Question

Musa Moshref and Shaniqua Hollins have operated a successful firm for many years, sharing net income and net losses equally. Taylor Anderson is to be

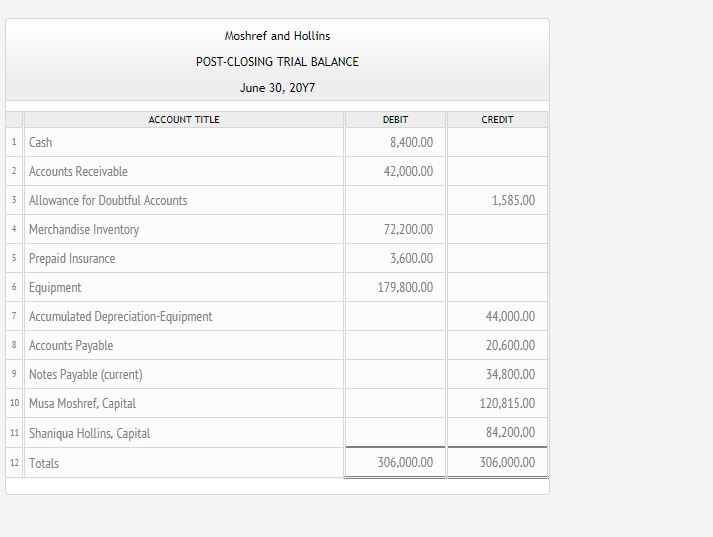

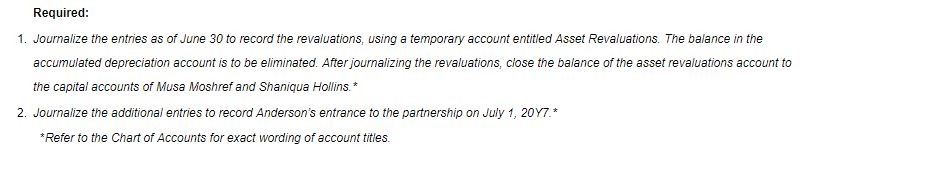

Musa Moshref and Shaniqua Hollins have operated a successful firm for many years, sharing net income and net losses equally. Taylor Anderson is to be admitted to the partnership on July 1 of the current year, in accordance with the following agreement: a. Assets and liabilities of the old partnership are to be valued at their book values as of June 30, except for the following: Accounts receivable amounting to $2,300 are to be written off, and the allowance for doubtful accounts is to be increased to 5% of the remaining accounts. Merchandise inventory is to be valued at $76,300. Equipment is to be valued at $155,800. b. Anderson is to purchase $69,700 of the ownership interest of Hollins for $75,300 cash and to contribute another $45,800 cash to the partnership for a total ownership equity of $115,500. The post-closing trial balance of Moshref and Hollins as of June 30 is as follows:

Moshref and Hollins POST-CLOSING TRIAL BALANCE June 30, 20Y7 ACCOUNT TITLE DEBIT CREDIT 1 Cash 8,400.00 2 Accounts Receivable 42,000.00 Allowance for Doubtful Accounts 1,585.00 72,200.00 3,600.00 179,800.00 4 Merchandise Inventory Prepaid Insurance Equipment 7Accumulated Depreciation-Equipment 8 Accounts Payable 9 Notes Payable (current) 10 Musa Moshref, Capital 11 Shaniqua Hollins, Capital 12 Totals 44,000.00 20,600.00 34,800.00 120,815.00 84,200.00 306,000.00 306,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started