Question

must be completed by hand You own a $1,000-par zero-coupon bond that has 5 years of remaining maturity. You plan on selling the bond in

must be completed by hand

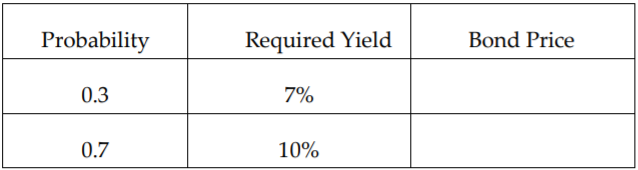

You own a $1,000-par zero-coupon bond that has 5 years of remaining maturity. You plan on selling the bond in one year and believe that the required yield next year will have the following probability distribution:

Note that the required yield can be interpreted as the discount rate.

a. What is your expected required yield when you sell the bond?

b. Calculate the variance of the required yield.

c. Calculate the bonds price in each situation and complete the right column. (Hint: one year later, the bond has 4 years of remaining maturity.)

d. What is your expected price when you sell the bond? (This exercise shows an example that the expected price may not be equal to the price of bond with the expected required yield.)

Bond Price Required Yield Probability 0.3 0.7 7% 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started