Answered step by step

Verified Expert Solution

Question

1 Approved Answer

multiple part question! need help with quickly please!!! This is DATA for 15a/15b/150 ABC Inc., is a merchandising company that prepares its master budget on

multiple part question! need help with quickly please!!!

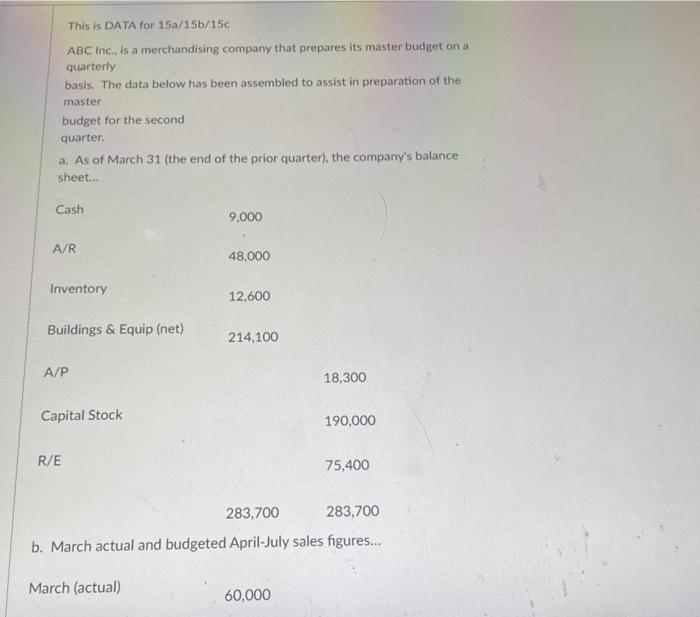

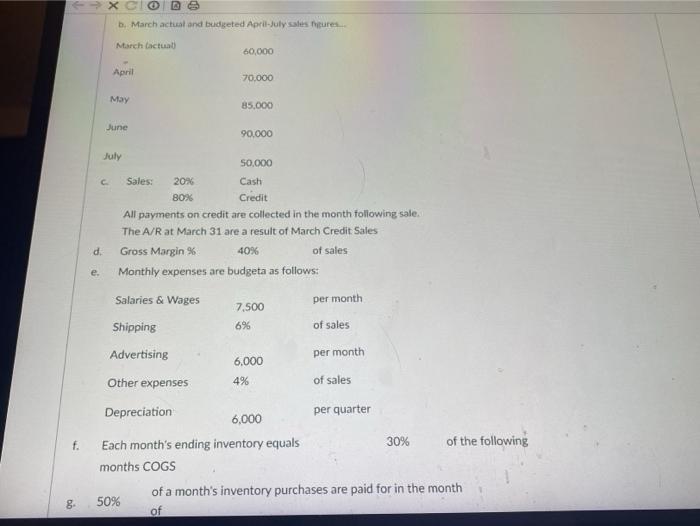

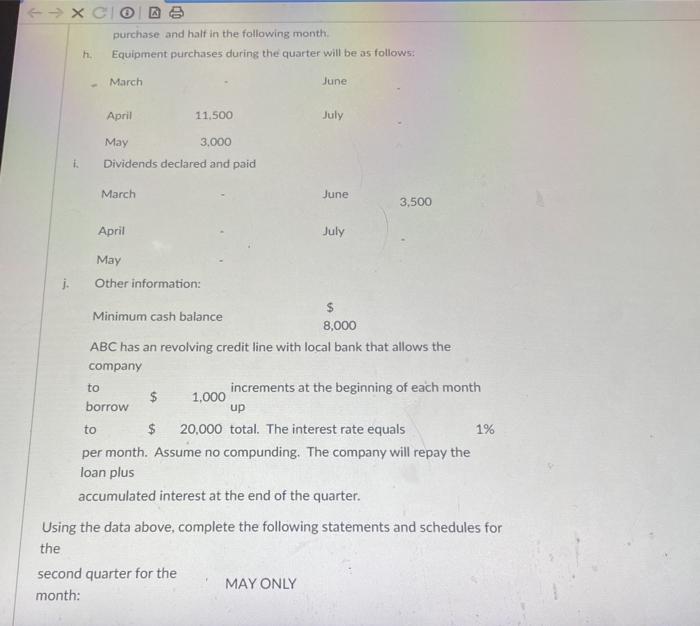

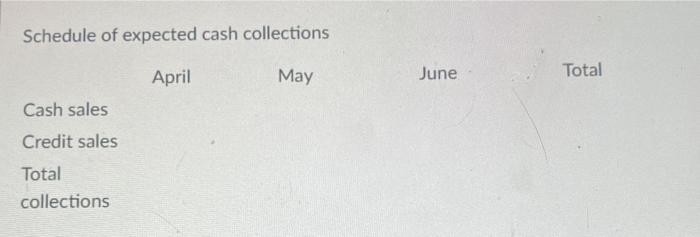

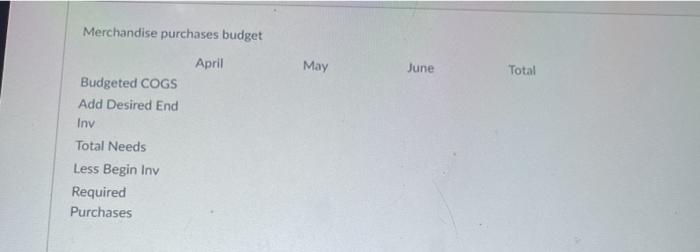

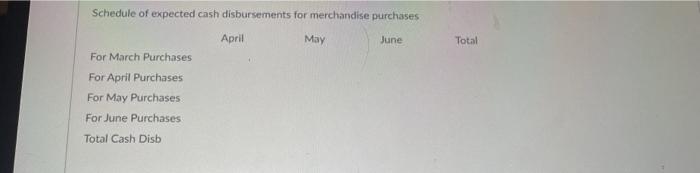

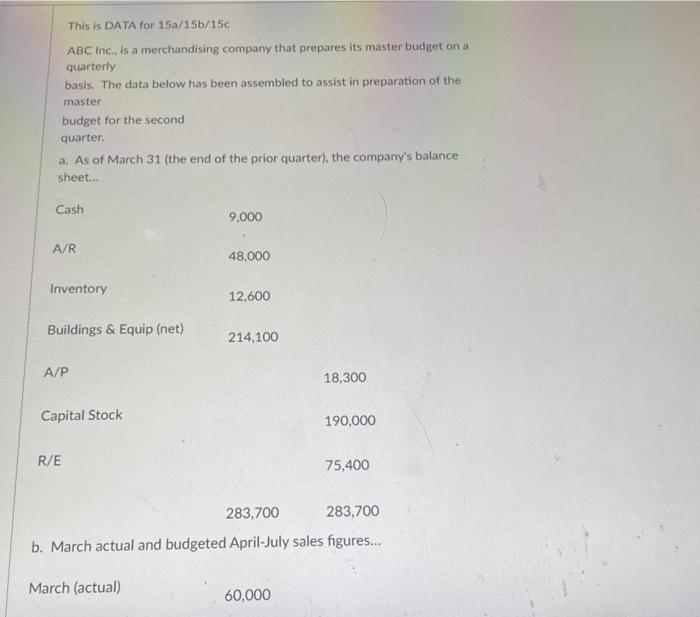

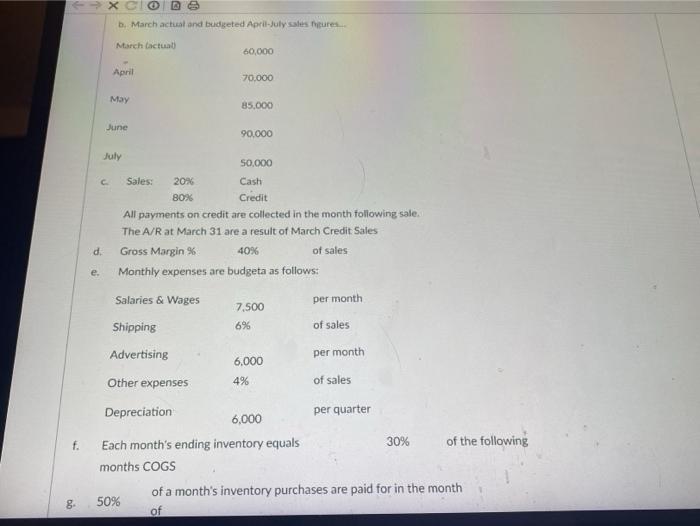

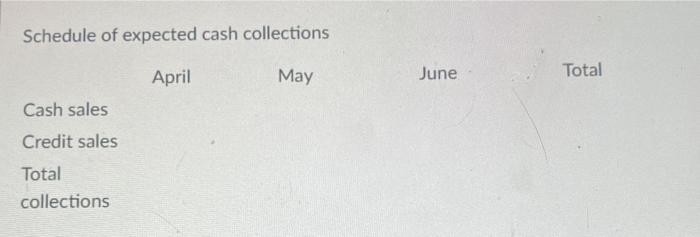

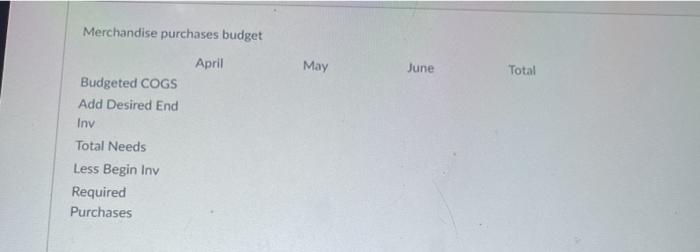

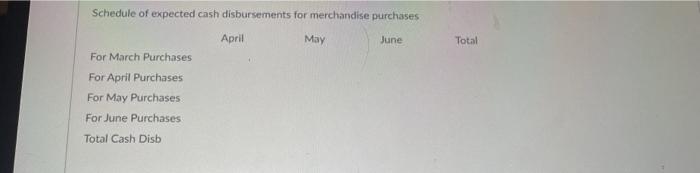

This is DATA for 15a/15b/150 ABC Inc., is a merchandising company that prepares its master budget on a quarterly basis. The data below has been assembled to assist in preparation of the master budget for the second quarter. a. As of March 31 (the end of the prior quarter), the company's balance sheet... Cash 9,000 AVR 48,000 Inventory 12,600 Buildings & Equip (net) 214.100 A/P 18,300 Capital Stock 190,000 R/E 75,400 283,700 283,700 b. March actual and budgeted April-July sales figures... March (actual) 60,000 - b. March actual and budgeted April-July sales res. March Cactual 60,000 April 70.000 May 85,000 June 90.000 July c e. 50.000 Sales: 20% Cash 80% Credit All payments on credit are collected in the month following sale. The A/R at March 31 are a result of March Credit Sales d. Gross Margin % 40% of sales Monthly expenses are budgeta as follows: Salaries & Wages per month 7.500 Shipping 696 of sales Advertising per month 6.000 Other expenses 4% of sales Depreciation per quarter 6,000 Each month's ending inventory equals 30% of the following months COGS of a month's inventory purchases are paid for in the month 50% of f. 00 EXC purchase and half in the following month h. Equipment purchases during the quarter will be as follows. March June April 11.500 July May 3,000 Dividends declared and paid March June 3,500 April July May Other information: j. to $ Minimum cash balance 8,000 ABC has an revolving credit line with local bank that allows the company increments at the beginning of each month $ 1,000 borrow up $ 20,000 total. The interest rate equals 1% per month. Assume no compunding. The company will repay the loan plus accumulated interest at the end of the quarter. Using the data above, complete the following statements and schedules for to the second quarter for the month: MAY ONLY Schedule of expected cash collections Total April June May Cash sales Credit sales Total collections Merchandise purchases budget April May June Total Budgeted COGS Add Desired End Inv Total Needs Less Begin Inv Required Purchases Total Schedule of expected cash disbursements for merchandise purchases April May June For March Purchases For April Purchases For May Purchases For June Purchases Total Cash Disb

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started