Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Multiple Select Question Select all that apply When can the married filing jointly or married filing separately filing status be used? ( Check all that

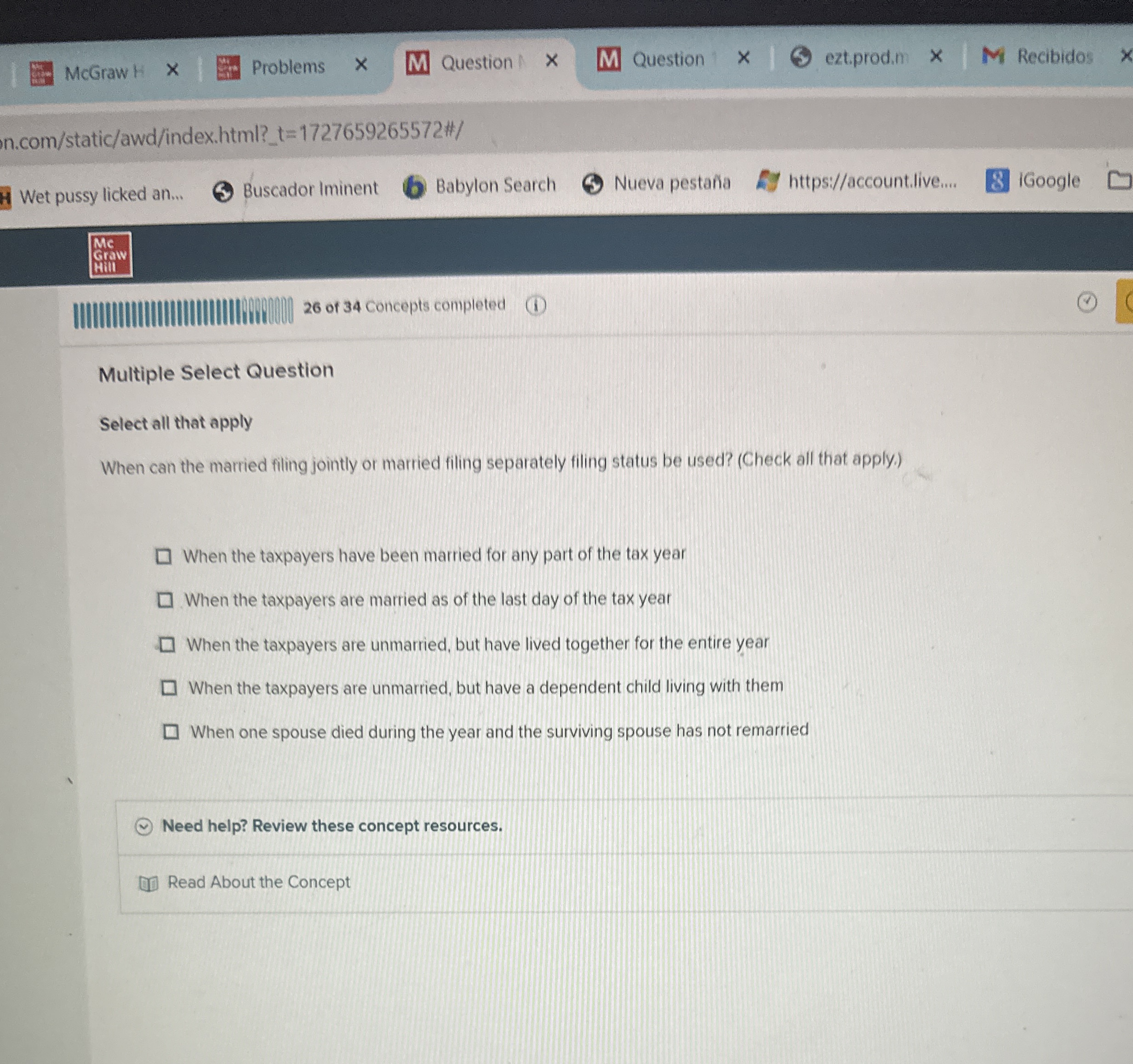

Multiple Select Question

Select all that apply

When can the married filing jointly or married filing separately filing status be used? Check all that apply.

When the taxpayers have been married for any part of the tax year

When the taxpayers are married as of the last day of the tax year

When the taxpayers are unmarried, but have lived together for the entire year

When the taxpayers are unmarried, but have a dependent child living with them

When one spouse died during the year and the surviving spouse has not remarried

Need help? Review these concept resources.

Read About the Concept

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started