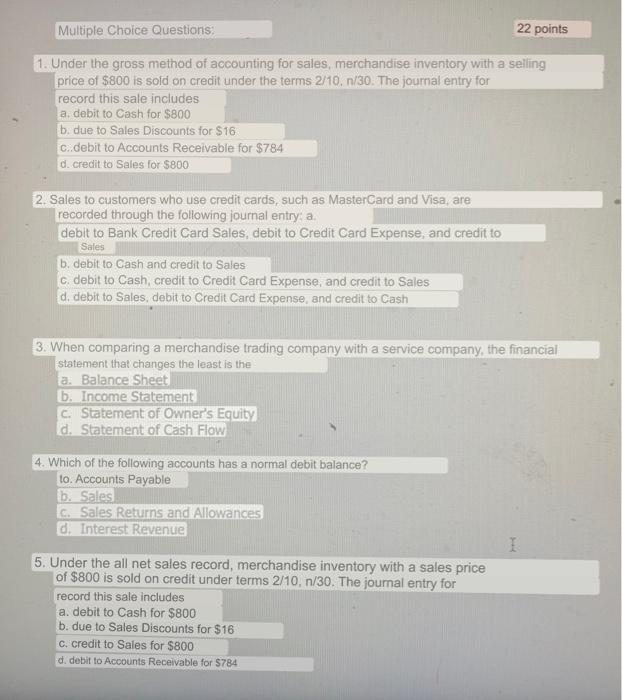

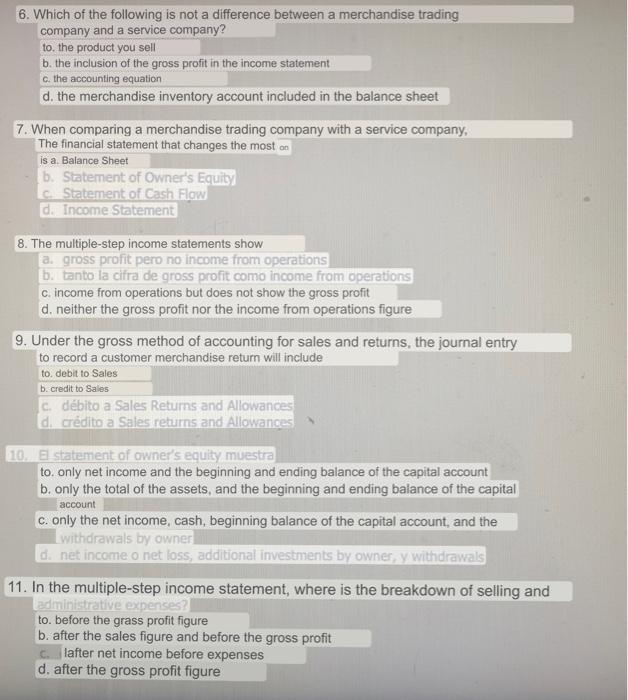

Multiple Choice Questions: 22 points 1. Under the gross method of accounting for sales, merchandise inventory with a selling price of $800 is sold on credit under the terms 2/10./30. The journal entry for record this sale includes a. debit to Cash for $800 b. due to Sales Discounts for $16 C.debit to Accounts Receivable for $784 d. credit to Sales for $800 2. Sales to customers who use credit cards, such as MasterCard and Visa, are recorded through the following journal entry a debit to Bank Credit Card Sales, debit to Credit Card Expense, and credit to Sales b. debit to Cash and credit to Sales C. debit to Cash, credit to Credit Card Expense, and credit to Sales d. debit to Sales, debit to Credit Card Expense, and credit to Cash 3. When comparing a merchandise trading company with a service company, the financial statement that changes the least is the a. Balance Sheet b. Income Statement C. Statement of Owner's Equity d. Statement of Cash Flow 4. Which of the following accounts has a normal debit balance? to. Accounts Payable b. Sales C Sales Returns and Allowances d. Interest Revenue 5. Under the all net sales record, merchandise inventory with a sales price of $800 is sold on credit under terms 2/10,n/30. The journal entry for record this sale includes a. debit to Cash for $800 b. due to Sales Discounts for $16 c. credit to Sales for $800 d. debit to Accounts Receivable for $784 6. Which of the following is not a difference between a merchandise trading company and a service company? 10. the product you sell b. the inclusion of the gross profit in the income statement c. the accounting equation d. the merchandise inventory account included in the balance sheet 7. When comparing a merchandise trading company with a service company, The financial statement that changes the most on is a Balance Sheet b. Statement of Owner's Equity Statement of Cash Flow d. Income Statement 8. The multiple-step income statements show a gross profit pero no income from operations bu tanto la cifra de gross profit como income from Operations c. income from operations but does not show the gross profit d. neither the gross profit nor the income from operations figure 9. Under the gross method of accounting for sales and returns, the journal entry to record a customer merchandise return will include to. debit to Sales b. credit to Sales c. dbito a Sales Returns and Allowances de crdito a Sales returns and Allowances 10. El statement of owner's equity muestra to only net income and the beginning and ending balance of the capital account b. only the total of the assets, and the beginning and ending balance of the capital account c. only the net income, cash, beginning balance of the capital account, and the withdrawals by owner d. net income o net loss, additional investments by owner, y withdrawals 11. In the multiple-step income statement, where is the breakdown of selling and administrative expenses? to. before the grass profit figure b. after the sales figure and before the gross profit lafter net income before expenses d. after the gross profit figure