Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Murad is considering starting a small catering business. He would need to purchase a delivery van and various equipment costing $125,000 to equip the business

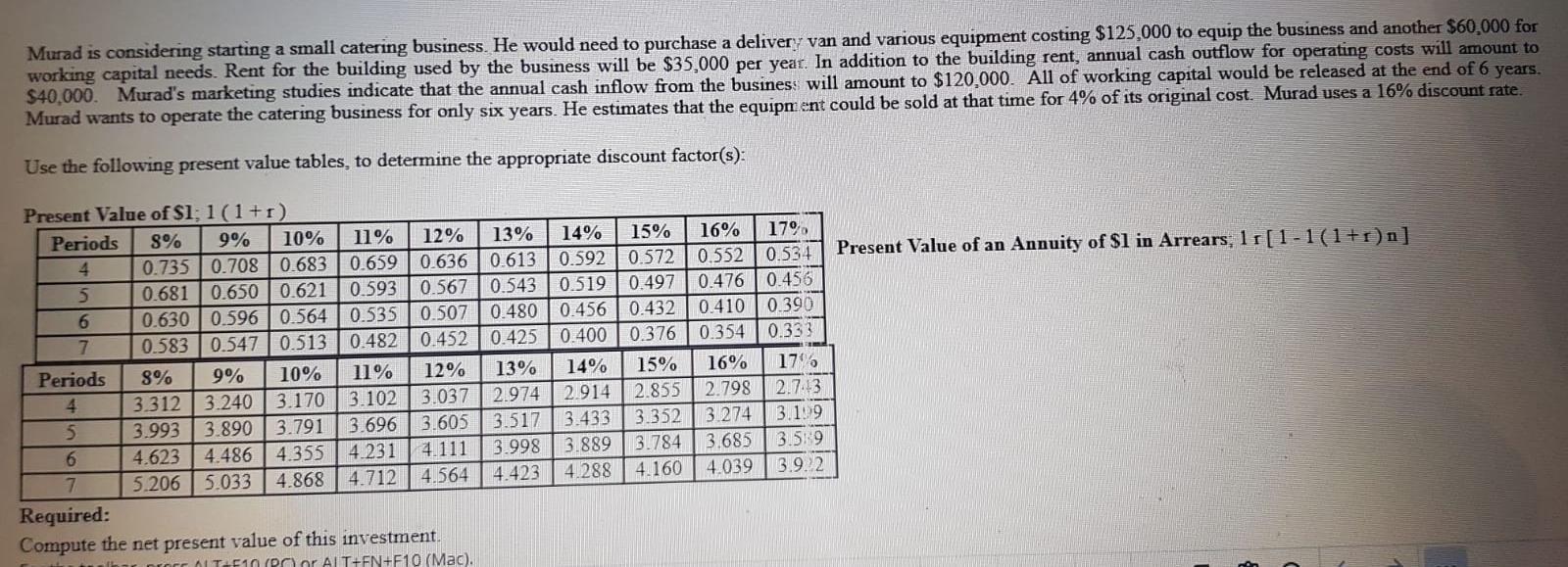

Murad is considering starting a small catering business. He would need to purchase a delivery van and various equipment costing $125,000 to equip the business and another $60,000 for working capital needs. Rent for the building used by the business will be $35,000 per year. In addition to the building rent, annual cash outflow for operating costs will amount to $40,000. Murad's marketing studies indicate that the annual cash inflow from the business will amount to $120,000. All of working capital would be released at the end of 6 years. Murad wants to operate the catering business for only six years. He estimates that the equipment could be sold at that time for 4% of its original cost. Murad uses a 16% discount rate. Use the following present value tables, to determine the appropriate discount factor(s): 17% Present Value of an Annuity of $1 in Arrears, 11 [1-1(1+r)n] 16% Present Value of $1; 1 (1+1) Periods 8% 9% 10% 11% 12% 13% 14% 15% 16% 4 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.5520.534 5 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.4760.456 6 0.630 | 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 7 0.5830.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 Periods 8% 9% 10% 11% 12% 13% 14% 15% 17% 4 3.312 3.240 3.170 3.102 3.037 | 2.9742.914 2.855 2.798 2.7.13 5 3.993 3.890 3.791 3.696 3.605 | 3.517 3.433 3.352 3.274 3.109 6 4.623 4.4864.355 4.231 4.111 3.9983.889 3.784 3.685 3.59 7 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.9.2 Required: Compute the net present value of this investment rol TF10 Pr Al T+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started