Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Multiple parts, please review each! Quick MC questions, I believe they are all correct but would just like to make sure I am doing them

Multiple parts, please review each! Quick MC questions, I believe they are all correct but would just like to make sure I am doing them correctly.

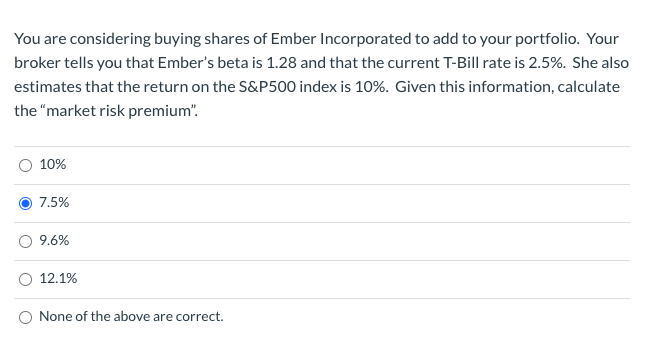

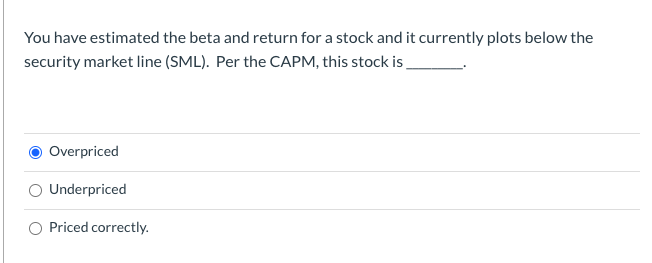

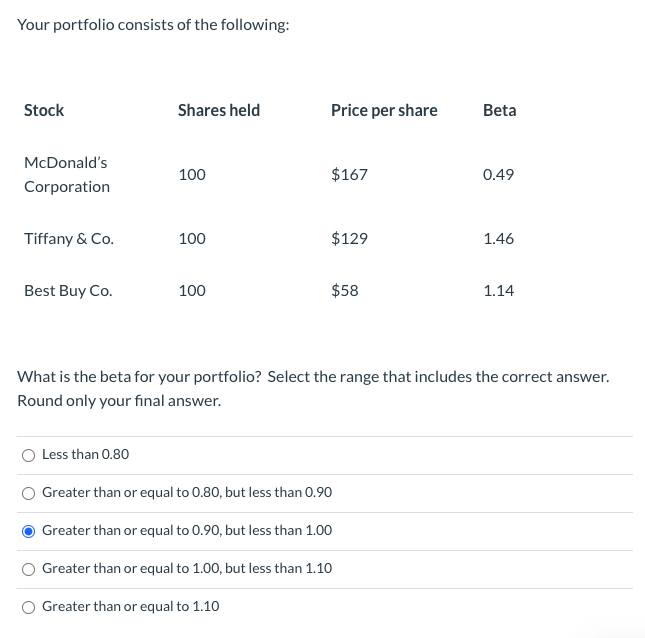

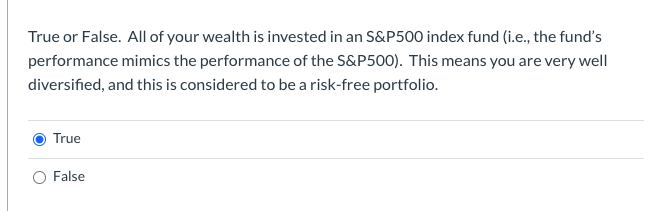

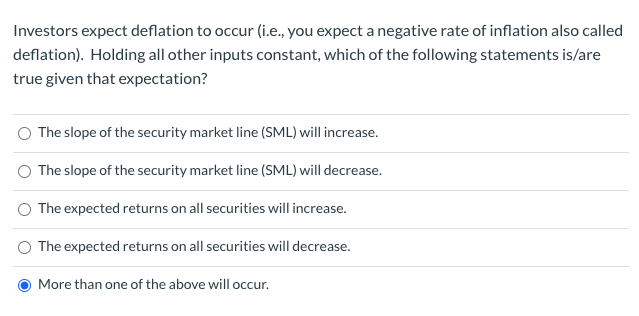

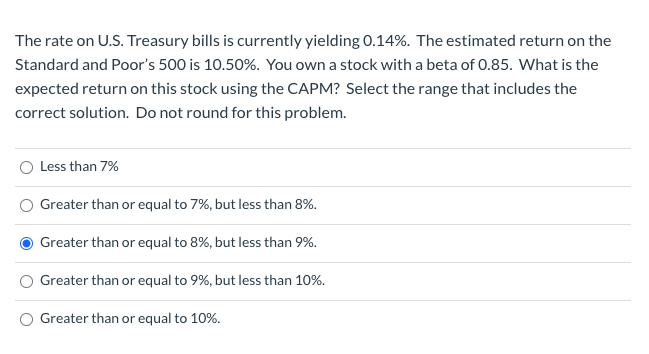

You are considering buying shares of Ember Incorporated to add to your portfolio. Your broker tells you that Ember's beta is 1.28 and that the current T-Bill rate is 2.5%. She also estimates that the return on the S&P500 index is 10%. Given this information, calculate the market risk premium". 10% 7.5% 9.6% 12.1% None of the above are correct. You have estimated the beta and return for a stock and it currently plots below the security market line (SML). Per the CAPM, this stock is Overpriced Underpriced Priced correctly. Your portfolio consists of the following: Stock Shares held Price per share Beta McDonald's Corporation 100 $167 0.49 Tiffany & Co. 100 $129 1.46 Best Buy Co. 100 $58 1.14 What is the beta for your portfolio? Select the range that includes the correct answer. Round only your final answer. Less than 0.80 Greater than or equal to 0.80, but less than 0.90 Greater than or equal to 0.90, but less than 1.00 Greater than or equal to 1.00, but less than 1.10 Greater than or equal to 1.10 True or False. All of your wealth is invested in an S&P500 index fund (i.e., the fund's performance mimics the performance of the S&P500). This means you are very well diversified, and this is considered to be a risk-free portfolio. True O False Investors expect deflation to occur (i.e., you expect a negative rate of inflation also called deflation). Holding all other inputs constant, which of the following statements is/are true given that expectation? The slope of the security market line (SML) will increase. The slope of the security market line (SML) will decrease. The expected returns on all securities will increase. The expected returns on all securities will decrease. More than one of the above will occur. The rate on U.S. Treasury bills is currently yielding 0.14%. The estimated return on the Standard and Poor's 500 is 10.50%. You own a stock with a beta of 0.85. What is the expected return on this stock using the CAPM? Select the range that includes the correct solution. Do not round for this problem. Less than 7% Greater than or equal to 7%, but less than 8%. Greater than or equal to 8%, but less than 9%. Greater than or equal to 9%, but less than 10%. Greater than or equal to 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started