Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MultiPower Ltd is a publicly listed company specialised in infrastructure construction. The company is evaluating the net present value (NPV) of a potential construction project

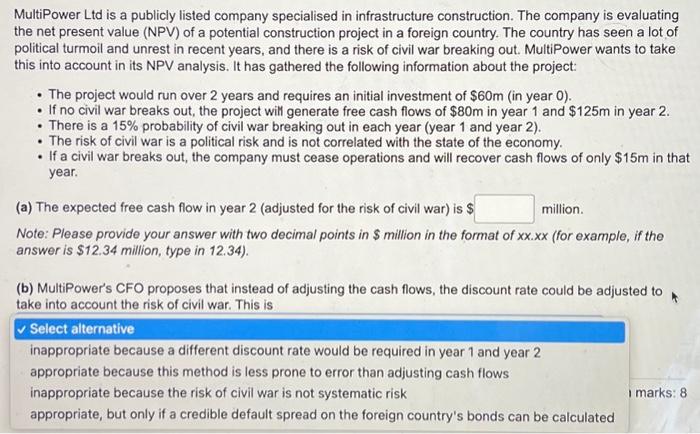

MultiPower Ltd is a publicly listed company specialised in infrastructure construction. The company is evaluating the net present value (NPV) of a potential construction project in a foreign country. The country has seen a lot of political turmoil and unrest in recent years, and there is a risk of civil war breaking out. MultiPower wants to take this into account in its NPV analysis. It has gathered the following information about the project: The project would run over 2 years and requires an initial investment of $60m (in year 0). If no civil war breaks out, the project will generate free cash flows of $80m in year 1 and $125m in year 2. There is a 15% probability of civil war breaking out in each year (year 1 and year 2). . The risk of civil war is a political risk and is not correlated with the state of the economy. If a civil war breaks out, the company must cease operations and will recover cash flows of only $15m in that year. (a) The expected free cash flow in year 2 (adjusted for the risk of civil war) is $ million. Note: Please provide your answer with two decimal points in $ million in the format of xx.xx (for example, if the answer is $12.34 million, type in 12.34). (b) MultiPower's CFO proposes that instead of adjusting the cash flows, the discount rate could be adjusted to take into account the risk of civil war. This is Select alternative inappropriate because a different discount rate would be required in year 1 and year 2 appropriate because this method is less prone to error than adjusting cash flows inappropriate because the risk of civil war is not systematic risk appropriate, but only if a credible default spread on the foreign country's bonds can be calculated marks: 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started