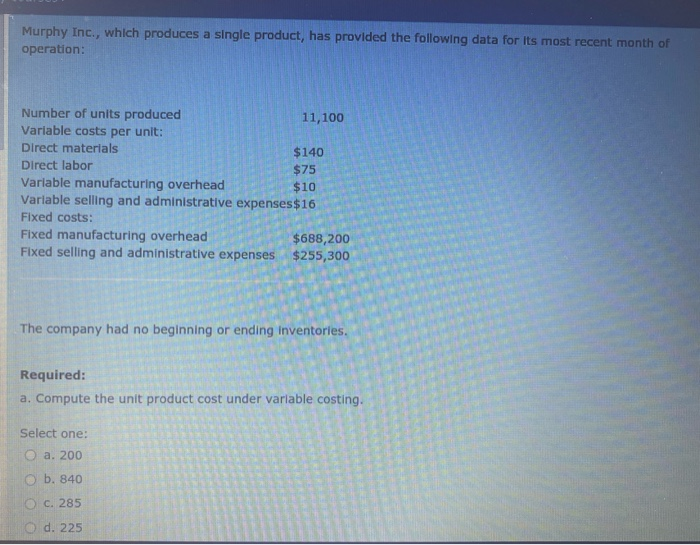

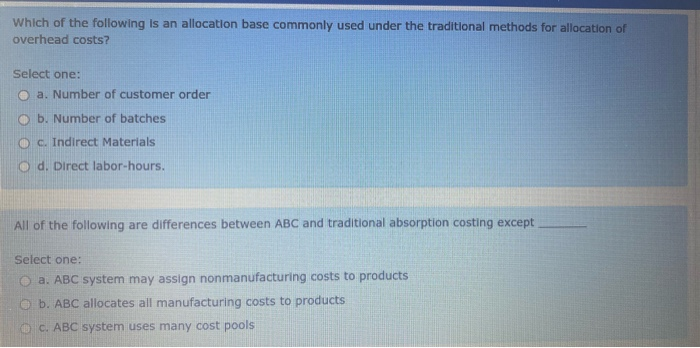

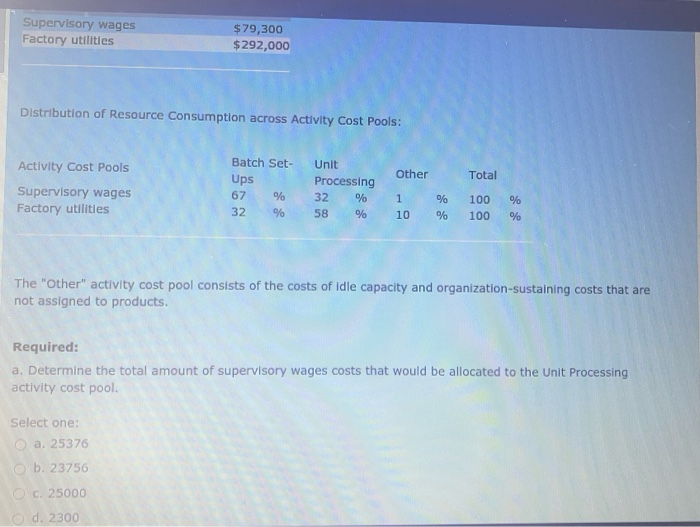

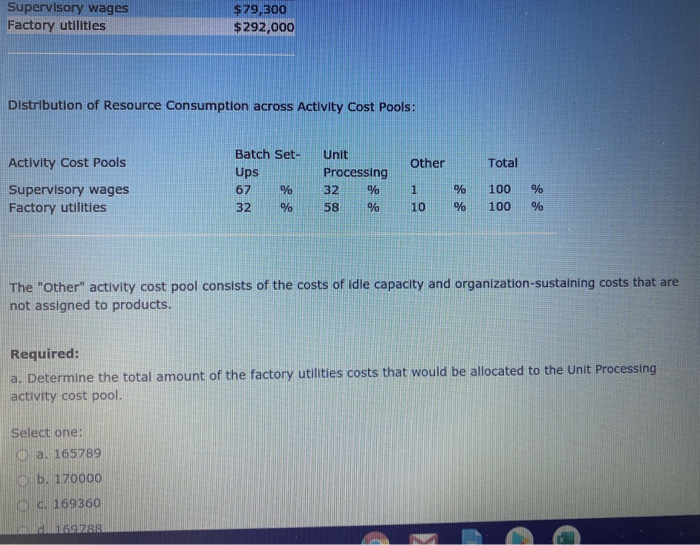

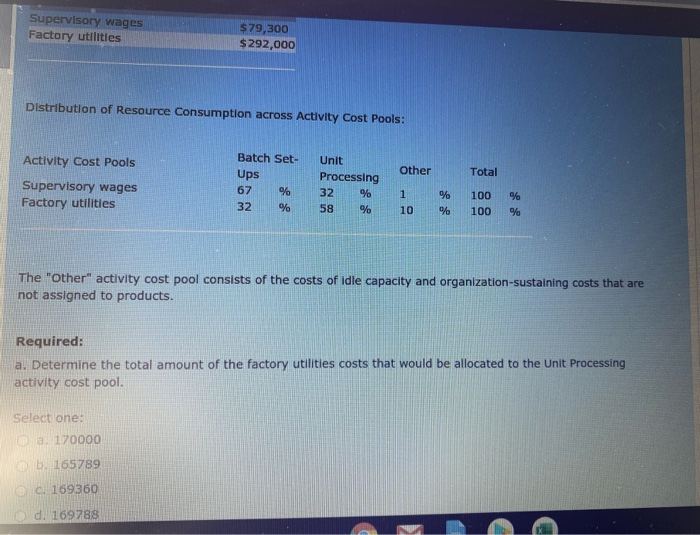

Murphy Inc., which produces a single product, has provided the following data for its most recent month of operation: Number of units produced 11,100 Variable costs per unit: Direct materials $140 Direct labor $75 Variable manufacturing overhead $10 Variable selling and administrative expenses $16 Fixed costs: Fixed manufacturing overhead $688,200 Fixed selling and administrative expenses $255,300 The company had no beginning or ending inventories. Required: a. Compute the unit product cost under variable costing. Select one: a. 200 b. 840 O c. 285 O d. 225 Which of the following is an allocation base commonly used under the traditional methods for allocation of overhead costs? Select one: O a. Number of customer order O b. Number of batches c. Indirect Materials d. Direct labor-hours. All of the following are differences between ABC and traditional absorption costing except Select one: O a. ABC system may assign nonmanufacturing costs to products O b. ABC allocates all manufacturing costs to products C. ABC system uses many cost pools Supervisory wages Factory utilities $ 79,300 $292,000 Distribution of Resource Consumption across Activity Cost Pools: Other Total Activity Cost Pools Supervisory wages Factory utilities Batch Set- Ups 67 % 32 % Unit Processing 32 % 58 % 1 10 % % 100 100 % % The "other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. Required: a. Determine the total amount of supervisory wages costs that would be allocated to the Unit Processing activity cost pool. Select one: a. 25376 b. 23756 C. 25000 O d. 2300 Supervisory wages Factory utilities $79,300 $292,000 Distribution of Resource Consumption across Activity Cost Pools: Activity Cost Pools Other Total Batch Set- Ups 67 % 32 % Unit Processing 32 % 58 % Supervisory wages Factory utilities 1 10 % % 100 100 % % The "other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. Required: a. Determine the total amount of the factory utilities costs that would be allocated to the Unit Processing activity cost pool. Select one: a. 165789 b. 170000 c. 169360 16191788 Supervisory wages Factory utilities $79,300 $ 292,000 Distribution of Resource Consumption across Activity Cost Pools: Other Total Activity Cost Pools Supervisory wages Factory utilities Batch Set- Ups 67 % 32 % Unit Processing 32 % 58 % 1 10 % % 100 100 % % The "other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. Required: a. Determine the total amount of the factory utilities costs that would be allocated to the Unit Processing activity cost pool. Select one: Ca. 170000 b. 165789 CI 169360 d. 169788