Question

Multi-Risk Insurance Company has decided that it wants to implement an enterprise risk management program.The company identified its most significant risks and determined that its

Multi-Risk Insurance Company has decided that it wants to implement an enterprise risk management program.The company identified its most significant risks and determined that its Risk Appetite will be focused on protecting its level of surplus as reported on its balance sheet.

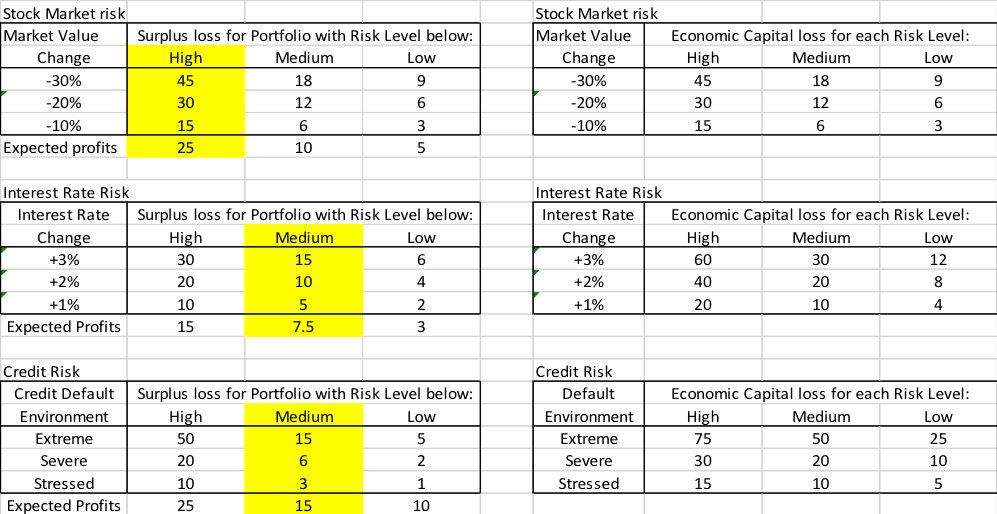

Risk Appetite: Surplus must be greater than $40 million in a market environment scenario that is defined as a stock market drop of 30%, interest rates rise 2% and a severe credit risk event.

The Risk Level in the charts refers to the three different choices available tothe company to decide how risky the company can structure its assets for that particular risk (high risk means that if the market scenario listed in the first column occurred, it would suffer more loss than a lower risk choice).The highlighted column shows the current level of risk at the company for that particular risk.The Expected Profits row at the bottom of each chart shows how much annual profit the company expects for each of the three risk level choices.All the risks are 100% correlated in the Risk Appetite market environment scenario.All values are in millions.

Current Balance sheet items as of December 2017:

Total Assets= $ 300(market value of total assets= $ 310)

Total Liabilities = $ 200(market value of total liabilities = $ 180)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started