Answered step by step

Verified Expert Solution

Question

1 Approved Answer

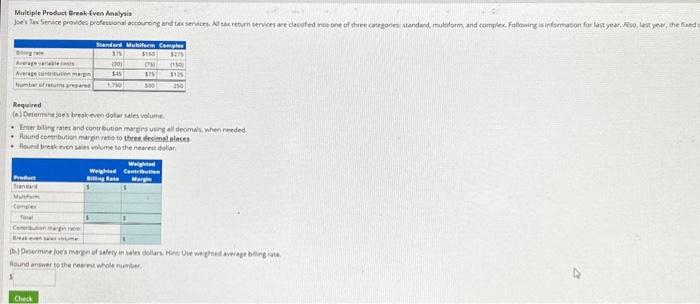

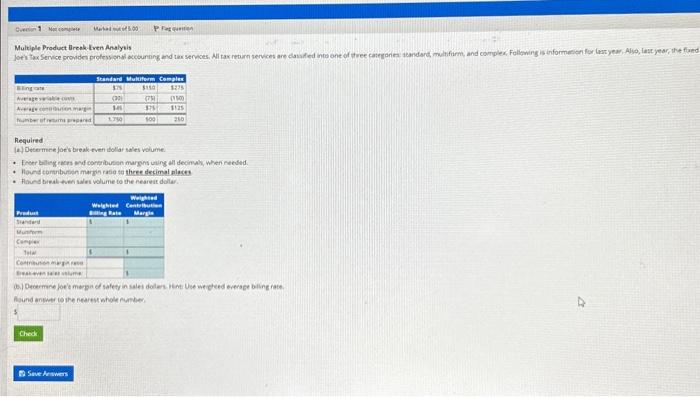

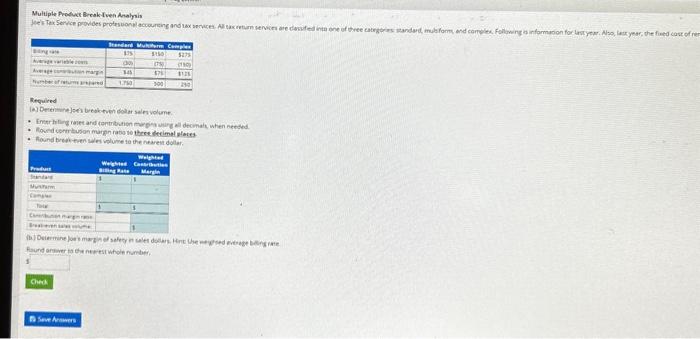

Multiple Product Break-Even Analysis Joe's Tax Service provides professional accounting and tax services. All tax return services are classified into one of three categories: standard,

Multiple Product Break-Even Analysis Joe's Tax Service provides professional accounting and tax services. All tax return services are classified into one of three categories: standard, multiform, and complex. Following is information for last year. Also, last year, the fixed Billing rate Average variable costs Average contribution margin Number of returns prepared Product Standard Multiform Complex Total Contribution margin ratio: Break-even sales volume: Required (a.) Determine Joe's break-even dollar sales volume. Enter billing rates and contribution margins using all decimals, when needed. Round contribution margin ratio to three decimal places. Round break-even sales volume to the nearest dollar, $ Standard Multiform Complex $75 $150 $275 (30) (75) $45 $75 1.750 500 Check Weighted Billing Rate $ $ Weighted Contribution Margin $ (150) $125 250 $ $ (b.) Determine Joe's margin of safety in sales dollars. Hint: Use weighted average billing rate. Round answer to the nearest whole number.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started