Answered step by step

Verified Expert Solution

Question

1 Approved Answer

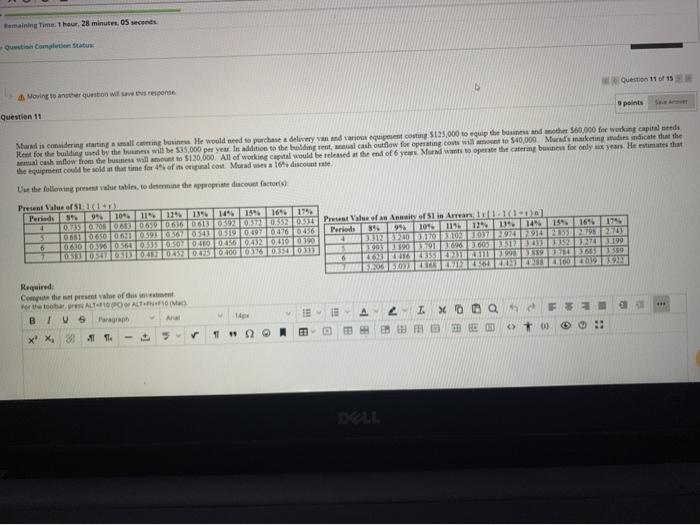

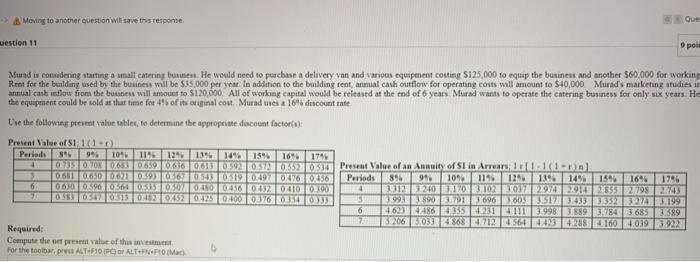

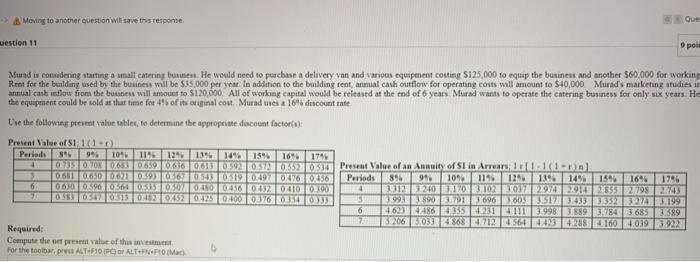

Murad is considering starting a small catering business. He would need to purchase a delivery van and various equipment costing $125,000 to equip the business

Murad is considering starting a small catering business. He would need to purchase a delivery van and various equipment costing $125,000 to equip the business and another $60,000 for working capital needs. Rent for the building used by the business will be S35,000 per year. In addition to the building rent, annual cash outflow for operating costs will amount to $40,000. Murad's marketing studies indicate that the annual cash inflow from the business will amount to $120,000. All of working capital would be released at the end of 6 years. Murad wants to operate the catering business for only six years. He estimates that the equipment could be sold at that time for 4% of its original cost. Murad uses a 16% discount rate. Use the following present value tables, to determine the appropriate discount factor(s):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started