Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Multiple-choice questions. Choose the best answer in each question. Answer all questions in this section. One mark for each question. Provide your answers in the

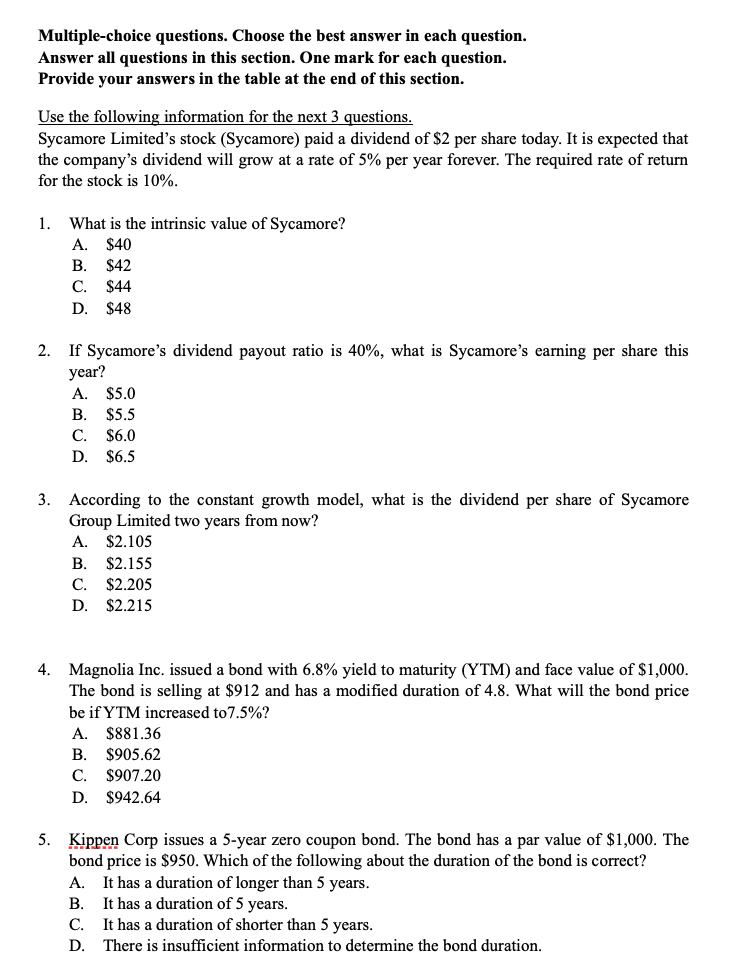

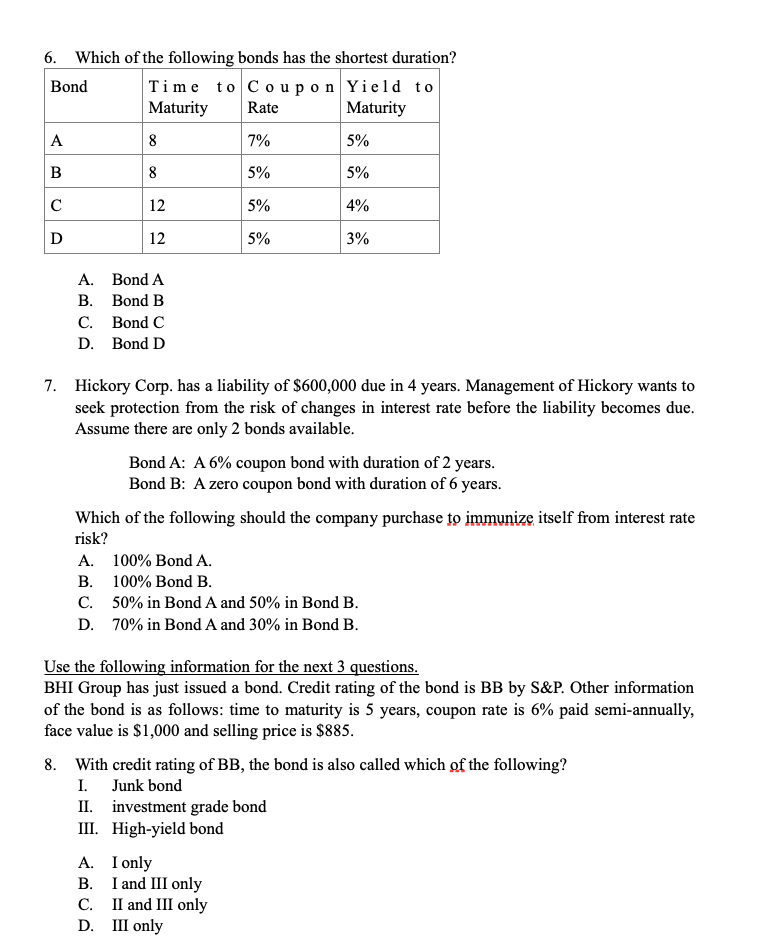

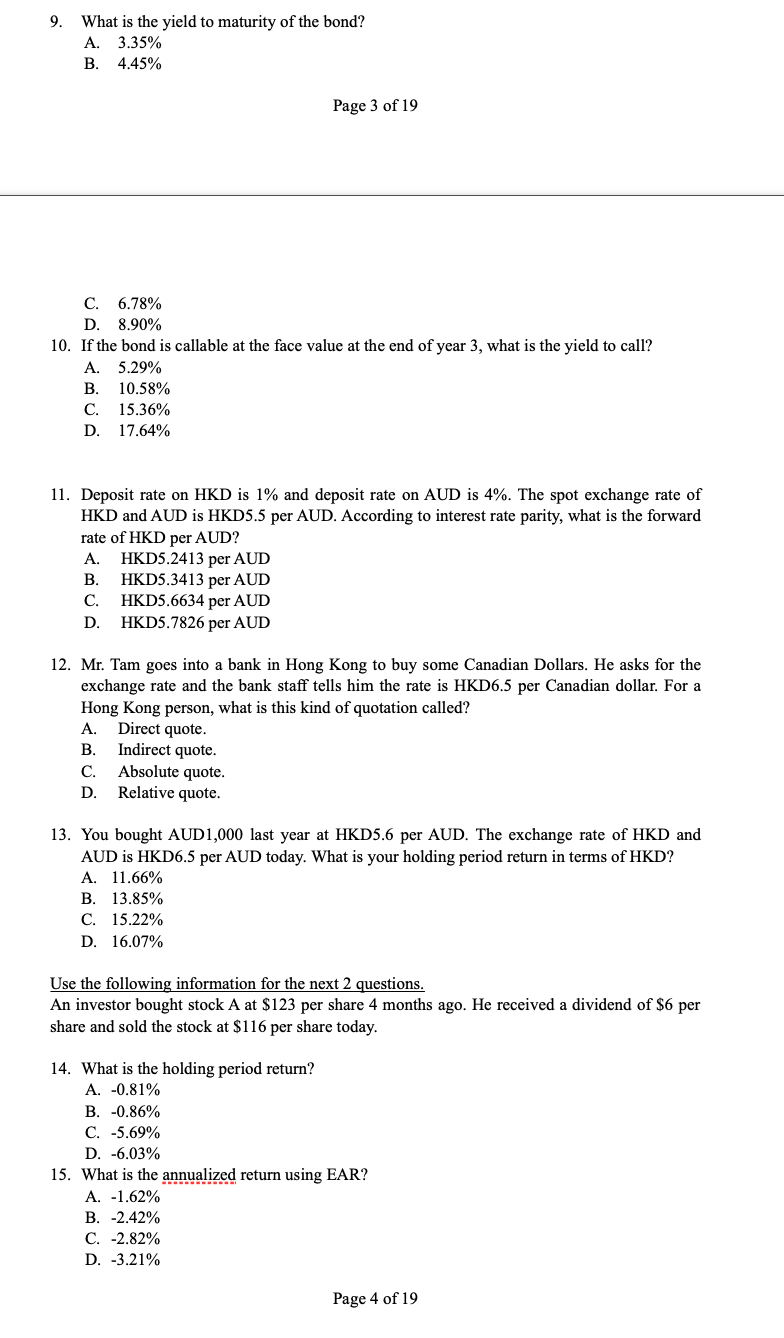

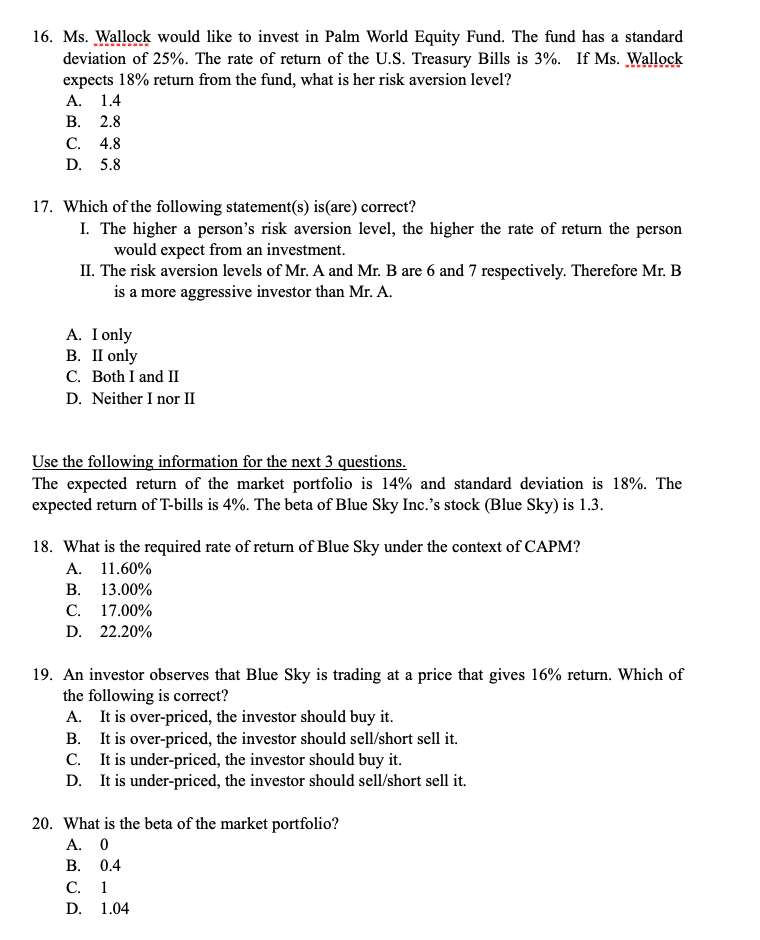

Multiple-choice questions. Choose the best answer in each question. Answer all questions in this section. One mark for each question. Provide your answers in the table at the end of this section.

Multiple-choice questions. Choose the best answer in each question. Answer all questions in this section. One mark for each question. Provide your answers in the table at the end of this section. Use the following information for the next 3 questions. Sycamore Limited's stock (Sycamore) paid a dividend of $2 per share today. It is expected that the company's dividend will grow at a rate of 5% per year forever. The required rate of return for the stock is 10%. 1. What is the intrinsic value of Sycamore? A. $40 B. $42 C. $44 D. $48 2. If Sycamore's dividend payout ratio is 40%, what is Sycamore's earning per share this year? A. $5.0 B. $5.5 C. $6.0 D. $6.5 3. According to the constant growth model, what is the dividend per share of Sycamore Group Limited two years from now? A. $2.105 B. $2.155 C. $2.205 D. $2.215 4. Magnolia Inc. issued a bond with 6.8% yield to maturity (YTM) and face value of $1,000. The bond is selling at $912 and has a modified duration of 4.8. What will the bond price be if YTM increased to 7.5%? A. $881.36 B. $905.62 C. $907.20 D. $942.64 5. Kippen Corp issues a 5-year zero coupon bond. The bond has a par value of $1,000. The bond price is $950. Which of the following about the duration of the bond is correct? A. It has a duration of longer than 5 years. B. It has a duration of 5 years. C. It has a duration of shorter than 5 years. D. There is insufficient information to determine the bond duration. 6. Which of the following bonds has the shortest duration? Bond Time to Coupon Yield to Maturity Rate Maturity A 8 7% 5% B 8 5% 5% 12 5% 4% D 12 5% 3% A. Bond A B. Bond B C. Bond C D. Bond D 7. Hickory Corp. has a liability of $600,000 due in 4 years. Management of Hickory wants to seek protection from the risk of changes in interest rate before the liability becomes due. Assume there are only 2 bonds available. Bond A: A 6% coupon bond with duration of 2 years. Bond B: A zero coupon bond with duration of 6 years. Which of the following should the company purchase to immunize itself from interest rate risk? A. 100% Bond A. B. 100% Bond B. C. 50% in Bond A and 50% in Bond B. D. 70% in Bond A and 30% in Bond B. Use the following information for the next 3 questions. BHI Group has just issued a bond. Credit rating of the bond is BB by S&P. Other information of the bond is as follows: time to maturity is 5 years, coupon rate is 6% paid semi-annually, face value is $1,000 and selling price is $885. 8. With credit rating of BB, the bond is also called which of the following? I. Junk bond II. investment grade bond III. High-yield bond A. I only B. I and III only C. II and III only D. III only 9. What is the yield to maturity of the bond? A. 3.35% B. 4.45% Page 3 of 19 C. 6.78% D. 8.90% 10. If the bond is callable at the face value at the end of year 3, what is the yield to call? A. 5.29% B. 10.58% C. 15.36% D. 17.64% 11. Deposit rate on HKD is 1% and deposit rate on AUD is 4%. The spot exchange rate of HKD and AUD is HKD5.5 per AUD. According to interest rate parity, what is the forward rate of HKD per AUD? A. HKD5.2413 per AUD B. HKD5.3413 per AUD C. HKD5.6634 per AUD D. HKD5.7826 per AUD 12. Mr. Tam goes into a bank in Hong Kong to buy some Canadian Dollars. He asks for the exchange rate and the bank staff tells him the rate is HKD6.5 per Canadian dollar. For a Hong Kong person, what is this kind of quotation called? A. Direct quote. B. Indirect quote. C. Absolute quote. D. Relative quote. 13. You bought AUD1,000 last year at HKD5.6 per AUD. The exchange rate of HKD and AUD is HKD6.5 per AUD today. What is your holding period return in terms of HKD? A. 11.66% B. 13.85% C. 15.22% D. 16.07% Use the following information for the next 2 questions. An investor bought stock A at $123 per share 4 months ago. He received a dividend of $6 per share and sold the stock at $116 per share today. 14. What is the holding period return? A. -0.81% B. -0.86% C. -5.69% D. -6.03% 15. What is the annualized return using EAR? A. -1.62% B. -2.42% C. -2.82% D. -3.21% Page 4 of 19 16. Ms. Wallock would like to invest in Palm World Equity Fund. The fund has a standard deviation of 25%. The rate of return of the U.S. Treasury Bills is 3%. If Ms. Wallock expects 18% return from the fund, what is her risk aversion level? A. 1.4 B. 2.8 C. 4.8 D. 5.8 17. Which of the following statement(s) is(are) correct? 1. The higher a person's risk aversion level, the higher the rate of return the person would expect from an investment. II. The risk aversion levels of Mr. A and Mr. B are 6 and 7 respectively. Therefore Mr. B is a more aggressive investor than Mr. A. A. I only B. II only C. Both I and II D. Neither I nor II Use the following information for the next 3 questions. The expected return of the market portfolio is 14% and standard deviation is 18%. The expected return of T-bills is 4%. The beta of Blue Sky Inc.'s stock (Blue Sky) is 1.3. 18. What is the required rate of return of Blue Sky under the context of CAPM? A. 11.60% B. 13.00% C. 17.00% D. 22.20% 19. An investor observes that Blue Sky is trading at a price that gives 16% return. Which of the following is correct? A. It is over-priced, the investor should buy it. B. It is over-priced, the investor should sell/short sell it. C. It is under-priced, the investor should buy it. D. It is under-priced, the investor should sell/short sell it. 20. What is the beta of the market portfolio? A. 0 B. 0.4 C. 1 D. 1.04

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started