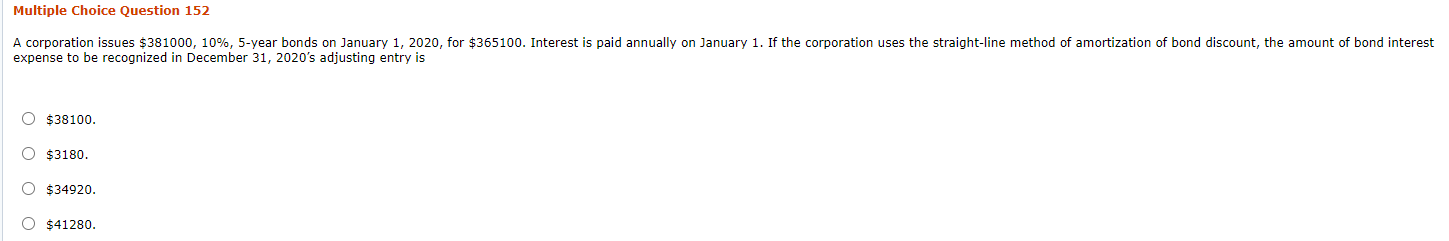

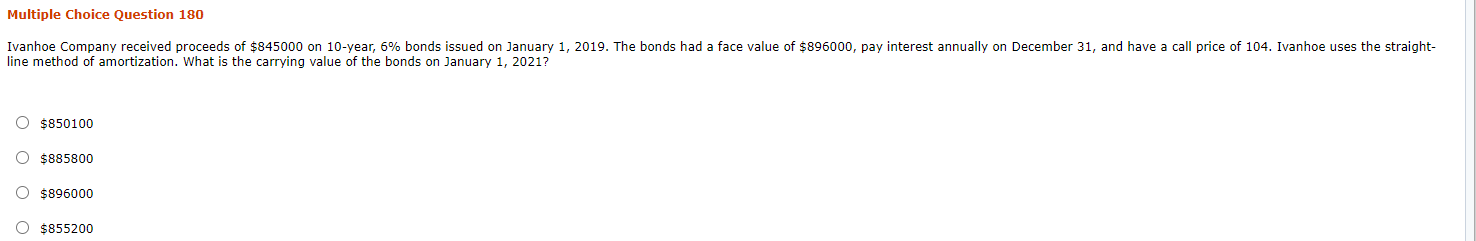

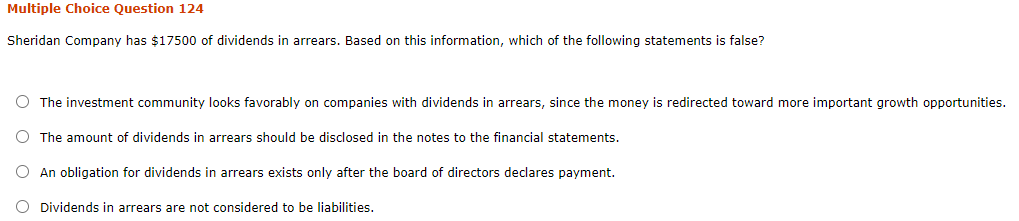

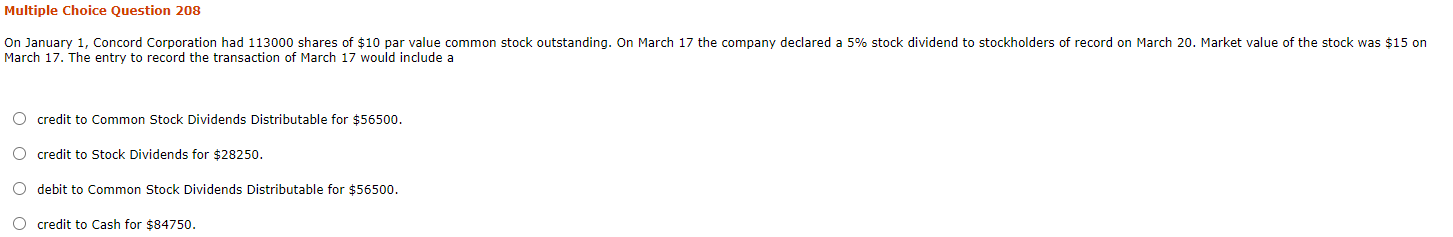

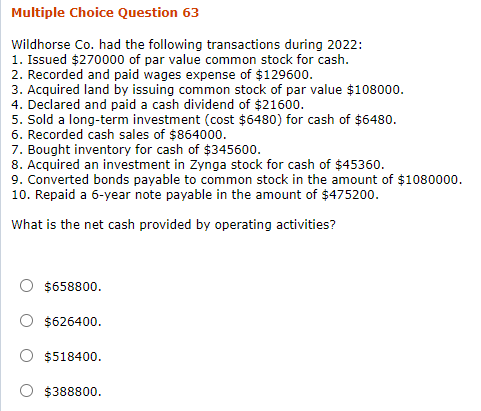

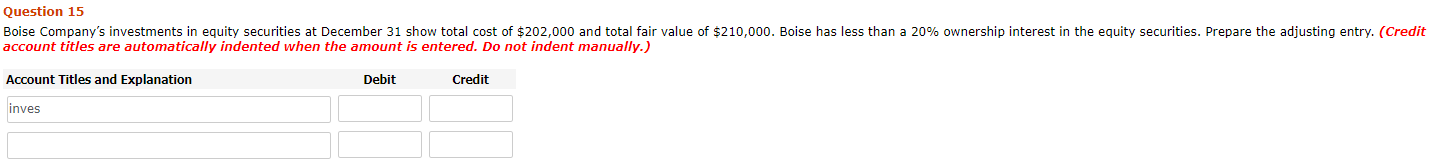

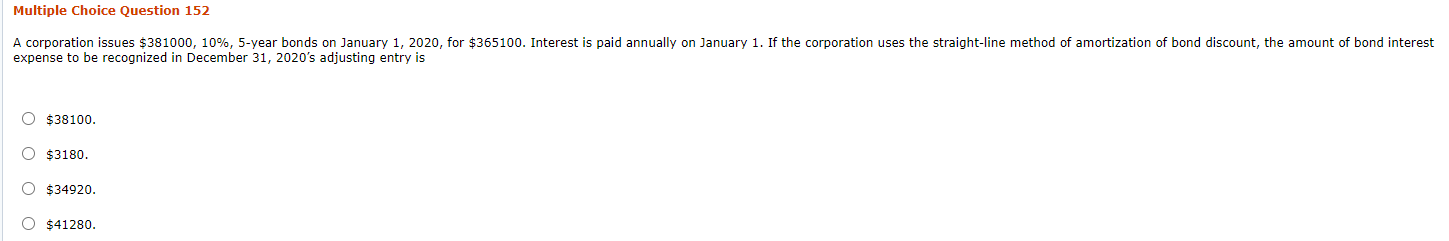

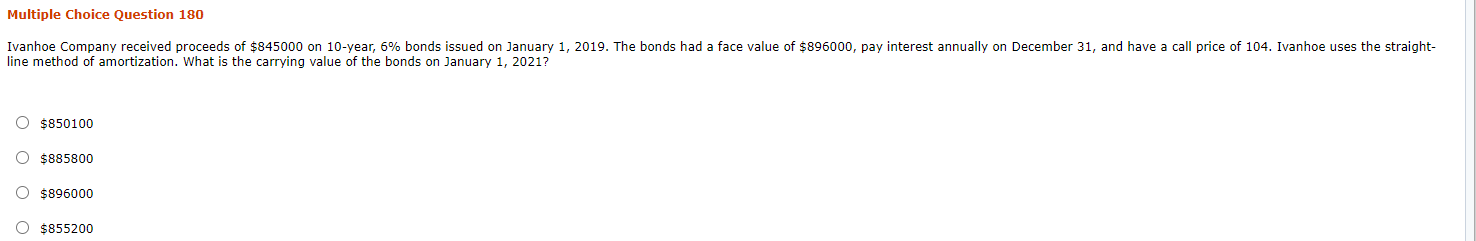

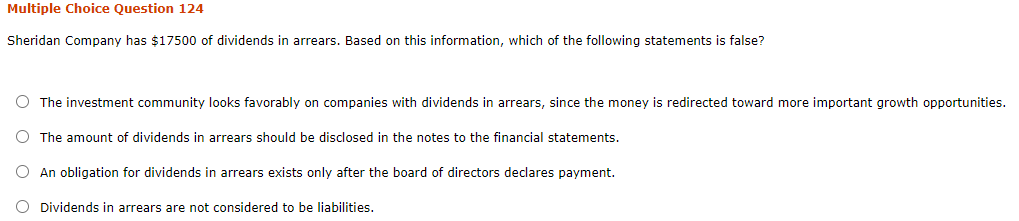

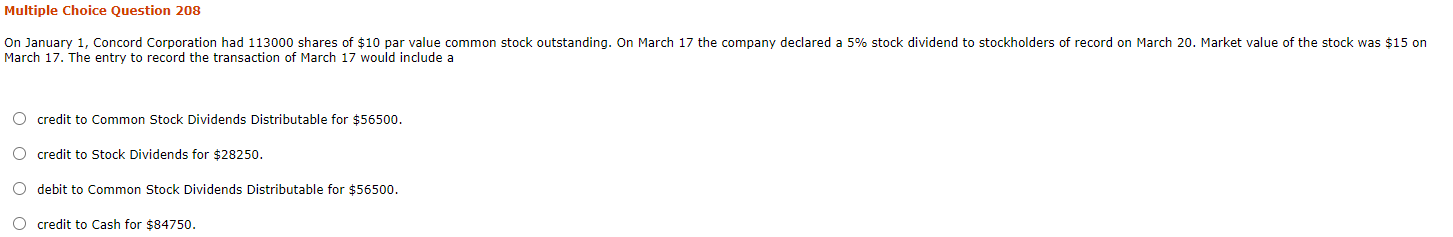

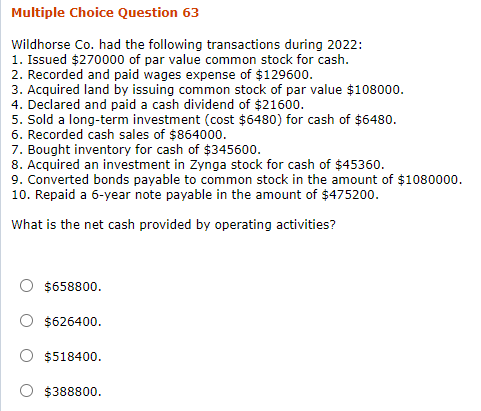

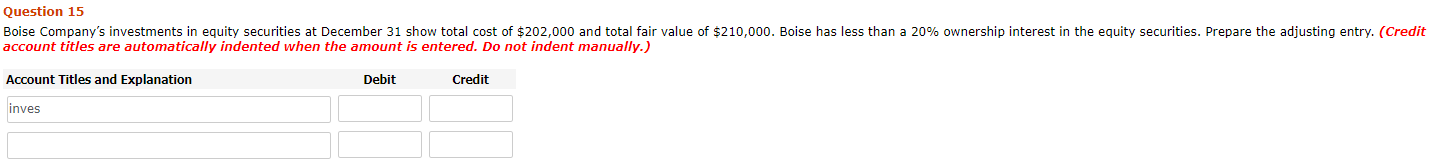

Multiple Choice Question 152 A corporation issues $381000, 10%, 5-year bonds on January 1, 2020, for $365100. Interest is paid annually on January 1. If the corporation uses the straight-line method of amortization of bond discount, the amount of bond interest expense to be recognized in December 31, 2020's adjusting entry is O $38100. O $3180. O $34920. O $41280. Multiple Choice Question 180 Ivanhoe Company received proceeds of $845000 on 10-year, 6% bonds issued on January 1, 2019. The bonds had a face value of $896000, pay interest annually on December 31, and have a call price of 104. Ivanhoe uses the straight- line method of amortization. What is the carrying value of the bonds on January 1, 2021? O $850100 O $885800 O $896000 O $855200 Multiple Choice Question 124 Sheridan Company has $17500 of dividends in arrears. Based on this information, which of the following statements is false? The investment community looks favorably on companies with dividends in arrears, since the money is redirected toward more important growth opportunities. The amount of dividends in arrears should be disclosed in the notes to the financial statements. O An obligation for dividends in arrears exists only after the board of directors declares payment. O Dividends in arrears are not considered to be liabilities. Multiple Choice Question 208 On January 1, Concord Corporation had 113000 shares of $10 par value common stock outstanding. On March 17 the company declared a 5% stock dividend to stockholders of record on March 20. Market value of the stock was $15 on March 17. The entry to record the transaction of March 17 would include a O credit to Common Stock Dividends Distributable for $56500. O credit to Stock Dividends for $28250. O debit to Common Stock Dividends Distributable for $56500. O credit to Cash for $84750. Multiple Choice Question 63 Wildhorse Co. had the following transactions during 2022: 1. Issued $270000 of par value common stock for cash. 2. Recorded and paid wages expense of $129600. 3. Acquired land by issuing common stock of par value $108000. 4. Declared and paid a cash dividend of $21600. 5. Sold a long-term investment (cost $6480) for cash of $6480. 6. Recorded cash sales of $864000. 7. Bought inventory for cash of $345600. 8. Acquired an investment in Zynga stock for cash of $45360. 9. Converted bonds payable to common stock in the amount of $1080000. 10. Repaid a 5-year note payable in the amount of $475200. What is the net cash provided by operating activities? $658800. $626400. $518400. O $388800. Question 15 Boise Company's investments in equity securities at December 31 show total cost of $202,000 and total fair value of $210,000. Boise has less than a 20% ownership interest in the equity securities. Prepare the adjusting entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit inves