Answered step by step

Verified Expert Solution

Question

1 Approved Answer

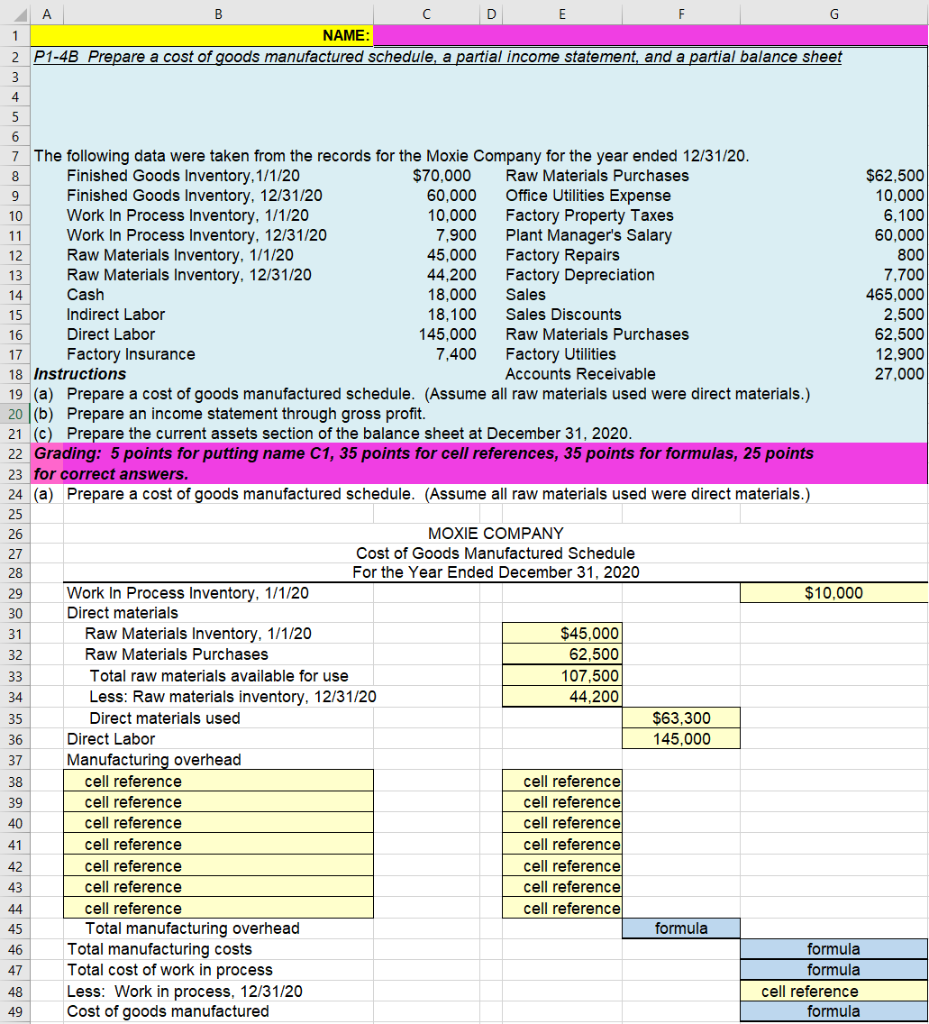

Must be cell referenced A B E G 1 NAME: 2 P1-4B Prepare a cost of goods manufactured schedule, a partial income statement, and a

Must be cell referenced

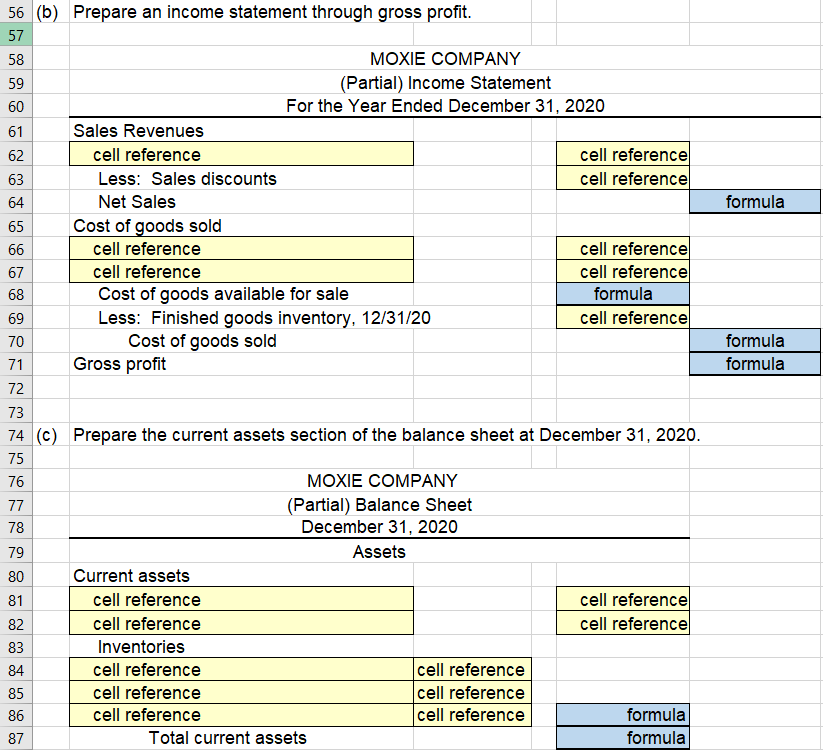

A B E G 1 NAME: 2 P1-4B Prepare a cost of goods manufactured schedule, a partial income statement, and a partial balance sheet 3 4 5 6 7 The following data were taken from the records for the Moxie Company for the year ended 12/31/20. 8 Finished Goods Inventory, 1/1/20 $70,000 Raw Materials Purchases $62,500 9 Finished Goods Inventory, 12/31/20 60,000 Office Utilities Expense 10,000 10 Work In Process Inventory, 1/1/20 10,000 Factory Property Taxes 6.100 11 Work In Process Inventory, 12/31/20 7,900 Plant Manager's Salary 60.000 12 Raw Materials Inventory, 1/1/20 45,000 Factory Repairs 800 13 Raw Materials Inventory, 12/31/20 44,200 Factory Depreciation 7,700 14 Cash 18,000 Sales 465,000 15 Indirect Labor 18,100 Sales Discounts 2,500 16 Direct Labor 145,000 Raw Materials Purchases 62,500 17 Factory Insurance 7,400 Factory Utilities 12.900 18 Instructions Accounts Receivable 27,000 19 (a) Prepare a cost of goods manufactured schedule. (Assume all raw materials used were direct materials.) 20 (6) Prepare an income statement through gross profit. 21 (C) Prepare the current assets section of the balance sheet at December 31, 2020. 22 Grading: 5 points for putting name C1, 35 points for cell references, 35 points for formulas, 25 points 23 for correct answers. 24 (a) Prepare a cost of goods manufactured schedule. (Assume all raw materials used were direct materials.) 25 26 MOXIE COMPANY 27 Cost of Goods Manufactured Schedule 28 For the Year Ended December 31, 2020 29 Work In Process Inventory, 1/1/20 $10,000 30 Direct materials 31 Raw Materials Inventory, 1/1/20 $45,000 32 Raw Materials Purchases 62.500 33 Total raw materials available for use 107,500 34 Less: Raw materials inventory, 12/31/20 44.200 35 Direct materials used $63,300 36 Direct Labor 145.000 37 Manufacturing overhead 38 cell reference cell reference 39 cell reference cell reference 40 cell reference cell reference 41 cell reference cell reference 42 cell reference cell reference 43 cell reference cell reference 44 cell reference cell reference 45 Total manufacturing overhead formula 46 Total manufacturing costs formula 47 Total cost of work in process formula 48 Less: Work in process, 12/31/20 cell reference 49 Cost of goods manufactured formula formula formula formula 56 (b) Prepare an income statement through gross profit. 57 58 MOXIE COMPANY 59 (Partial) Income Statement 60 For the Year Ended December 31, 2020 61 Sales Revenues 62 cell reference cell reference 63 Less: Sales discounts cell reference 64 Net Sales 65 Cost of goods sold 66 cell reference cell reference 67 cell reference cell reference 68 Cost of goods available for sale formula 69 Less: Finished goods inventory, 12/31/20 cell reference 70 Cost of goods sold 71 Gross profit 72 73 74 (C) Prepare the current assets section of the balance sheet at December 31, 2020. 75 76 MOXIE COMPANY 77 (Partial) Balance Sheet 78 December 31, 2020 79 Assets 80 Current assets 81 cell reference cell reference 82 cell reference cell reference 83 Inventories 84 cell reference cell reference 85 cell reference cell reference 86 cell reference cell reference formula 87 Total current assets formulaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started