multiple choice quetion

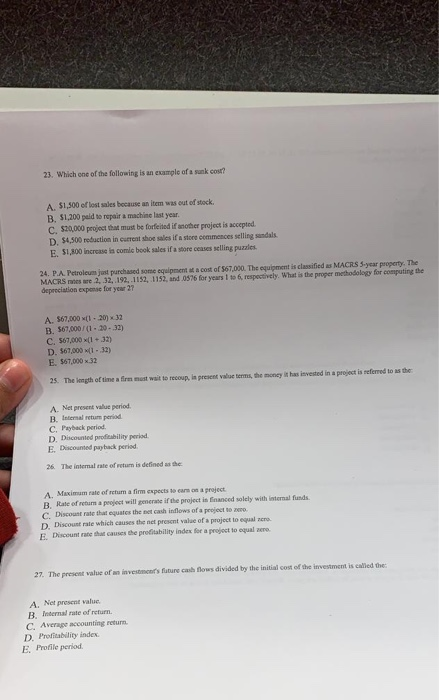

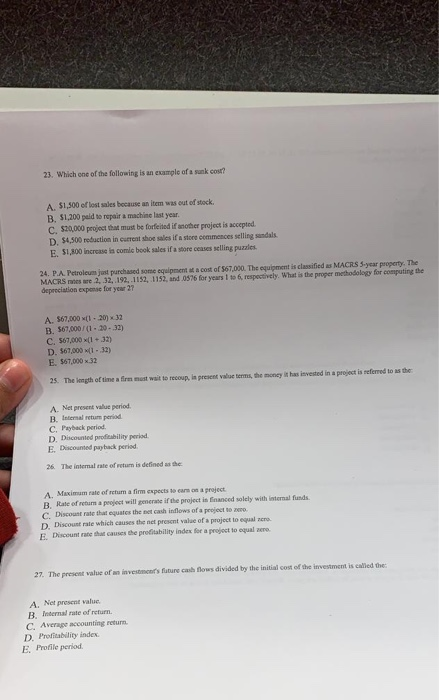

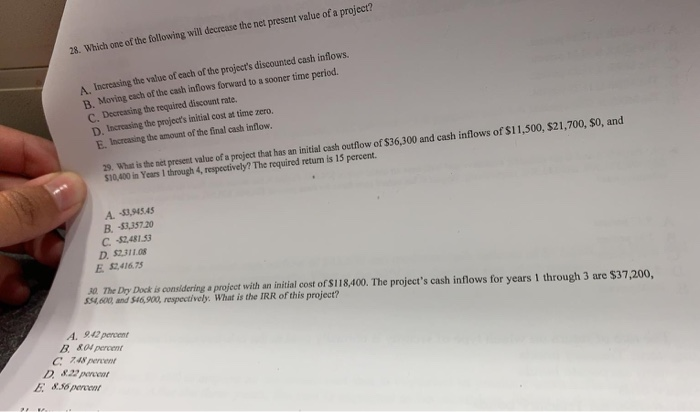

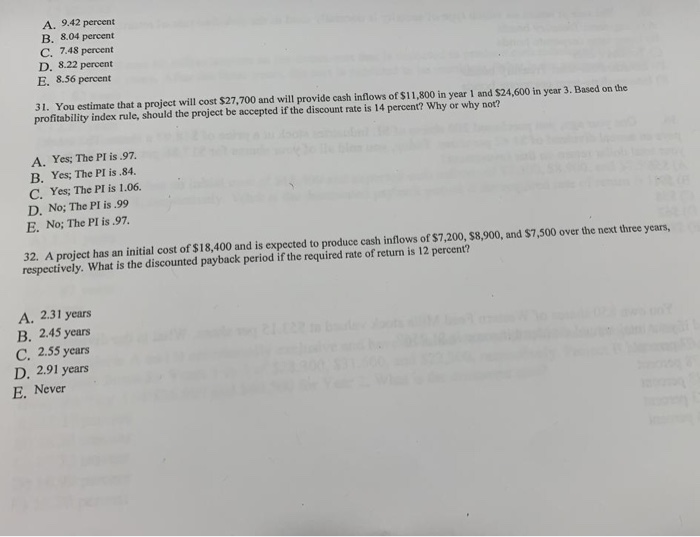

23. Which one of the following is an example of a sunk cost? A. $1,500 of lost sales bocause an item was out of stock B. S1,200 paid to repair a machine last year C. $20,000 project at must be forfeited if sober project is accepted D. $4,500 reduction in currest shoe sales if a store cemmences selling sandals E. $1,300 increase is comic book sales if a sore ceases seling puzales. 24. P.A. Petroleum just purchased soese equipment sta cost of $67,00.The equipment is classified as MACRS syear peoperty. The depreciation expense for year 27 MACRS aoes are 2, 32, 192, 1152, 1152, and 0576 for years 1 to 6, respoctively. What is the proper methodology for computing the A. $67,000 t 20)32 B. $67,0001(.20-32) C. 567,000 *(1+32) D. $67,000 1-32) E. $67,000 x 32 25. The lngth ot tine a firea mest wait to recoup, in present vabue terms, the money it has invested in a project is seferred to as ther A. Net present value period B. Intersal returm period C. Payback period D. Discounted profieability period E. Dicoumed payhack perisd 26. The intemal rate of veturm is defined as the A. Maximum rate of retun a firm expects to cars on a groject B. Rate of returm a peoject will gemerase if the project is Enanced solely with isternal funds C. Discoust rate that equates the net cash inflows of a project to aro D. Discount rate which causes the net present valae of a project to equal acro E. Discount rate shat causes tdhe profiability index for a projeoct to oqual aere 27. The present value of an investmcnts future casth fnows divided by the initial cost of the investment is caled the: A. Net present value. B. indernal rate of refurn C. Averape accounting return D. Profitability index. E. Profile period a project? of the following will decrease the net present value of 28. Which one Increasing the value of each of the project's discounted cash inflows. Moving each of the cash inflows forward to a sooner time period. A. B. Decreasing the required discount rate. E Increasing the amount of the final cash inflovw 29. What is the niet present value of a project that has an initial cash outflow of $36,300 and cash inflows of $11,500, $21,700, $0, and C. D. Increasing the project's initial cost at time zero. $10,400 in Years I through 4, respectively? The required retum is 13 percent. A.. 94545 . "su57.20 C$2,481.53 D. $2311.08 E 2,416.75 n ese a dringe roier wit srit or $18,400. The projeet's cash inflows for years 1 through 3 are $37,200, 4,600 and 546,900, respectively. What is the IRR of this project? A. 942 percent B 04 percent C 748 percen D22 peat 8:.6 pecent A. 9.42 percent B. 8.04 percent C. 7.48 percent D. 8.22 percent E. 8.56 percent 31. You estimate that a project will cost $27,700 and will provide cash inflows of $11,800 in year 1 and $24,600 in year 3. Based on the profitability index rule, should the project be accepted if the discount rate is 14 percent? Why or why not? A. Yes; The PI is.97 B. Yes; The PI is.84 C. Yes; The PI is 1.06. D. No; The PI is.99 E. No; The PI is.97 32. A project has an initial cost of $18,400 and is expected to produce cash inflows of $7,200, $8,900, and $7,500 over the next three years, respectively. What is the discounted payback period if the required rate of return is 12 percent? A. 2.31 years B. 2.45 years C. 2.55 years D. 2.91 years Never 23. Which one of the folowing is an example of s sunk cost? A. $1,300 of lost sales because an item was eut of stock B. $1.200 paid to repair aachine last year C, $20,000 project that mast be foefehed if another project is accepted D. $4,500 reduction in current shoe sales if a store commences selling sandals E. 51,800 Increase in comic book sales if'astore ceases selling puzzles 24 P.A Petroloum jest parchased some oqipment at a cest of $67,000. The equipment is classified as MACRS S y property. The MACRS e tes are 2, 32. .192, .1152, .$2.und OSS Ir years l is,tepatively, what is be poper method 10 tranguring the depreciation expense for yewr 27 A. $67,0001-20)32 B. 567,00010-20-32) C. 567,000 t 32) D. $47000 (I-32) E. $670032 The length of time a firs mast wait to rocsep, i prosent vale tmes, the money it has invesited in a project A. Net present value periad B. mnalemm period C. Payback period D. Discounted prolitubility period E. Discousted payback period 26 The isternal rate of return is defined as the A. Maximuss rate of eetern a firm expects to eam on a project B. Rate of resarm a project will genenee if the project is financed solely with intarnal unds C. Discount rade that equates the net cash intlows of a project to zcro. D. Discount rate which caunes the net present value of a project to oqual aero E. Discount rate that causes the prolitability index for a project to equal acro 27. The present value of an investoment's fature cash flows divided by the initial cost of the investment is called the A. Net present value B. Indermal rate of return C. Average accounting return. D. Profitability Index E. Profile period The Peck 6,00 sares of soc $37.3 n 28.20 E 1493 Pools has 24,000 shares of stock outstanding with apar value of SI per share and a market price of $26 a share. The just announced 0irm a 3-for-J stock split. How many shares of stock will be outstanding after the splic B 14,400 share C. 12,000 shares D. 32,000 shares E. 40,000 shares & What is a prospectus? A. A letter issued by the SEC authorizing a new issue of securities B. A report stating that the SEC recommends a new security to invesors C. A letter issued by the SEC that outlines the changes required for a registration statement to be approved. D. A document that describes the details of a proposed security offering along with relevant information about the issuer. E. An advertisement in a financial newspaper that describes a security offering 9. JLK is a partnership that was formed two years ago for the purpose of creating new fad items and distributing them directly to consumers. The firm has been extremely successful thus far and has decided to incorporate and offer shares of stock to the general public. What is this type of an equity offering called? A. Venture capital offering. B. Shelf offering. C. Private placement D. Seasoned equity offering E. Initial public offering. 10. Executive Tours has decided to take its firm public and has hired an investment firm to handle this offering. The investment firm is servin as a(n): A. Aftermarket specialist B. Venture capitalist. D. Seasoned writer E. Primary investor 23. Which one of the following is an example of a sunk cost? A. $1,500 of lost sales bocause an item was out of stock B. S1,200 paid to repair a machine last year C. $20,000 project at must be forfeited if sober project is accepted D. $4,500 reduction in currest shoe sales if a store cemmences selling sandals E. $1,300 increase is comic book sales if a sore ceases seling puzales. 24. P.A. Petroleum just purchased soese equipment sta cost of $67,00.The equipment is classified as MACRS syear peoperty. The depreciation expense for year 27 MACRS aoes are 2, 32, 192, 1152, 1152, and 0576 for years 1 to 6, respoctively. What is the proper methodology for computing the A. $67,000 t 20)32 B. $67,0001(.20-32) C. 567,000 *(1+32) D. $67,000 1-32) E. $67,000 x 32 25. The lngth ot tine a firea mest wait to recoup, in present vabue terms, the money it has invested in a project is seferred to as ther A. Net present value period B. Intersal returm period C. Payback period D. Discounted profieability period E. Dicoumed payhack perisd 26. The intemal rate of veturm is defined as the A. Maximum rate of retun a firm expects to cars on a groject B. Rate of returm a peoject will gemerase if the project is Enanced solely with isternal funds C. Discoust rate that equates the net cash inflows of a project to aro D. Discount rate which causes the net present valae of a project to equal acro E. Discount rate shat causes tdhe profiability index for a projeoct to oqual aere 27. The present value of an investmcnts future casth fnows divided by the initial cost of the investment is caled the: A. Net present value. B. indernal rate of refurn C. Averape accounting return D. Profitability index. E. Profile period a project? of the following will decrease the net present value of 28. Which one Increasing the value of each of the project's discounted cash inflows. Moving each of the cash inflows forward to a sooner time period. A. B. Decreasing the required discount rate. E Increasing the amount of the final cash inflovw 29. What is the niet present value of a project that has an initial cash outflow of $36,300 and cash inflows of $11,500, $21,700, $0, and C. D. Increasing the project's initial cost at time zero. $10,400 in Years I through 4, respectively? The required retum is 13 percent. A.. 94545 . "su57.20 C$2,481.53 D. $2311.08 E 2,416.75 n ese a dringe roier wit srit or $18,400. The projeet's cash inflows for years 1 through 3 are $37,200, 4,600 and 546,900, respectively. What is the IRR of this project? A. 942 percent B 04 percent C 748 percen D22 peat 8:.6 pecent A. 9.42 percent B. 8.04 percent C. 7.48 percent D. 8.22 percent E. 8.56 percent 31. You estimate that a project will cost $27,700 and will provide cash inflows of $11,800 in year 1 and $24,600 in year 3. Based on the profitability index rule, should the project be accepted if the discount rate is 14 percent? Why or why not? A. Yes; The PI is.97 B. Yes; The PI is.84 C. Yes; The PI is 1.06. D. No; The PI is.99 E. No; The PI is.97 32. A project has an initial cost of $18,400 and is expected to produce cash inflows of $7,200, $8,900, and $7,500 over the next three years, respectively. What is the discounted payback period if the required rate of return is 12 percent? A. 2.31 years B. 2.45 years C. 2.55 years D. 2.91 years Never 23. Which one of the folowing is an example of s sunk cost? A. $1,300 of lost sales because an item was eut of stock B. $1.200 paid to repair aachine last year C, $20,000 project that mast be foefehed if another project is accepted D. $4,500 reduction in current shoe sales if a store commences selling sandals E. 51,800 Increase in comic book sales if'astore ceases selling puzzles 24 P.A Petroloum jest parchased some oqipment at a cest of $67,000. The equipment is classified as MACRS S y property. The MACRS e tes are 2, 32. .192, .1152, .$2.und OSS Ir years l is,tepatively, what is be poper method 10 tranguring the depreciation expense for yewr 27 A. $67,0001-20)32 B. 567,00010-20-32) C. 567,000 t 32) D. $47000 (I-32) E. $670032 The length of time a firs mast wait to rocsep, i prosent vale tmes, the money it has invesited in a project A. Net present value periad B. mnalemm period C. Payback period D. Discounted prolitubility period E. Discousted payback period 26 The isternal rate of return is defined as the A. Maximuss rate of eetern a firm expects to eam on a project B. Rate of resarm a project will genenee if the project is financed solely with intarnal unds C. Discount rade that equates the net cash intlows of a project to zcro. D. Discount rate which caunes the net present value of a project to oqual aero E. Discount rate that causes the prolitability index for a project to equal acro 27. The present value of an investoment's fature cash flows divided by the initial cost of the investment is called the A. Net present value B. Indermal rate of return C. Average accounting return. D. Profitability Index E. Profile period The Peck 6,00 sares of soc $37.3 n 28.20 E 1493 Pools has 24,000 shares of stock outstanding with apar value of SI per share and a market price of $26 a share. The just announced 0irm a 3-for-J stock split. How many shares of stock will be outstanding after the splic B 14,400 share C. 12,000 shares D. 32,000 shares E. 40,000 shares & What is a prospectus? A. A letter issued by the SEC authorizing a new issue of securities B. A report stating that the SEC recommends a new security to invesors C. A letter issued by the SEC that outlines the changes required for a registration statement to be approved. D. A document that describes the details of a proposed security offering along with relevant information about the issuer. E. An advertisement in a financial newspaper that describes a security offering 9. JLK is a partnership that was formed two years ago for the purpose of creating new fad items and distributing them directly to consumers. The firm has been extremely successful thus far and has decided to incorporate and offer shares of stock to the general public. What is this type of an equity offering called? A. Venture capital offering. B. Shelf offering. C. Private placement D. Seasoned equity offering E. Initial public offering. 10. Executive Tours has decided to take its firm public and has hired an investment firm to handle this offering. The investment firm is servin as a(n): A. Aftermarket specialist B. Venture capitalist. D. Seasoned writer E. Primary investor