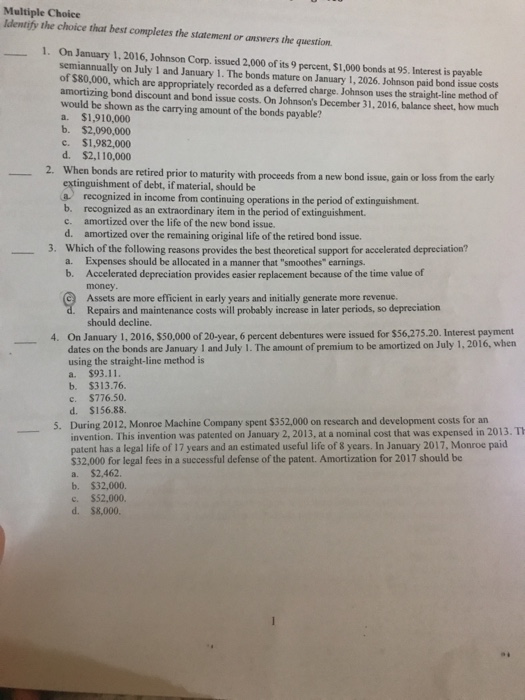

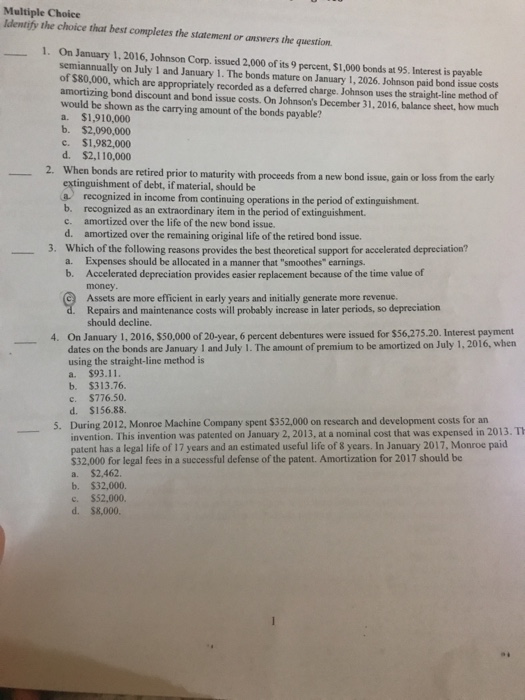

Multiple Choice ldentify the choice that best completes the statement or answers the question 1. On January 1, 2016, Johnson Corp. issued 2,000 of its 9 percent, $1,000 bonds at 95. Interest is payable semiannually on July 1 and January 1. The bonds mature on January 1, of $80,000, which are appropriately recorded as a deferred charge. Johnson uses the straight-line method of amortizing bond discount and bond issue costs. On Johnson's December 31, 2016, balance sheet, how mach would be shown as the carrying amount of the bonds payable? a. $1,910,000 b. $2,090,000 c. $1,982,000 d. $2,110,000 2026. Johnson paid bond issue costs 2. When bonds are retired prior to maturity with proceeds from a new bond issue, gain or loss from the carly extinguishment of debt, if material, should be a recognized in income from continuing operations in the period of extinguishment. b. recognized as an extraordinary item in the period of extinguishment. c. amortized over the life of the new bond issue. d. amortized over the remaining original life of the retired bond issue. 3. Which of the following reasons provides the best theoretical support for accelerated depreciation? a. b. Expenses should be allocated in a manner that "smoothes" earnings. Accelerated depreciation provides easier replacement because of the time value of moncy c Assets are more efficient in early years and initially generate more revenue. Repairs and maintenance costs will probably increase in later periods, so depreciation should decline. 4. On January 1, 2016, $50,000 of 20-year,6 percent debentures were issued for $56,275.20. Interest payment dates on the bonds are January 1 and July I. The amount of premium to be amortized on July 1, 2016, when using the straight-line method is a. $93.11 b. $313.76 c. $776.50. d. $156.88. During 2012, Monroe Machine Company spent $352,000 on research and development costs for an invention. This invention was patented on January 2, 2013, at a nominal cost that was expensed in 2013. TI patent has a legal life of 17 years and an estimated useful life of 8 years. In January 2017, Monroe paid S32,000 for legal fees in a successful defense of the patent. Amortization for 2017 should be a. $2,462. b. $32,000. c $52.000. d. $8,000. 5