Mussa Holdings (Pty) Ltd has an established retail outlet network in the greater part of Johannesburg. The business has a capital structure of 6

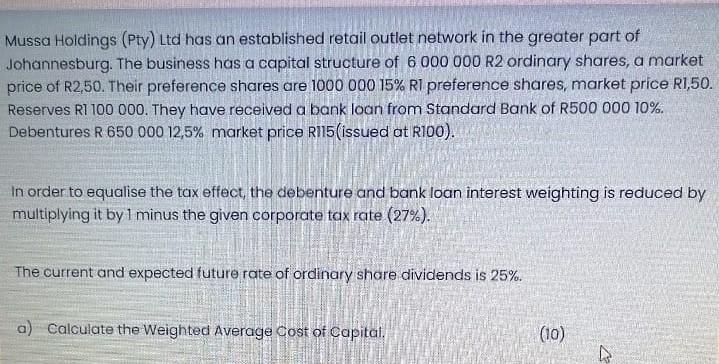

Mussa Holdings (Pty) Ltd has an established retail outlet network in the greater part of Johannesburg. The business has a capital structure of 6 000 000 R2 ordinary shares, a market price of R2,50. Their preference shares are 1000 000 15% RI preference shares, market price R1,50. Reserves R1 100 000. They have received a bank loan from Standard Bank of R500 000 10%. Debentures R 650 000 12,5% market price R115(issued at R100). In order to equalise the tax effect, the debenture and bank loan interest weighting is reduced by multiplying it by 1 minus the given corporate tax rate (27%). The current and expected future rate of ordinary share dividends is 25%. a) Calculate the Weighted Average Cost of Capital. (10) M Capital source Market value Show calculations Weight Cost Weighted Cost

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started