Answered step by step

Verified Expert Solution

Question

1 Approved Answer

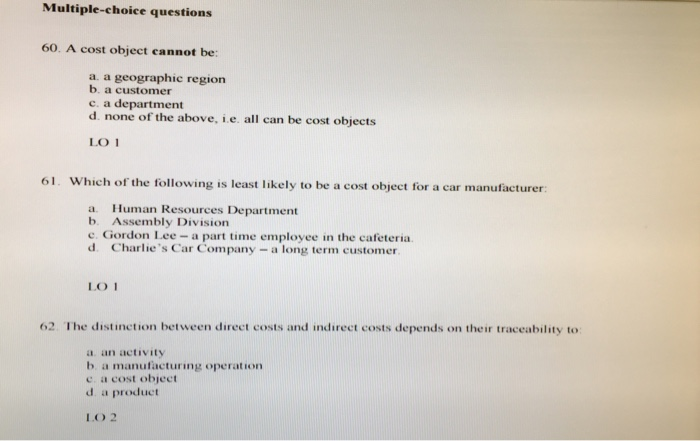

Multiple-choice questions 60. A cost object cannot be: a. a geographic region b. a customer c. a department d. none of the above, i.e.

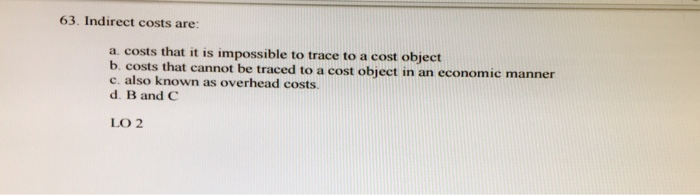

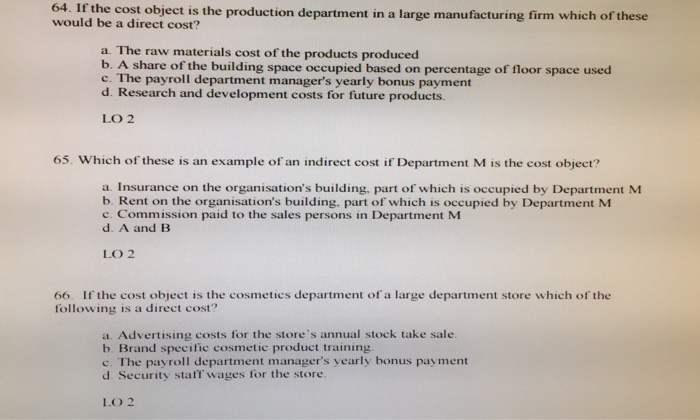

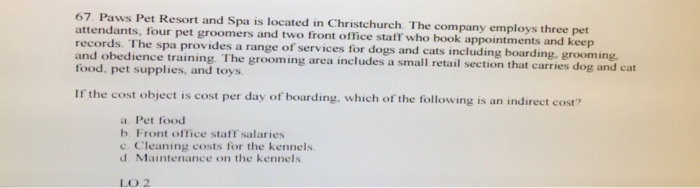

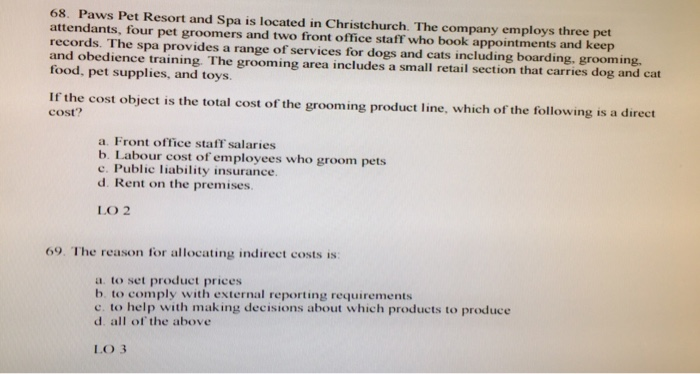

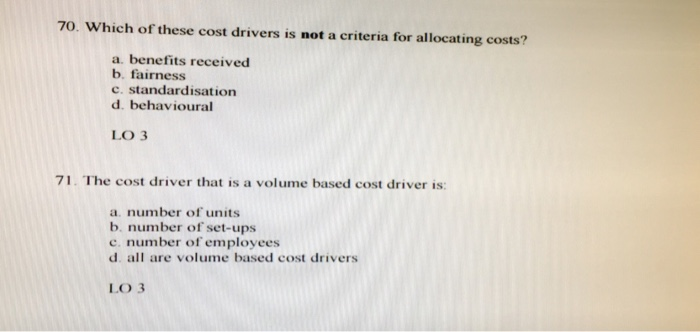

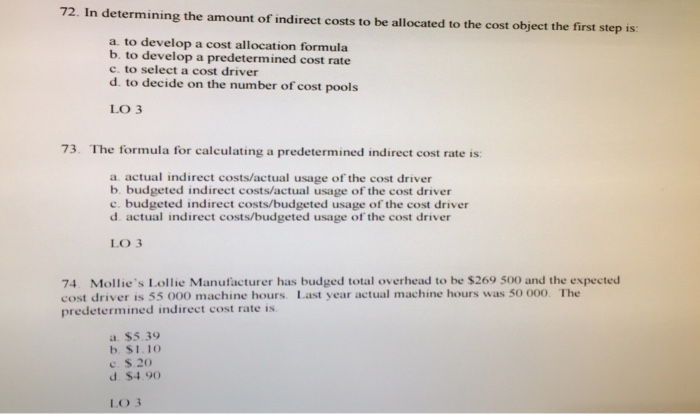

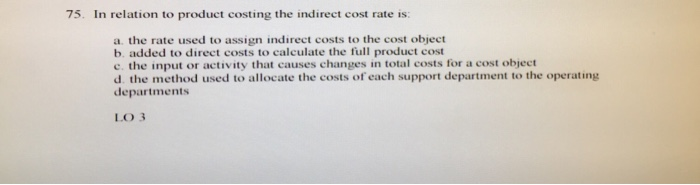

Multiple-choice questions 60. A cost object cannot be: a. a geographic region b. a customer c. a department d. none of the above, i.e. all can be cost objects LO 1 61. Which of the following is least likely to be a cost object for a car manufacturer: a. Human Resources Department b. Assembly Division c. Gordon Lee-a part time employee in the cafeteria. d. Charlie's Car Company. - a long term customer. LO 1 62. The distinction between direct costs and indirect costs depends on their traceability to: a. an activity b. a manufacturing operation c. a cost object d. a product LO 2 63. Indirect costs are: a. costs that it is impossible to trace to a cost object b. costs that cannot be traced to a cost object in an economic manner c. also known as overhead costs. d. B and C LO 2 64. If the cost object is the production department in a large manufacturing firm which of these would be a direct cost? a. The raw materials cost of the products produced b. A share of the building space occupied based on percentage of floor space used c. The payroll department manager's yearly bonus payment d. Research and development costs for future products. LO 2 65. Which of these is an example of an indirect cost if Department M is the cost object? a. Insurance on the organisation's building, part of which is occupied by Department M b. Rent on the organisation's building, part of which is occupied by Department M c. Commission paid to the sales persons in Department M d. A and B LO 2 66. If the cost object is the cosmetics department of a large department store which of the following is a direct cost? a. Advertising costs for the store's annual stock take sale. b. Brand specific cosmetic product training. c. The payroll department manager's yearly bonus payment d. Security staff wages for the store. LO2 67. Paws Pet Resort and Spa is located in Christchurch. The company employs three pet attendants, four pet groomers and two front office staff who book appointments and keep records. The spa provides a range of services for dogs and cats including boarding, grooming. and obedience training. The grooming area includes a small retail section that carries dog and cat food, pet supplies, and toys. If the cost object is cost per day of boarding, which of the following is an indirect cost? a. Pet food b. Front office staff salaries c. Cleaning costs for the kennels. d. Maintenance on the kennels. LO 2 68. Paws Pet Resort and Spa is located in Christchurch. The company employs three pet attendants, four pet groomers and two front office staff who book appointments and keep records. The spa provides a range of services for dogs and cats including boarding, grooming, and obedience training. The grooming area includes a small retail section that carries dog and cat food, pet supplies, and toys. If the cost object is the total cost of the grooming product line, which of the following is a direct cost? a. Front office staff salaries b. Labour cost of employees who groom pets c. Public liability insurance. d. Rent on the premises. LO 2 69. The reason for allocating indirect costs is: a. to set product prices b. to comply with external reporting requirements c. to help with making decisions about which products to produce d. all of the above LO 3 70. Which of these cost drivers is not a criteria for allocating costs? a. benefits received b. fairness c. standardisation d. behavioural LO 3 71. The cost driver that is a volume based cost driver is: a. number of units b. number of set-ups c. number of employees d. all are volume based cost drivers LO 3 72. In determining the amount of indirect costs to be allocated to the cost object the first step is: a. to develop a cost allocation formula b. to develop a predetermined cost rate c. to select a cost driver d. to decide on the number of cost pools LO 3 73. The formula for calculating a predetermined indirect cost rate is: a. actual indirect costs/actual usage of the cost driver b. budgeted indirect costs/actual usage of the cost driver c. budgeted indirect costs/budgeted usage of the cost driver d. actual indirect costs/budgeted usage of the cost driver LO 3 74. Mollie's Lollie Manufacturer has budged total overhead to be $269 500 and the expected cost driver is 55 000 machine hours. Last year actual machine hours was 50 000. The predetermined indirect cost rate is a. $5.39 b. $1.10 c. $.20 d. $4.90 LO 3 75. In relation to product costing the indirect cost rate is: a. the rate used to assign indirect costs to the cost object b. added to direct costs to calculate the full product cost c. the input or activity that causes changes in total costs for a cost object d. the method used to allocate the costs of each support department to the operating departments LO 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided images here are the corrected answers to the questions 60 A cost object cannot be a a geographic region 61 Which of the followin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started