Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. . Muskoka Boys Shaving Co. (MBSC) is a GST/HST registrant operating an online store in Ontarios cottage country region. The company specializes in selling

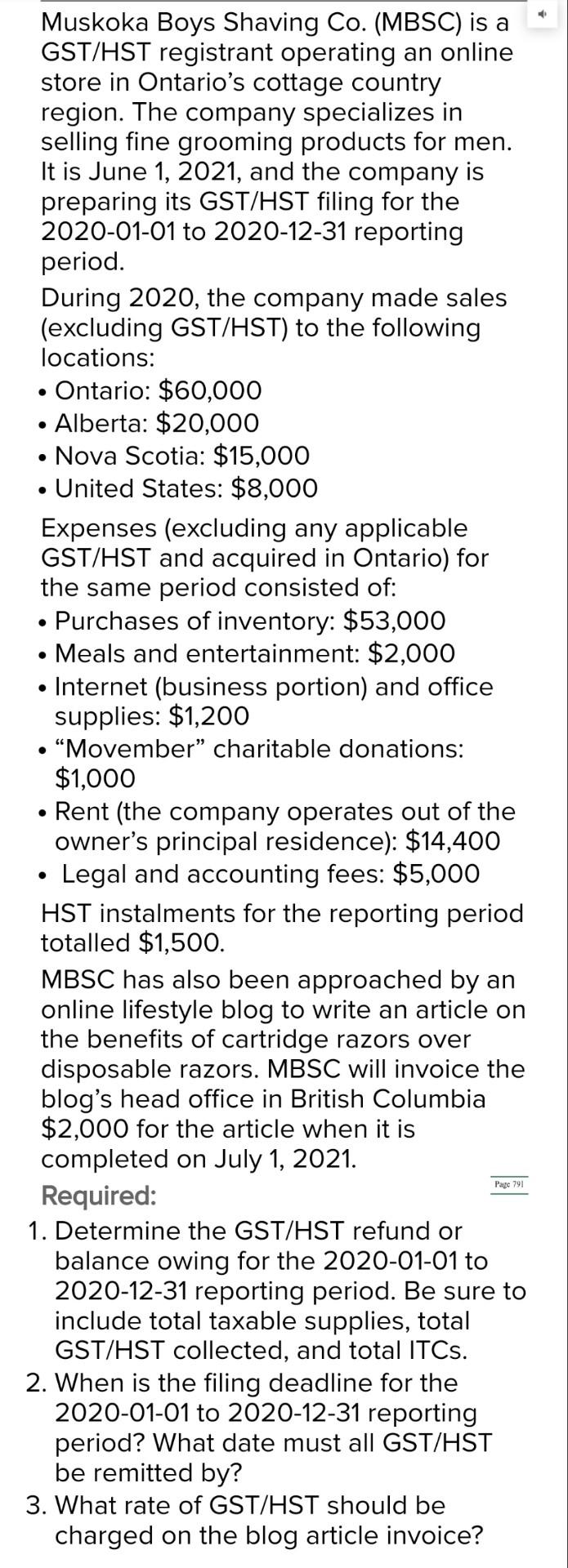

. . Muskoka Boys Shaving Co. (MBSC) is a GST/HST registrant operating an online store in Ontarios cottage country region. The company specializes in selling fine grooming products for men. It is June 1, 2021, and the company is preparing its GST/HST filing for the 2020-01-01 to 2020-12-31 reporting period. During 2020, the company made sales (excluding GST/HST) to the following locations: Ontario: $60,000 Alberta: $20,000 Nova Scotia: $15,000 United States: $8,000 Expenses (excluding any applicable GST/HST and acquired in Ontario) for the same period consisted of: Purchases of inventory: $53,000 Meals and entertainment: $2,000 Internet (business portion) and office supplies: $1,200 "Movember charitable donations: $1,000 Rent (the company operates out of the owner's principal residence): $14,400 Legal and accounting fees: $5,000 HST instalments for the reporting period totalled $1,500. MBSC has also been approached by an online lifestyle blog to write an article on the benefits of cartridge razors over disposable razors. MBSC will invoice the blog's head office in British Columbia $2,000 for the article when it is completed on July 1, 2021. Required: 1. Determine the GST/HST refund or balance owing for the 2020-01-01 to 2020-12-31 reporting period. Be sure to include total taxable supplies, total GST/HST collected, and total ITCs. 2. When is the filing deadline for the 2020-01-01 to 2020-12-31 reporting period? What date must all GST/HST be remitted by? 3. What rate of GST/HST should be charged on the blog article invoice? . Page 791 . . Muskoka Boys Shaving Co. (MBSC) is a GST/HST registrant operating an online store in Ontarios cottage country region. The company specializes in selling fine grooming products for men. It is June 1, 2021, and the company is preparing its GST/HST filing for the 2020-01-01 to 2020-12-31 reporting period. During 2020, the company made sales (excluding GST/HST) to the following locations: Ontario: $60,000 Alberta: $20,000 Nova Scotia: $15,000 United States: $8,000 Expenses (excluding any applicable GST/HST and acquired in Ontario) for the same period consisted of: Purchases of inventory: $53,000 Meals and entertainment: $2,000 Internet (business portion) and office supplies: $1,200 "Movember charitable donations: $1,000 Rent (the company operates out of the owner's principal residence): $14,400 Legal and accounting fees: $5,000 HST instalments for the reporting period totalled $1,500. MBSC has also been approached by an online lifestyle blog to write an article on the benefits of cartridge razors over disposable razors. MBSC will invoice the blog's head office in British Columbia $2,000 for the article when it is completed on July 1, 2021. Required: 1. Determine the GST/HST refund or balance owing for the 2020-01-01 to 2020-12-31 reporting period. Be sure to include total taxable supplies, total GST/HST collected, and total ITCs. 2. When is the filing deadline for the 2020-01-01 to 2020-12-31 reporting period? What date must all GST/HST be remitted by? 3. What rate of GST/HST should be charged on the blog article invoice? . Page 791

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started