8,800 e Accounts Receivable Insurance Expense Investment Cash Withdrawals Owner's Equity The total of all the assets is: a. $9,400 b. $9,000 c. $9,100 d. $9,800 e. $10,300 31. The revenue recognition concept a. is in not in conflict with the cash method of accounting b. determines when revenue is credited to a revenue account c. states that revenue is not recorded until the cash is received d. controls all revenue reporting for the cash basis of accounting 32. The matching concept a. addresses the relationship between the journal and the balance sheet b. determines whether the normal balance of an account is a debit or credit requires that the dollar amount of debits equal the dollar amount of credits on a trial c. balance d. determines that expenses related to revenue be reported at the same time the revenue is reported 33. Deferred expenses have a not yet been recorded as expenses or paid been recorded as expenses and paid c been incurred and paid d. not yet been recorded as expenses 34. Deferred revenue is revenue that is earned and the cash has been received b. a. earned but the cash has not been received not earned and the cash has not been received not earned but the cash has been received c. 35. Which one of the following accounts below would likely be included in a deferral adjusting entry? a. Interest Revenue b Unearned Revenue c. Salaries Payable d. Accounts Receivable 36. The balance in the office supplies account on June I was $6,300, supplies purchased during June were 5.100, and the supplies on hand at June 30 were $2,500. The amount to be used for the appropriate adjusting entry is a. $3,700 b. $11,900 C. $5,700 d. $6,900 37. The difference between the balance of a fixed asset account and the related accumulated depreciation accour is termed a. historical cost b. contra asset c. book value d. market value 38. The supplies account has a balance of s1,200 apthe beginning of the year and was debited during the year fo S2,300, representing the total of supplies purchased during the year. If $650 of supplies are on hand at the end of the year, the supplies expense to be reported on the income statement for the year is a. $650 b. $1,750 c. $4,150 d. $2,850 39. The type of account and normal balance of Accumulated Depreciation is a. asset, credit b. asset, debit c. contra asset, credit contra asset, debit Accrued revenues would appear on the balance sheet as a. assets b. liabilities O capital d. prepaid expenses 40. 41. Which of the accounting steps in the accounting process below would be completed last? preparing the adjusted trial balance b. a. posting preparing the financial statements d.) journalizing When preparing the statement of owner's equity, the beginning capital balance can always be found a. b. c. d. 42. in the Income Statement columns of the work sheet in the statement of cash flows in the general ledger in the Balance Shcet columns of the work sheet 43. Accumulated Depreciation appears on the balance sheet in the current assets section b. balance sheet in the property, plant and equipment section c. balance sheet in the long-term liabilities section d. income statement as an operating expense 44. The Balance Sheet should be prepared a. before the income statement and the statement of owner's equity b. before the income statement and after the statement of owner's equity c. after the income statement and the statement of owner's equity d. after the icome statement and before the statement of owner's equity On which financial statement will Income Summary be shown? a. 45. Statement of Owner's Equity b. Balance Sheet Income Statement c. d. No financial statement The income summary account is also called a the closing account b. the clearing account c. the nominal account d. the temporary account 46. Finley Company Worksheet For the Year Ended December 31, 2010 Adjusted Trial Income Statement Balance Sheet Balance Debit 48,000 18,000 Account Title Credit tDebit Credit 48,000 Cash Accounts Receivable Supplies 18,000 6,000 57,000 6,000 57,000 men Accumulated Depr-Equip Accounts Payable 18,000 18,000 30,000 6,000 33,000 33,000 3.000 3,000 Fees Earned 141,000 141,000 63,000 18,000 63,000 18,000 se Rent Ex Depreciation Expense15,000 Totals Net Income (Loss) 228,000|228,000|96,000-141,000 -132,000 -87,000 000 132,000 The journal entry to close revenues would be: a. 47. debit Income Summary $141,000, credit Fees Earned $141,000 b. debit C. Finley, Capital $141,000, credit Fees Earned $141,000 c. debit Fees Earned $141,000; credit Income Summary $141,000 d. credit Fees Earned $141,000; credit C. Finley, Capital S141,000 Based on the preceding trial balance, the entry to close expenses would be: a. Wages Expense 48. 63,000 18,000 Depreciation Expense 15,000 Rent Expense Income Summary 96,000 b. Expenses Income Summary 96,000 c. Wages Expense 63,000 Rent Expense Depreciation Expense 18,000 C. Finley, Drawing 96,000 Wages Expense 63,000 Depreciation Expense 15,000 15,000 d. Income Summary 96,000 Rent Expense 18,000 The natural business year a is a fiscal year that ends when business activities are at its lowest point. b. is a calendar year that ends when business activities are at its lowest point. c. is a fiscal year that ends when business activities are at its highest point d. is a calendar year that ends when business activities are at its highest point. 49. Net income appears on the work sheet in the a. debit column of the Balance Sheet columns b. debit column of the Adjustments columns 50. debit column of the Income Statement columns d. credit column of the Income Statement columns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts