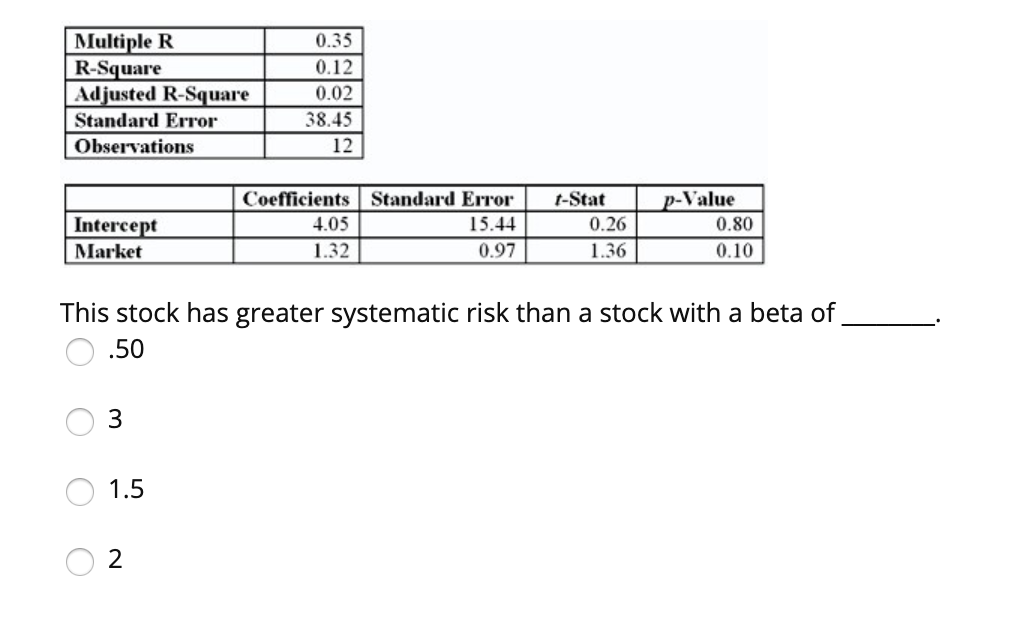

Question: Multiple R T R-Square Adjusted R-Square Standard Error Observations 0.35 0.12 0.02 38.45 12 Intercept Market Coefficients Standard Error -Stat 4.05 15.44 0.26 1.32 0.97

Multiple R T R-Square Adjusted R-Square Standard Error Observations 0.35 0.12 0.02 38.45 12 Intercept Market Coefficients Standard Error -Stat 4.05 15.44 0.26 1.32 0.97 11.36 p-Value 0.80 0.10 rket - This stock has greater systematic risk than a stock with a beta of 0.50 W o O O 1.5 N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts