Answered step by step

Verified Expert Solution

Question

1 Approved Answer

must answer 3 questions with the 5 stocks listed and the given informstion being the hrp and the beta. the guidelines for each question is

must answer 3 questions with the 5 stocks listed and the given informstion being the hrp and the beta. the guidelines for each question is also posted

Question 1

Question 1 guidelines

Question 2

Question 2 Guidelines

Question 3

Question 3 Guidelines

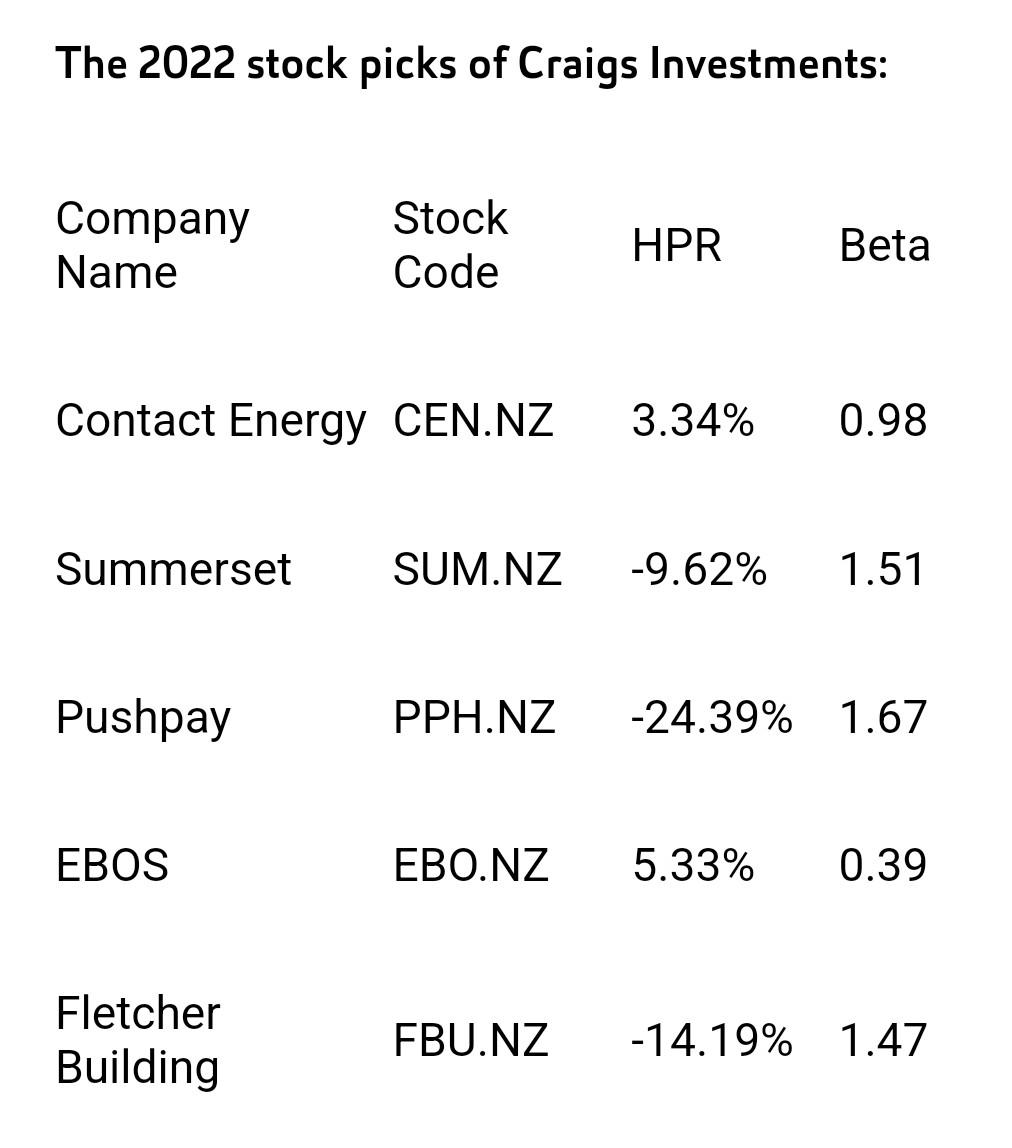

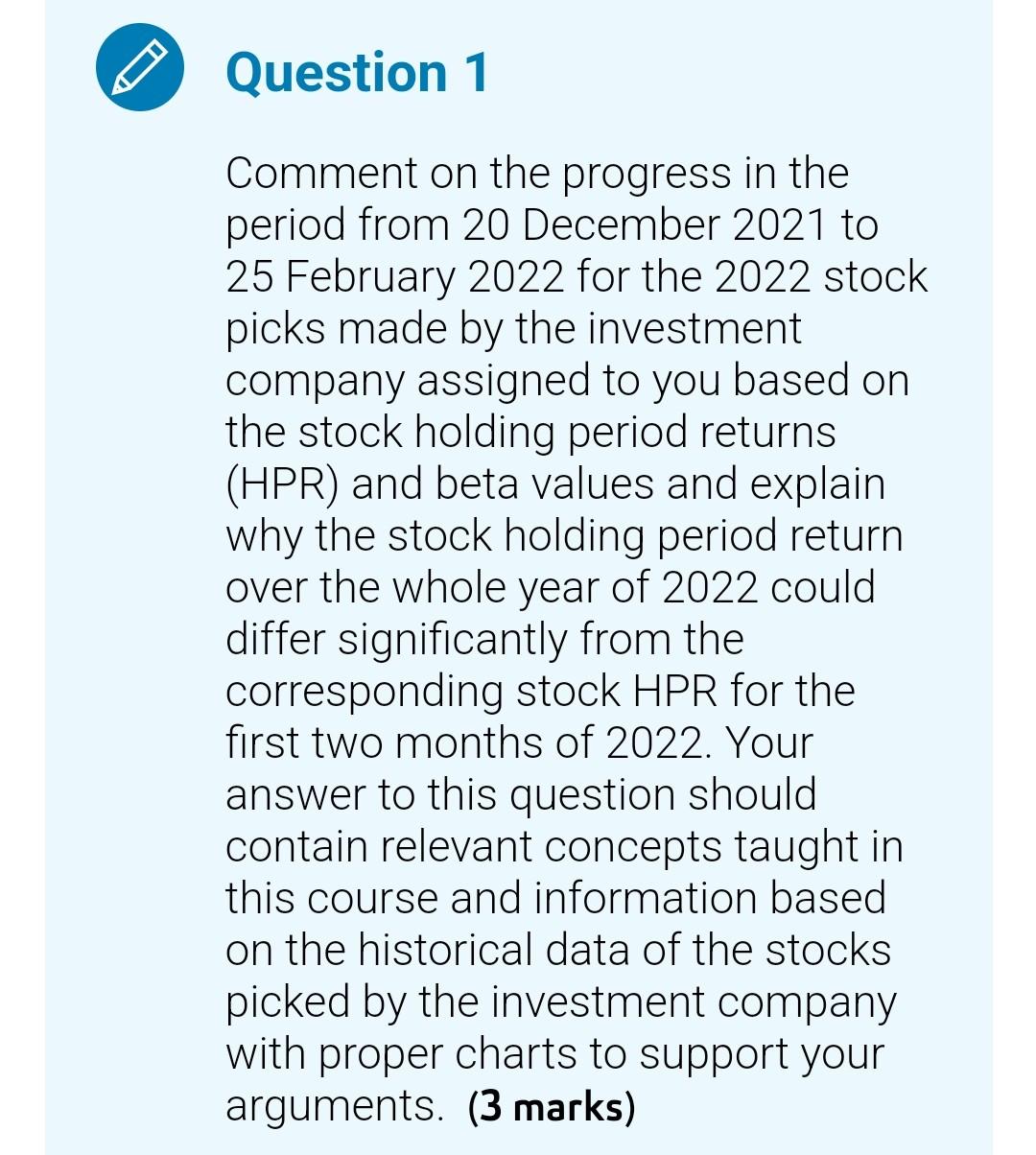

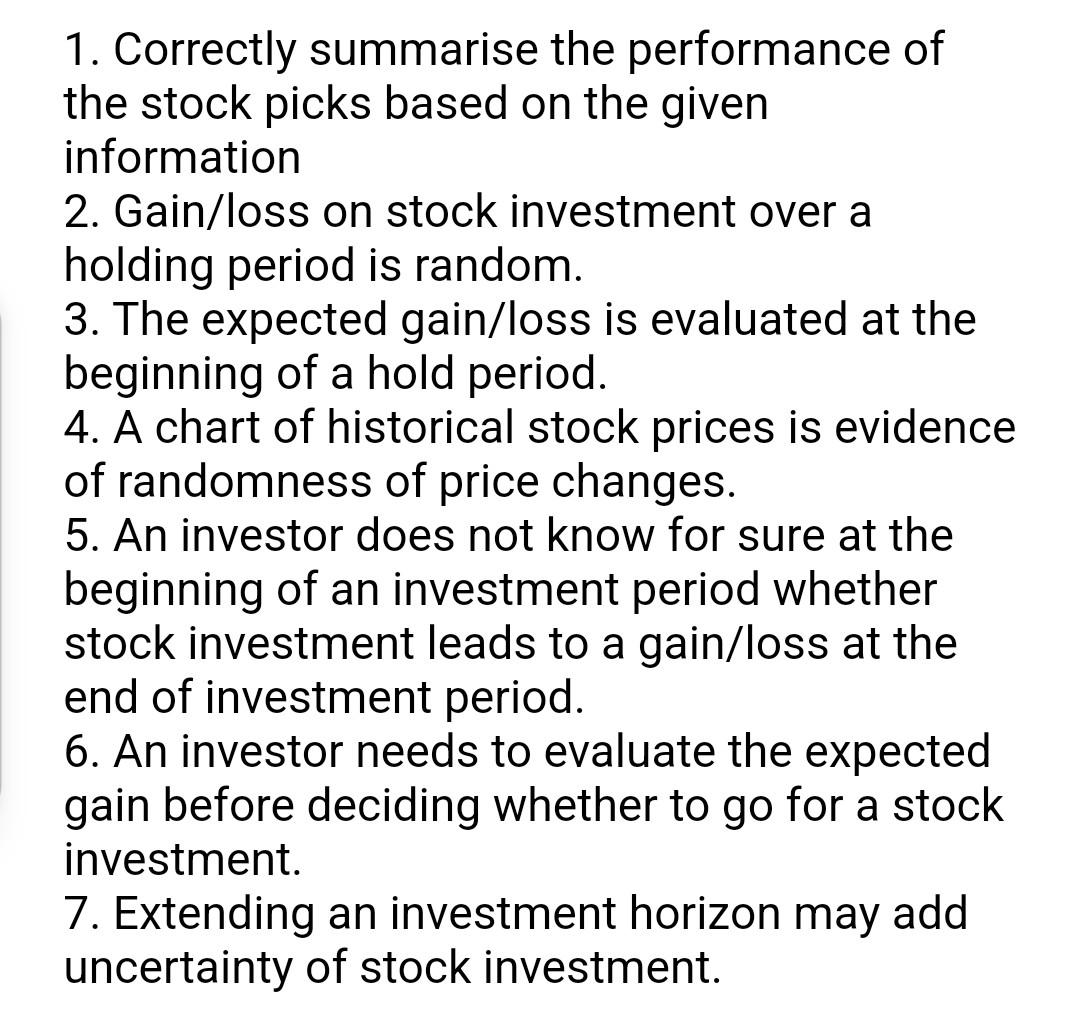

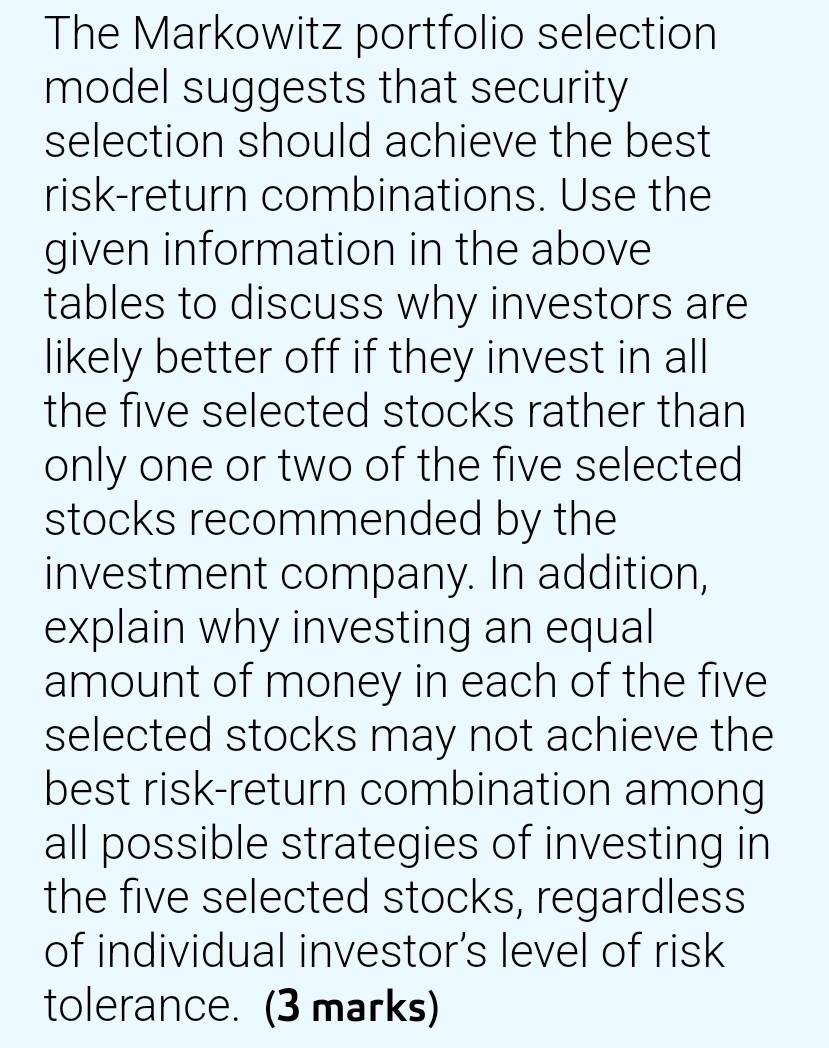

The 2022 stock picks of Craigs Investments: Company Name Stock Code HPR Beta Contact Energy CEN.NZ 3.34% 0.98 Summerset SUM.NZ -9.62% 1.51 Pushpay PPH.NZ -24.39% 1.67 EBOS EBO.NZ 5.33% 0.39 Fletcher Building FBU.NZ -14.19% 1.47 Question 1 Comment on the progress in the period from 20 December 2021 to 25 February 2022 for the 2022 stock picks made by the investment company assigned to you based on the stock holding period returns (HPR) and beta values and explain why the stock holding period return over the whole year of 2022 could differ significantly from the corresponding stock HPR for the first two months of 2022. Your answer to this question should contain relevant concepts taught in this course and information based on the historical data of the stocks picked by the investment company with proper charts to support your arguments. (3 marks) 1. Correctly summarise the performance of the stock picks based on the given information 2. Gain/loss on stock investment over a holding period is random. 3. The expected gain/loss is evaluated at the beginning of a hold period. 4. A chart of historical stock prices is evidence of randomness of price changes. 5. An investor does not know for sure at the beginning of an investment period whether stock investment leads to a gain/loss at the end of investment period. 6. An investor needs to evaluate the expected gain before deciding whether to go for a stock investment. 7. Extending an investment horizon may add uncertainty of stock investment. The Markowitz portfolio selection model suggests that security selection should achieve the best risk-return combinations. Use the given information in the above tables to discuss why investors are likely better off if they invest in all the five selected stocks rather than only one or two of the five selected stocks recommended by the investment company. In addition, explain why investing an equal amount of money in each of the five selected stocks may not achieve the best risk-return combination among all possible strategies of investing in the five selected stocks, regardless of individual investor's level of risk tolerance. (3 marks) 1. The more different stocks included in a stock investment portfolio, the less risk for the portfolio in general. 2. Stocks selected from different sectors likely reduce the stock portfolio risk more than stocks from the same sector. 3. Optimal risky portfolio with five stocks is a particular combination of five stocks that has the largest Sharpe ratio. 4. An equally weighted portfolio may not be the optimal risky portfolio as the weights in the optimal risky portfolio may not be the same. 5. All investors should choose the optimal risky portfolio regardless of their risk preference. Describe how an investor can combine a risk-free asset with the portfolio of the five selected stocks recommended by the investment company to produce the optimal investment portfolio suitable for the investor's level of risk tolerance. (2 marks) 1. An investor should first know how much risk he/she is willing to take. That is, first evaluate an investor's risk tolerance level. 2. Allocate investor's investment fund between the risk-free asset and the risky asset according to his/her risk tolerance level. 3. The risky asset in this case is the optimal risky portfolio of the five selected stocks. 4. Investor's combination of the risk-free asset and the risky asset varies for different investors due to differences in risk tolerance level. The 2022 stock picks of Craigs Investments: Company Name Stock Code HPR Beta Contact Energy CEN.NZ 3.34% 0.98 Summerset SUM.NZ -9.62% 1.51 Pushpay PPH.NZ -24.39% 1.67 EBOS EBO.NZ 5.33% 0.39 Fletcher Building FBU.NZ -14.19% 1.47 Question 1 Comment on the progress in the period from 20 December 2021 to 25 February 2022 for the 2022 stock picks made by the investment company assigned to you based on the stock holding period returns (HPR) and beta values and explain why the stock holding period return over the whole year of 2022 could differ significantly from the corresponding stock HPR for the first two months of 2022. Your answer to this question should contain relevant concepts taught in this course and information based on the historical data of the stocks picked by the investment company with proper charts to support your arguments. (3 marks) 1. Correctly summarise the performance of the stock picks based on the given information 2. Gain/loss on stock investment over a holding period is random. 3. The expected gain/loss is evaluated at the beginning of a hold period. 4. A chart of historical stock prices is evidence of randomness of price changes. 5. An investor does not know for sure at the beginning of an investment period whether stock investment leads to a gain/loss at the end of investment period. 6. An investor needs to evaluate the expected gain before deciding whether to go for a stock investment. 7. Extending an investment horizon may add uncertainty of stock investment. The Markowitz portfolio selection model suggests that security selection should achieve the best risk-return combinations. Use the given information in the above tables to discuss why investors are likely better off if they invest in all the five selected stocks rather than only one or two of the five selected stocks recommended by the investment company. In addition, explain why investing an equal amount of money in each of the five selected stocks may not achieve the best risk-return combination among all possible strategies of investing in the five selected stocks, regardless of individual investor's level of risk tolerance. (3 marks) 1. The more different stocks included in a stock investment portfolio, the less risk for the portfolio in general. 2. Stocks selected from different sectors likely reduce the stock portfolio risk more than stocks from the same sector. 3. Optimal risky portfolio with five stocks is a particular combination of five stocks that has the largest Sharpe ratio. 4. An equally weighted portfolio may not be the optimal risky portfolio as the weights in the optimal risky portfolio may not be the same. 5. All investors should choose the optimal risky portfolio regardless of their risk preference. Describe how an investor can combine a risk-free asset with the portfolio of the five selected stocks recommended by the investment company to produce the optimal investment portfolio suitable for the investor's level of risk tolerance. (2 marks) 1. An investor should first know how much risk he/she is willing to take. That is, first evaluate an investor's risk tolerance level. 2. Allocate investor's investment fund between the risk-free asset and the risky asset according to his/her risk tolerance level. 3. The risky asset in this case is the optimal risky portfolio of the five selected stocks. 4. Investor's combination of the risk-free asset and the risky asset varies for different investors due to differences in risk tolerance level

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started