Question

Multiple choice options for each question: Dividends one year from now (D 1 ): $3.33, $2.87, $2.78, or $2.48 per share Horizon value (Stock's value

Multiple choice options for each question:

Multiple choice options for each question:

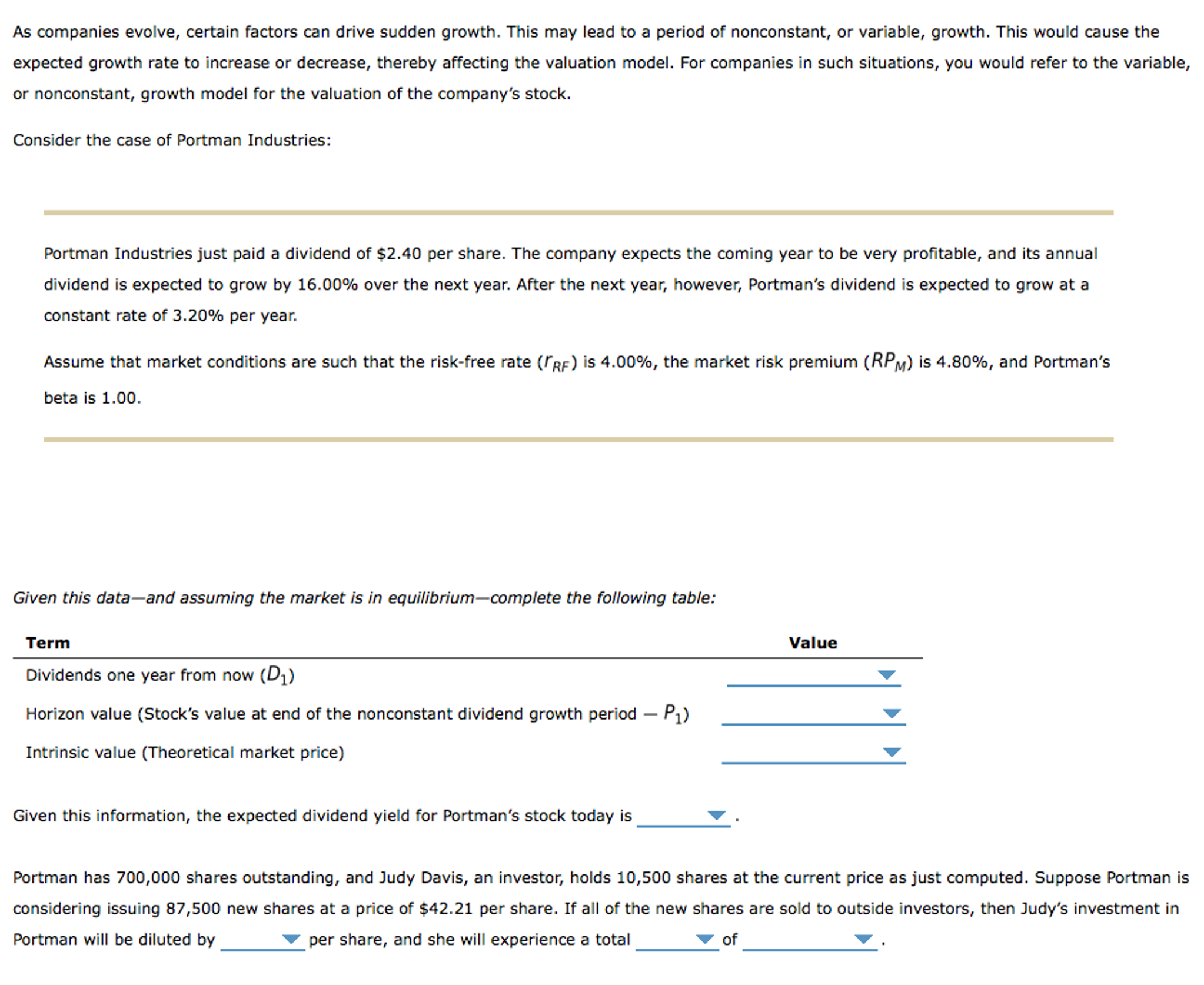

Dividends one year from now (D1): $3.33, $2.87, $2.78, or $2.48 per share

Horizon value (Stock's value at end of the nonconstant dividend growth period - P1): $49.64, $62.39, $51.25, or $89.69 per share

Intrinsic value (Theoretical market price): $47.10, $59.59, $49.66, or $54.93 per share

Given this information, the expected dividend yield for Portman's stock today is: 5.60%, 5.78%, 5.42%, or 5.90%

If all of the new shares are sold to outside investors, then Judy's investment in Portman will be diluted by ($0.71, $0.83, $1.74, or $1.02) and she will experience a total (loss or profit) of ($5,664.75, $8,715.00, $6,536.25, or $10,458.00)

As companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the expected growth rate to increase or decrease, thereby affecting the valuation model. For companies in such situations, you would refer to the variable, or nonconstant, growth model for the valuation of the company's stock. Consider the case of Portman Industries: Portman Industries just paid a dividend of $2.40 per share. The company expects the coming year to be very profitable, and its annual dividend is expected to grow by 16.00% over the next year. After the next year, however, Portman's dividend is expected to grow at a constant rate of 3.20% per year. Assume that market conditions are such that the risk-free rate (rRF) is 4.00%, the market risk premium (RPM) is 4.80%, and Portman's beta is 1.00 Given this data-and assuming the market is in equilibrium-complete the following table: Term Value Dividends one year from now (D1) Horizon value (Stock's value at end of the nonconstant dividend growth period -P1) Intrinsic value (Theoretical market price) Given this information, the expected dividend yield for Portman's stock today is Portman has 700,000 shares outstanding, and Judy Davis, an investor, holds 10,500 shares at the current price as just computed. Suppose Portman is considering issuing 87,500 new shares at a price of $42.21 per share. If all of the new shares are sold to outside investors, then Judy's investment in Portman will be diluted by per share, and she will experience a total of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started