Answered step by step

Verified Expert Solution

Question

1 Approved Answer

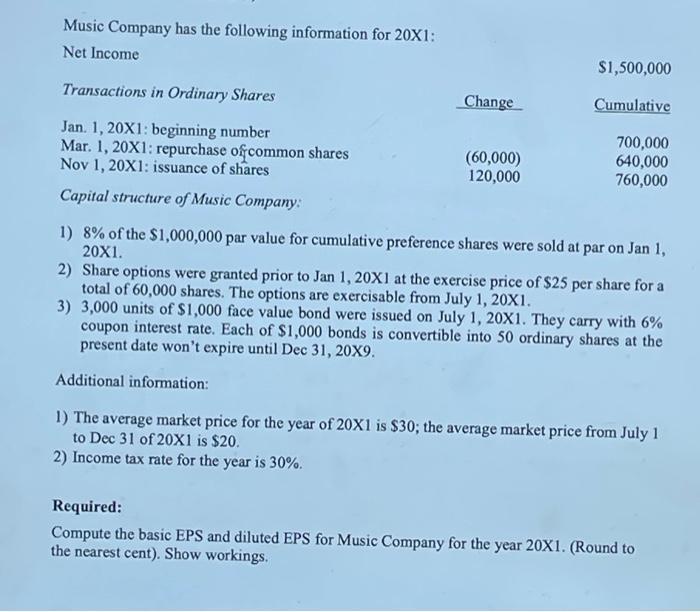

Music Company has the following information for 20X1: Net Income Transactions in Ordinary Shares Jan. 1, 20X1: beginning number Mar. 1, 20X1: repurchase of

Music Company has the following information for 20X1: Net Income Transactions in Ordinary Shares Jan. 1, 20X1: beginning number Mar. 1, 20X1: repurchase of common shares Nov 1, 20X1: issuance of shares Capital structure of Music Company: Change (60,000) 120,000 $1,500,000 Cumulative 700,000 640,000 760,000 1) 8% of the $1,000,000 par value for cumulative preference shares were sold at par on Jan 1, 20X1. 2) Share options were granted prior to Jan 1, 20X1 at the exercise price of $25 per share for a total of 60,000 shares. The options are exercisable from July 1, 20X1. 3) 3,000 units of $1,000 face value bond were issued on July 1, 20X1. They carry with 6% coupon interest rate. Each of $1,000 bonds is convertible into 50 ordinary shares at the present date won't expire until Dec 31, 20X9. Additional information: 1) The average market price for the year of 20X1 is $30; the average market price from July 1 to Dec 31 of 20X1 is $20. 2) Income tax rate for the year is 30%. Required: Compute the basic EPS and diluted EPS for Music Company for the year 20X1. (Round to the nearest cent). Show workings.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Basic EPS Net Income 1500000 Weighted Average Number of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started