Question

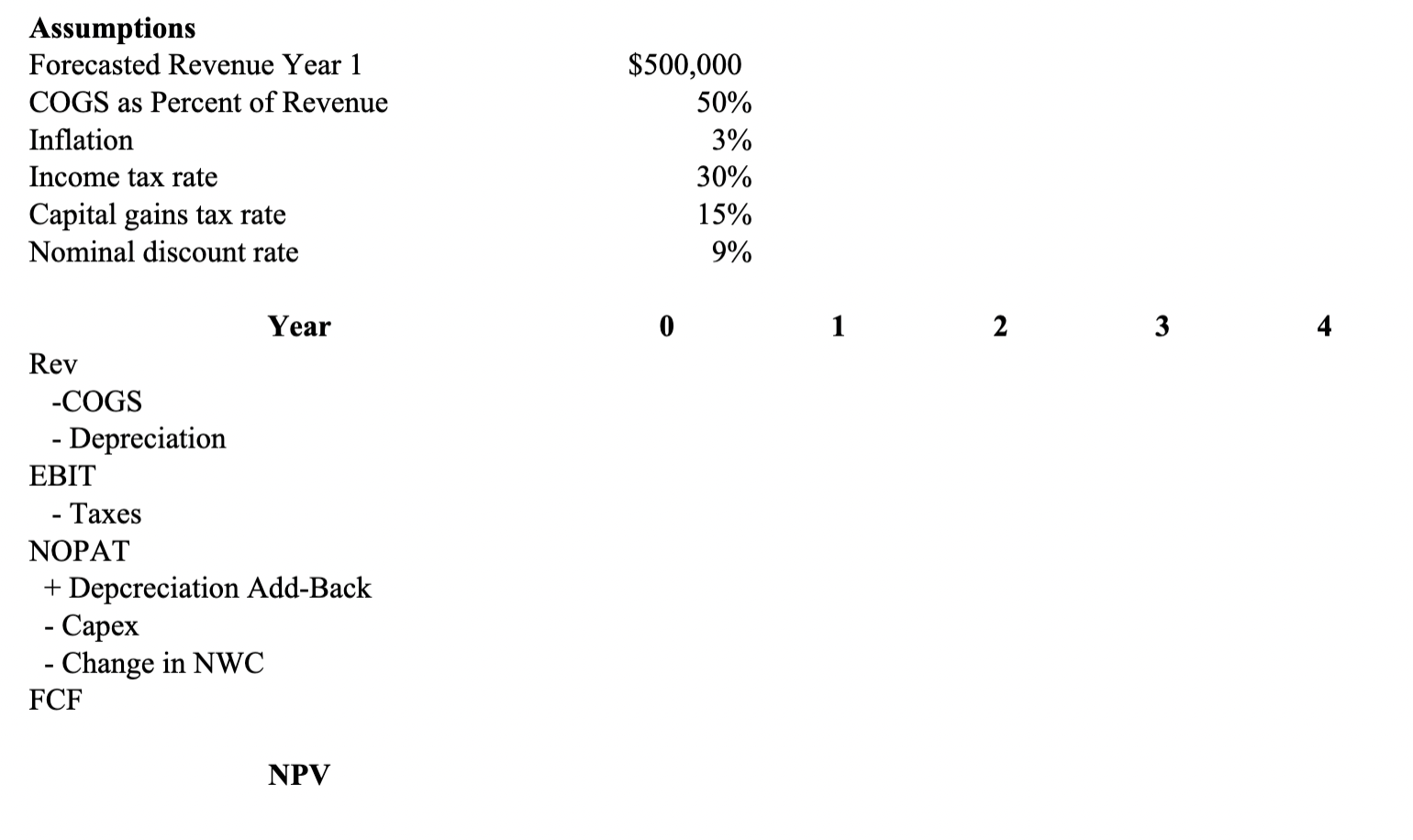

Multiple Types of Depreciation Treatments S&S Fitness Company is considering adding a new line of treadmills for obese dogs. Projected revenues are $500,000 for next

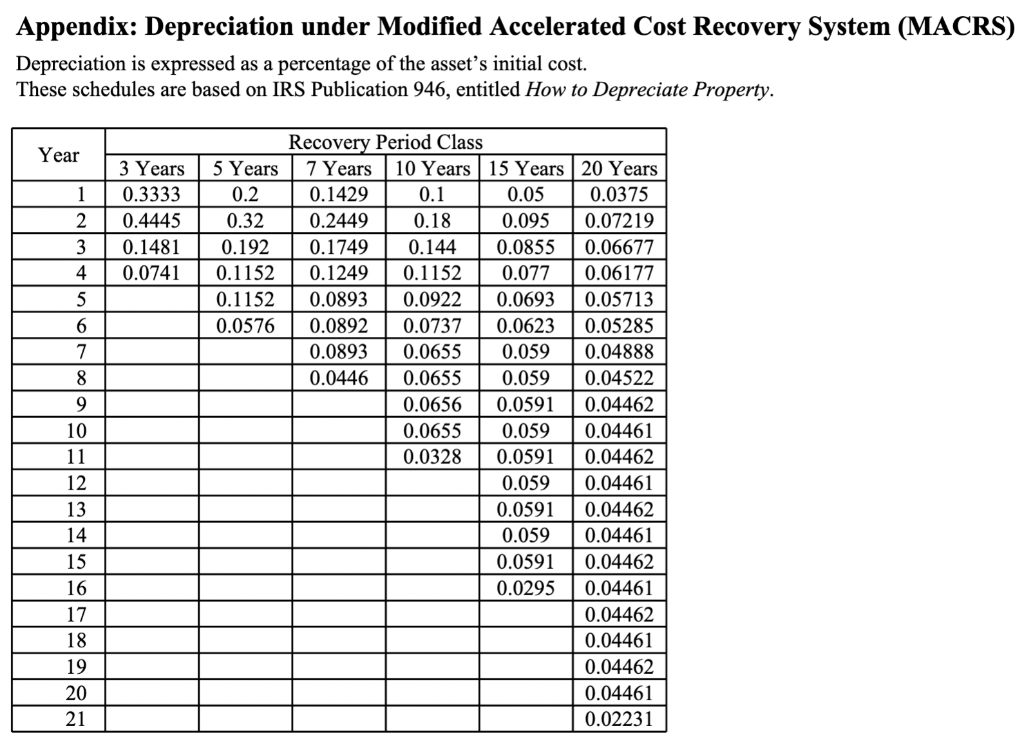

Multiple Types of Depreciation Treatments S&S Fitness Company is considering adding a new line of treadmills for obese dogs. Projected revenues are $500,000 for next year and will grow at the forecasted inflation rate of 3% in each of the following three years, after which S&S Fitness will end the project. The projected cost-of-goods- sold (COGS) is 50% of revenues. The corporate income tax rate is 30%, capital gains tax rate is 15%, and the nominal discount rate is 9%. The project will deploy the following assets: a) A piece of land that could currently be sold for $150,000. The real value of the land is estimated to appreciate by 2% per year. b) New machinery with an initial investment of $440,000 that has a useful life of 4 years. Depreciation will be on a 5-year MACRS schedule. The machinery is estimated to have a market value of $12,000 at the end of year 4. c) The project will use other equipment transferred from another facility owned by the firm. This equipment has a market value of $180,000 and a book value of $100,000. If the equipment is kept rather than sold, its remaining book value can be depreciated next year. When the project ends in year 4, the equipment will have a market value of $48,000. d) The project will use excess capacity in the current packaging plant. While this excess capacity has no alternative use now, it is estimated that the firm will have to invest $180,000 in a new packaging plant in year 2 as a consequence of this project using up excess capacity instead of year 4 as originally planned. This equipment is depreciated straight-line to a zero salvage value over two years. Find the NPV of the project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started