Answered step by step

Verified Expert Solution

Question

1 Approved Answer

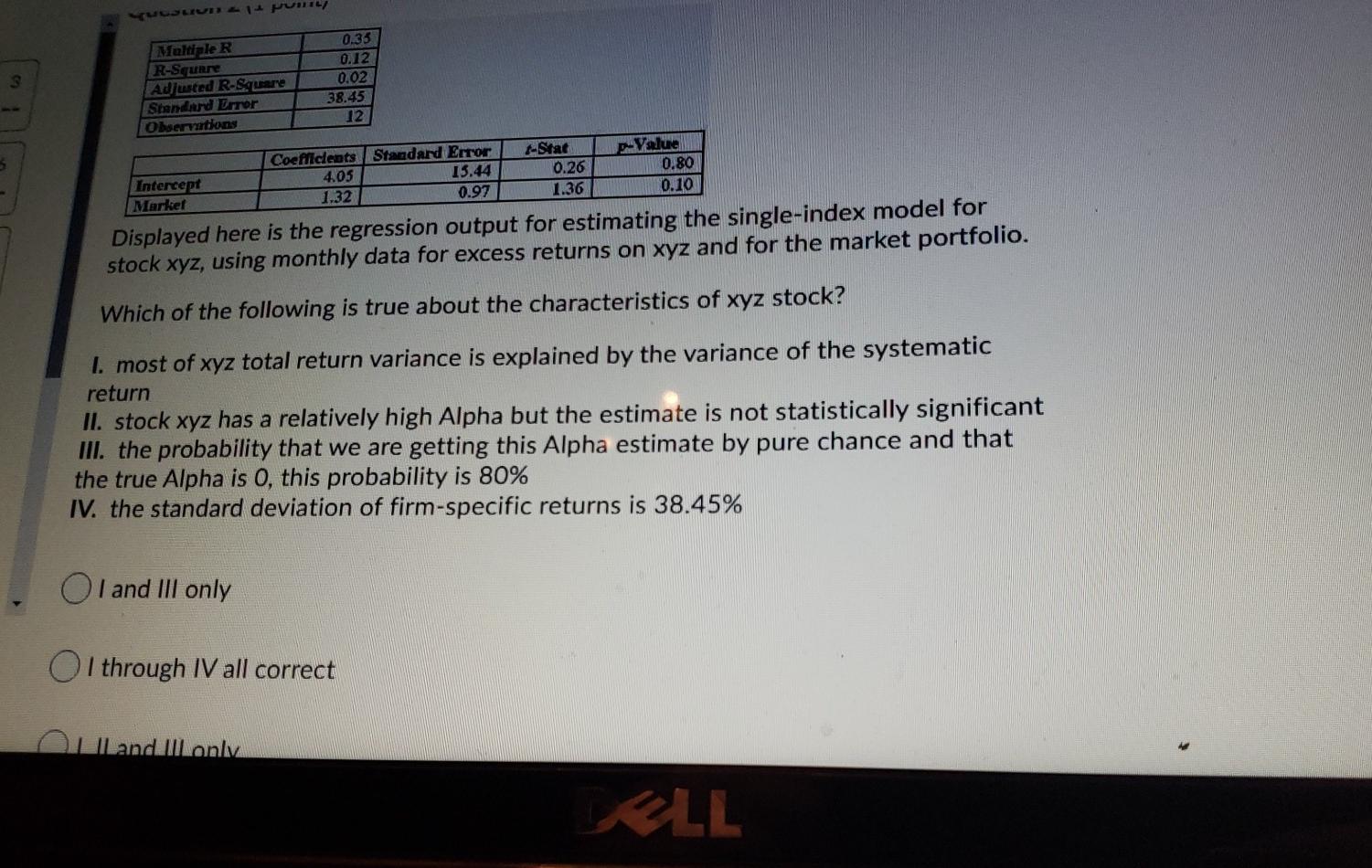

OLUR41 PUSL Maltiple R R-Square Adjusted R-Srare Standard Error Observations 0.35 0.12 0.02 38.45 12 5 -Stat 0.26 1.36 Coefficients Standard Error 15.44 1.32 0.97

OLUR41 PUSL Maltiple R R-Square Adjusted R-Srare Standard Error Observations 0.35 0.12 0.02 38.45 12 5 -Stat 0.26 1.36 Coefficients Standard Error 15.44 1.32 0.97 p-Value 0.80 0.10 4.05 Intercept Market Displayed here is the regression output for estimating the single-index model for stock xyz, using monthly data for excess returns on xyz and for the market portfolio. Which of the following is true about the characteristics of xyz stock? 1. most of xyz total return variance is explained by the variance of the systematic return II. stock xyz has a relatively high Alpha but the estimate is not statistically significant III. the probability that we are getting this Alpha estimate by pure chance and that the true Alpha is 0, this probability is 80% IV. the standard deviation of firm-specific returns is 38.45% I and III only O1 through IV all correct Landill only KELL OLUR41 PUSL Maltiple R R-Square Adjusted R-Srare Standard Error Observations 0.35 0.12 0.02 38.45 12 5 -Stat 0.26 1.36 Coefficients Standard Error 15.44 1.32 0.97 p-Value 0.80 0.10 4.05 Intercept Market Displayed here is the regression output for estimating the single-index model for stock xyz, using monthly data for excess returns on xyz and for the market portfolio. Which of the following is true about the characteristics of xyz stock? 1. most of xyz total return variance is explained by the variance of the systematic return II. stock xyz has a relatively high Alpha but the estimate is not statistically significant III. the probability that we are getting this Alpha estimate by pure chance and that the true Alpha is 0, this probability is 80% IV. the standard deviation of firm-specific returns is 38.45% I and III only O1 through IV all correct Landill only KELL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started