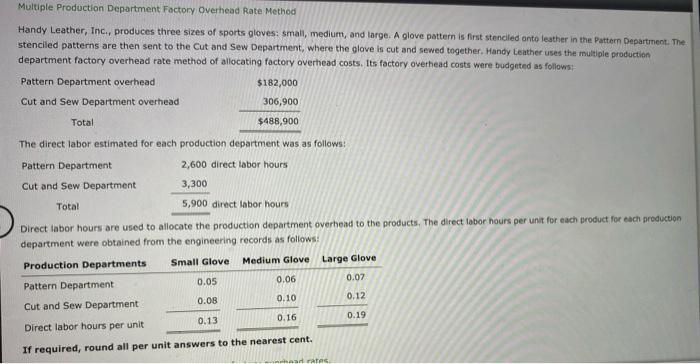

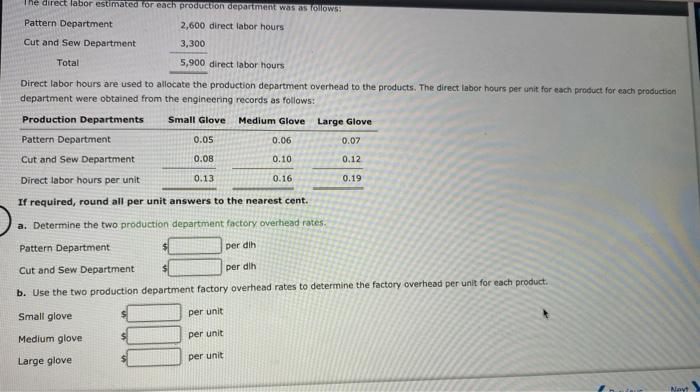

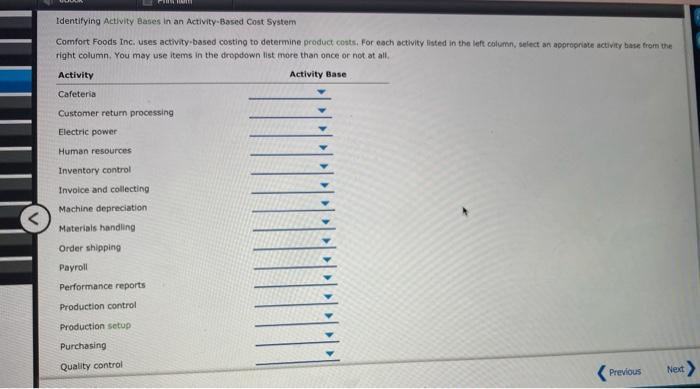

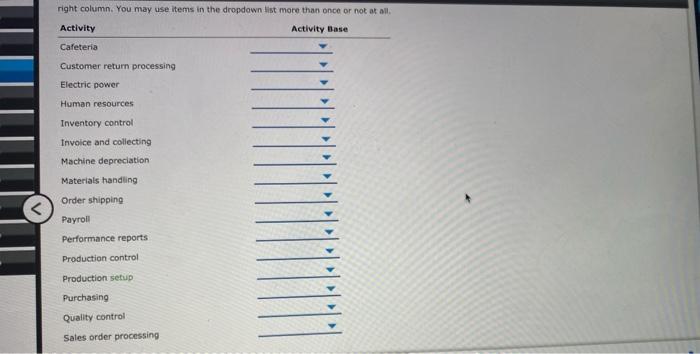

Multiple Production Department Factory Overhead Rate Method Handy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stenciled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: Pattern Department overhead $182,000 Cut and Sew Department overhead 306,900 Total $488,900 The direct labor estimated for each production department was as follows: Pattern Department 2,600 direct labor hours Cut and Sew Department 3,300 Total 5,900 direct labor hours Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: Production Departments Small Glove Medium Glove Large Glove Pattern Department 0.05 0.06 0.07 Cut and Sew Department 0.08 0.10 0,12 0.13 0.16 0.19 Direct labor hours per unit If required, round all per unit answers to the nearest cent. STA The direct labor estimated for each production department was as follows: Pattern Department 2,600 direct labor hours Cut and Sew Department 3,300 Total 5,900 direct labor hours Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: Production Departments Small Glove Medium Glove Large Glove Pattern Department 0.05 0.06 0.07 Cut and Sew Department 0.08 0.10 0.12 Direct labor hours per unit 0.13 0.16 0.19 If required, round all per unit answers to the nearest cent. a. Determine the two production department factory overhead rates Pattern Department per dih Cut and Sew Department per dih b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product. Small glove per unit Medium glove per unit Large glove per unit Nayt Identifying Activity Bases in an Activity-Based Cost System Comfort Foods Inc. uses activity based costing to determine product costs. For each activity listed in the left column, select an appropriate activity base from the right column. You may use items in the dropdown list more than once or not at all Activity Activity Base Cafeteria Customer return processing Electric power Human resources Inventory control Invoice and collecting Machine depreciation Materials handling Order shipping Payroll Performance reports Production control Production setup Purchasing Quality control Next