Question

MULTIPLE CHOICE (ONLY SELECT THE CORRECT OPTION) Question 21 The question is based on the following information: The government sector's net issuance of long-term government

MULTIPLE CHOICE (ONLY SELECT THE CORRECT OPTION)

Question 21

The question is based on the following information:

The government sector's net issuance of long-term government bonds and treasury bills was R192 billion and R56,6 billion respectively in 2017. Non-residents bought long-term government bonds of R165 billion during 2017. At the end of 2017, the total outstanding amount of government bonds amounted to R1 731 billion, while the outstanding treasury bills amounted to R250 billion.

Which of the following mentioned in the paragraph above refers to a stock?

[1] Issuance of long-term government bonds to the amount of R192 billion during 2017.

[2] Issuance of treasury bills to the amount of R56,6 billion during 2017.

[3] Long-term government bonds to the amount of R165 billion sold to foreigners during 2017.

[4] Outstanding government bonds at the end of 2017 amounted to R1 731 billion.

[5] Outstanding treasury bills at the end of 2017 amounted to R250 billion.

- A.1, 2, 3, 4 and 5 all refer to stocks

- B.only 1, 2 and 3 refer to stocks

- C.only 1, 3 and 4 refer to stocks

- D.only 4 and 5 refer to stocks

- E.only 2 and 5 refer to stocks

Question 24

If the exchange rate changes from R15,05 = ?1, to R14,10 = ?1, ...

[1]the Rand has appreciated.

[2]the Euro has appreciated.

[3]South African imports from Europe will now cost less in terms of Rand.

[4]European imports from South Africa will now cost less in terms of the Euro.

- A.only 1 and 4 are correct

- B.only 1 and 3 are correct

- C.only 2 and 4 are correct

- D.only 2 and 3 are correct

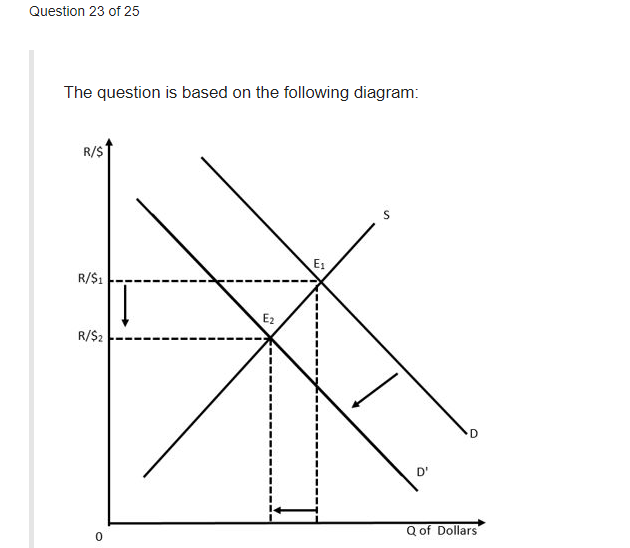

QUESTION 23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started