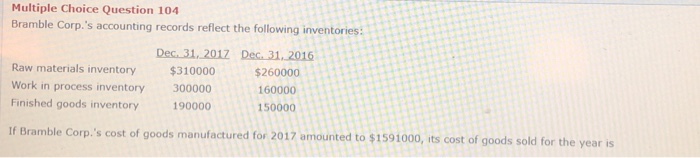

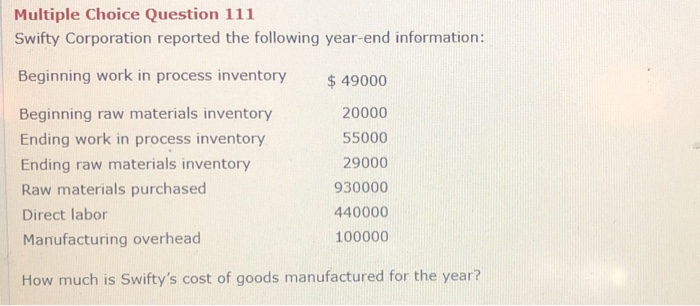

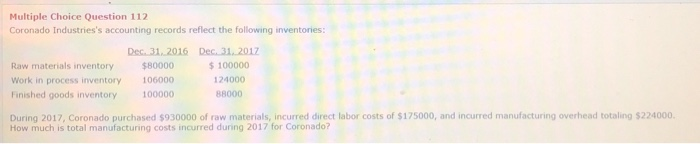

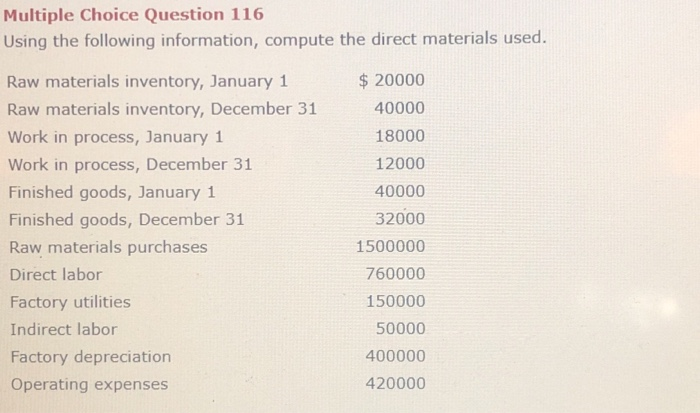

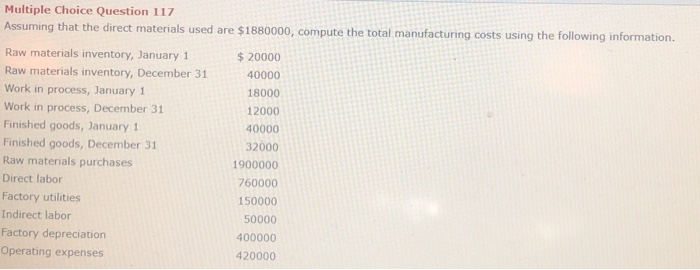

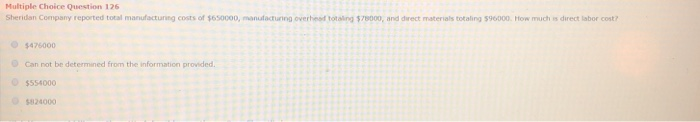

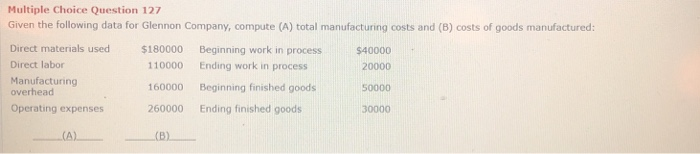

Multiple Choice Question 104 Bramble Corp.'s accounting records reflect the following inventories: Raw materials inventory Work in process inventory Finished goods inventory $310000 300000 190000 $260000 160000 150000 If Bramble Corp.'s cost of goods manufactured for 2017 amounted to $1591000, its cost of goods sold for the year is Multiple Choice Question 111 Swifty Corporation reported the following year-end information: Beginning work in process inventory 49000 Beginning raw materials inventory Ending work in process inventory Ending raw materials inventory Raw materials purchased Direct labor Manufacturing overhead 20000 55000 29000 930000 440000 100000 How much is Swifty's cost of goods manufactured for the year? Multiple Choice Question 112 Coronado Industries's accounting records reflect the following inventories Raw materials inventory Work in process inventory Finished goods inventory $80000 106000 100000 100000 124000 88000 During 2017, Coronado purchased $930000 of raw materials, incurred direct labor costs of $175000, and incurred manufacturing overhead totaling $224000. How much is total manufacturing costs incurred during 2017 for Coronado? Multiple Choice Question 116 Using the following information, compute the direct materials used. Raw materials inventory, January 1 Raw materials inventory, December 31 Work in process, January 1 Work in process, December 31 Finished goods, January 1 Finished goods, December 31 Raw materials purchases Direct labor Factory utilities Indirect labor Factory depreciation Operating expenses $ 20000 40000 18000 12000 40000 32000 1500000 760000 150000 50000 400000 420000 Multiple Choice Question 117 Assuming that the direct materials used are $1880000, compute the total manufacturing costs using the following information Raw materials inventory, January 1 Raw materials inventory, December 31 Work in process, January 1 Work in process, December 31 Finished goods, January 1 Finished goods, December 31 Raw materials purchases Direct labor Factory utilities Indirect labor Factory depreciation Operating expenses 20000 40000 18000 12000 40000 32000 1900000 760000 150000 50000 400000 420000 Multiple Choice Question 126 Sheridan Company reported total manufacturing costs of $650000, manulacrunng overhead totain 78000 and direct materials totaling $96000 How m uch ss direct labor c $476000 Can not be determined from the information provided $554000 $824000 Multiple Choice Question 127 Given the following data for Glennon Company, compute (A) total manufacturing costs and (B) costs of goods manufactured: Direct materials used Direct labor Manufacturing $180000 Beginning work in process$40000 110000 160000 260000 Ending work in process Beginning finished goods Ending finished goods 20000 50000 30000 overhead Operating expenses