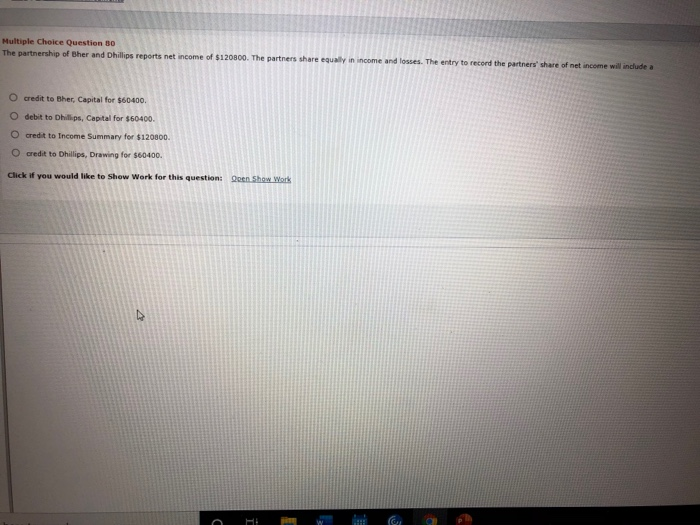

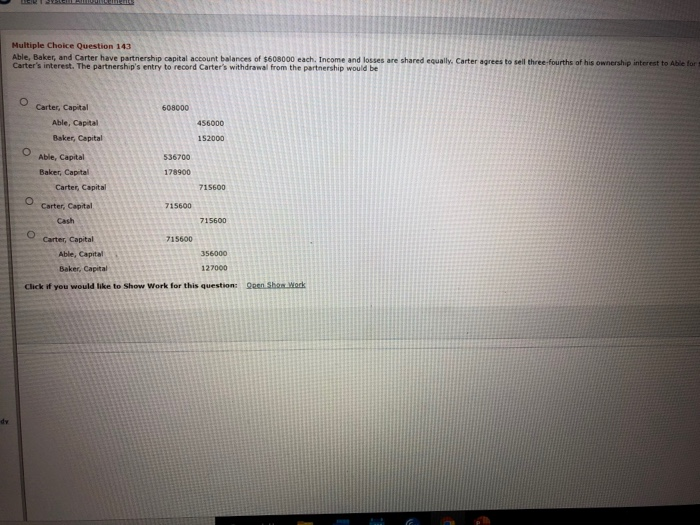

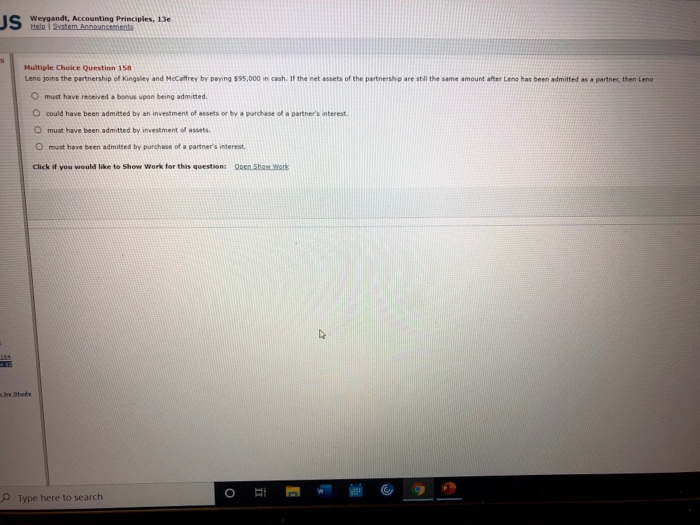

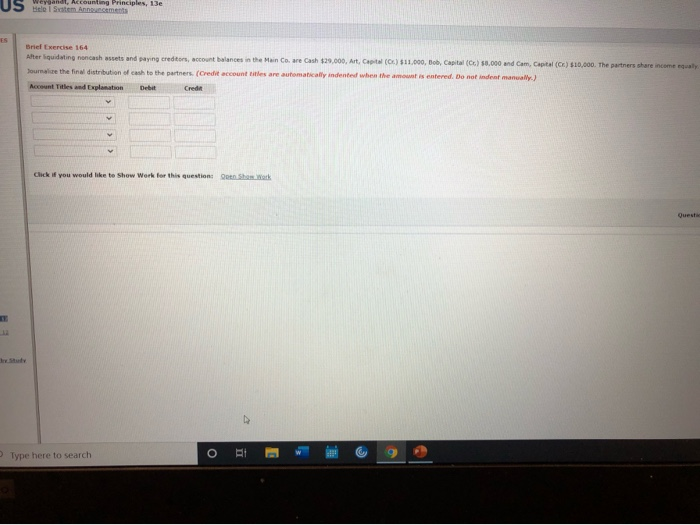

Multiple Choice Question Bo The partnership of Bher and Dhillips reports net income of $120800. The partners share equally in income and losses. The entry to record the partners' share of net income will include a O credit to Bher, Capital for $60400 O debit to Dhillips, Capital for $60400 O credit to Income Summary for $120000 O credit to Dhillips, Drawing for $60400. Click if you would like to show Work for this question: Coen Show Work GA Multiple Choice Question 143 Able, Baker, and Carter have partnership capital account balances of $608000 each. Income and losses are shared equally. Carter agrees to sell three-fourths of his ownership interest to Able for Carter's interest. The partnership's entry to record Carter's withdrawal from the partnership would be Carter, Capital 608000 Able, Capital 456000 Baker, Capital 152000 O Able, Capital 536700 Baker, Capital 178900 Carter, Capital 715600 O Carter, Capital 715600 Cash 715600 O Carter, Capital 715600 Able, Capital 356000 Baker, Capital 127000 Click if you would like to Show Work for this questioneen Sbon Work dv CALCULATOR PRINTER VERSION NET each. Income and losses are shared equally Carter agrees to sell three fourths of his ownership interest to Able for $528000 and one-fourth to Baker for $107600. Able and Baker will use personal assets to purchase ne partnership would be Work SUBMIT ANSWER Question Attempts of I used 9:28 AM 7/21/2020 JS WestendtAccounting Principles, 13e Multiple Choice Question 158 Leno joins the partnership of Kingsley and McCaffrey by paying $95,000 in cash. If the net assets of the partnership are still the same amount after Leno has been admitted as a partner, then Leno O must have received a bonus upon being admitted. O could have been admitted by an investment of assets or by a purchase of a partner's interest. O must have been admitted by investment of assets O must have been admitted by purchase of a partner's interest Click if you would like to show Work for this question: Open Show Work O Type here to search RE US Sete Announcements Weyandt, Mccounting Principles, 13e ES Brief Exercise 164 Alter liquidating noncash assets and paying credito, account balances in the Main Co. are Cash $29.000, Art, Capital (0) $11,000, Bob, Capital (C) 50,000 and Cam, Capital (CE) $10,000. The partners share income equally Journalise the final distribution of cash to the partners. (Credit account titles are automatically indented when the amount is entered. Do not indes manually) Account Titles and Explanation Debit Credit Click if you would like to show Work for this questions Open Sherwork Questa O Type here to search BI