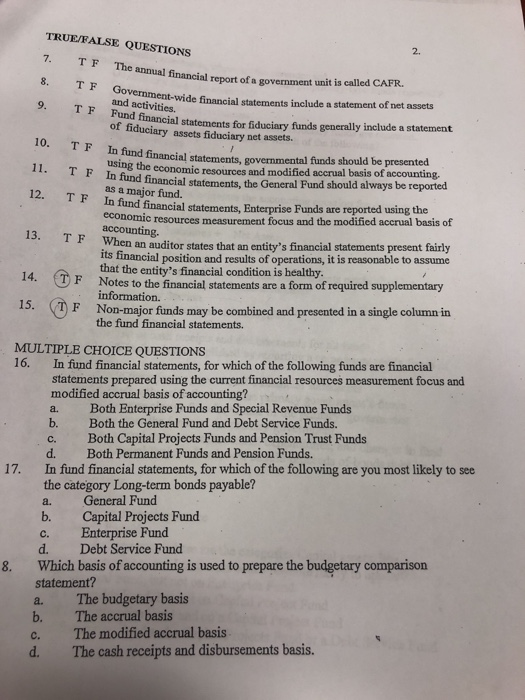

multiple choice

TRUE/FALSE QUESTIONS 2. al report of a government unit is called CAFR 8. TF Government-wide financial statements include a statement of net assets and activities. 9. T F tind financial statements for fiduciary funds generally include a statement 10. T F In fund financial statements, governmeaal basis of accounting funds should be presented ng the economic resources and modified accrual basis of In fund financial statements, the General Fund should always be reported In fund financial statements, Enterprise Funds are reported using the as a major fund. economic resources measurement accounting focus and the modified accrual basis of an auditor states that an entity's financial statements present fairly s financial position and results of operations, it is reasonable to assume that the entity's financial condition is healthy Notes to the financial statements are a form of required supplementary information. F Non-major funds may be combined and presented in a single column in the fund financial statements. 15 F MULTIPLE CHOICE QUESTIONS 16. In fund financial statements, for which of the following funds are financial statements prepared using the current financial resources measurement focus and modified accrual basis of accounting? a. Both Enterprise Funds and Special Revenue Funds b. Both the General Fund and Debt Service Funds. c. Both Capital Projects Funds and Pension Trust Funds d. Both Permanent Funds and Pension Funds. In fund financial statements, for which of the following are you most likely to see the category Long-term bonds payable? a. General Fund b. Capital Projects Fund c. Enterprise Fund d. Debt Service Fund 17. Which basis of accounting is used to prepare the budgetary comparison statement? 8. The budgetary basis The accrual basis a. b. c. The modified accrual basis d. The cash receipts and disbursements basis. TRUE/FALSE QUESTIONS 2. al report of a government unit is called CAFR 8. TF Government-wide financial statements include a statement of net assets and activities. 9. T F tind financial statements for fiduciary funds generally include a statement 10. T F In fund financial statements, governmeaal basis of accounting funds should be presented ng the economic resources and modified accrual basis of In fund financial statements, the General Fund should always be reported In fund financial statements, Enterprise Funds are reported using the as a major fund. economic resources measurement accounting focus and the modified accrual basis of an auditor states that an entity's financial statements present fairly s financial position and results of operations, it is reasonable to assume that the entity's financial condition is healthy Notes to the financial statements are a form of required supplementary information. F Non-major funds may be combined and presented in a single column in the fund financial statements. 15 F MULTIPLE CHOICE QUESTIONS 16. In fund financial statements, for which of the following funds are financial statements prepared using the current financial resources measurement focus and modified accrual basis of accounting? a. Both Enterprise Funds and Special Revenue Funds b. Both the General Fund and Debt Service Funds. c. Both Capital Projects Funds and Pension Trust Funds d. Both Permanent Funds and Pension Funds. In fund financial statements, for which of the following are you most likely to see the category Long-term bonds payable? a. General Fund b. Capital Projects Fund c. Enterprise Fund d. Debt Service Fund 17. Which basis of accounting is used to prepare the budgetary comparison statement? 8. The budgetary basis The accrual basis a. b. c. The modified accrual basis d. The cash receipts and disbursements basis