Answered step by step

Verified Expert Solution

Question

1 Approved Answer

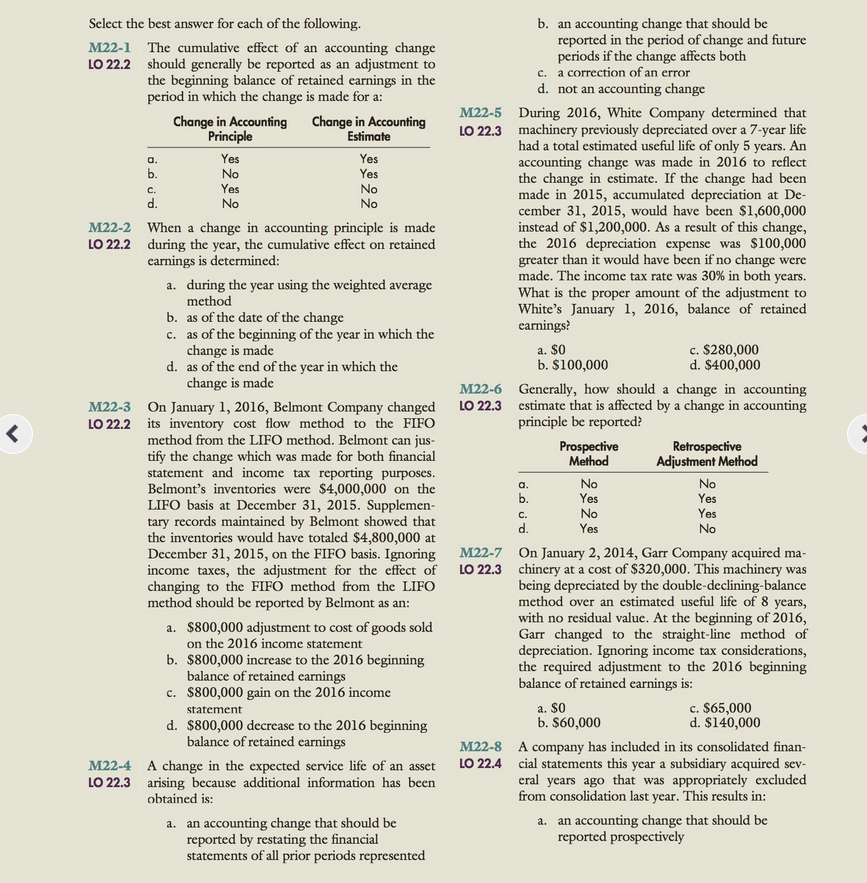

Multiple choice questions 1-7 Select the best answer for each of the following. an accounting change that should be reported in the period of change

Multiple choice questions 1-7

Select the best answer for each of the following. an accounting change that should be reported in the period of change and future periods if the change affects both b. M22-1 The cumulative effect of an accounting change LO 22.2 should generally be reported as an adjustment to c. a correction of an error the be balance of retained earnings in the d. not an accounting change period in which the change is made for a: M22-5 LO 22.3 During 2016, White Company determined that machinery previously depreciated over a 7-year life had a total estimated useful life of only 5 years. An accounting change was the change in estimate. If the change had been made in 2015, accumulated depreciation at De cember 31, 2015, would have been $1,600,000 instead of $1,200,000. As a result of this change, the 2016 depreciation expense was S100,000 greater than it would have been if no change were made. The income tax rate was 30% in both What is the proper amount of the adjustment to White's January 1, 2016, balance of retained Change in Accounting Change in Accounting Estimate e in 2016 to refl No No 2-2 When a change in accounting principle is LO 22.2 during the year, the cumulative effect on retained earnings is determined during the year using the weighted average method a. b. as of the date of the change c. as of th e beginnin g of the year in which the a. $0 c. $280,000 d. $400,000 change is made d. as of the end of the year in which the b. $100,000 change is made M22-6 Generally, how should a change in accounting LO 22.3 estimate that is affected by a change in accounting principle be reported? On January 1, 2016, Belmont Company changed its inventory cost flow method to the FIFO method from the LIFO method. Belmont can jus- tify the change which was made for both financial statement and income tax reporting purposes Belmont's inventories were $4,000,000 on the LIFO basis at December 31, 2015. Supplemen tary records maintained by Belmont showed that the inventories would have totaled $4,800,000 at December 31, 2015, on the FIFO basis. Ignoring income taxes, the adjustment for the effect of changing to the FIFO method from the LIFO M22-3 LO 22.2 Adjustment Method No No No es No On January 2, 2014, Garr Company acquired ma chinery at a cost of $320,000. This machinery was being depreciated by the double-declining-balance method over an estimated useful life of 8 years, with no residual value. At the Garr changed to the straight-line method of depreciation. the required adjustment to balance of retained earnings is M22-7 LO 22.3 method should be reported by Bclmont as an beginning of 2016 the 2016 begi c. $65,000 $800,000 adjustment to cost of goods sold on the 2016 a. income statement Ignoring income tax considerations ginning b. $800,000 inc c. $800,000 gain on the 2016 income d. $800,000 decrease to the 2016 beginning rease to the 2016 beginning balance of retained earnings statement b. $60,000 d. $140,000 balance of retained earnings company has included in its consolidated finan M22-4 A change in the expected service life of an asset LO 22.4 cial statements this year a subsidiary acquired sev eral years ago that was appropriately excluded LO 22.3 arising because additional information has been from consolidation last year. This results in a. an accounting change that should be obtained is: an accounting change that should be reported by restating the fi statements of all prior periods represented a. reported prospectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started