Must be done in Excel. Show all work, I need to see what cells or Excel functions have been used to get the answers.

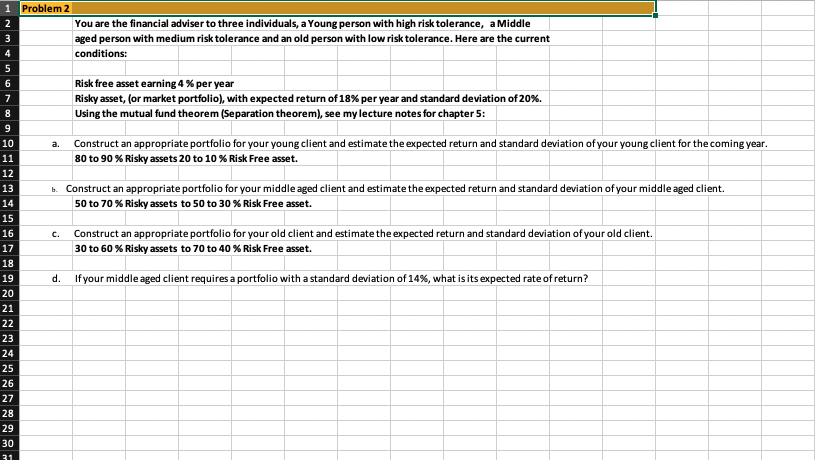

Problem 2 1 2 3 You are the financial adviser to three individuals, a Young person with high risk tolerance, a Middle aged person with medium risk tolerance and an old person with low risk tolerance. Here are the current conditions: 4 5 6 7 Risk free asset earning 4 % per year Risky asset, (or market portfolio), with expected return of 18% per year and standard deviation of 20%. Using the mutual fund theorem (Separation theorem), see my lecture notes for chapter 5: 8 a. Construct an appropriate portfolio for your young client and estimate the expected return and standard deviation of your young client for the coming year. 80 to 90 % Risky assets 20 to 10 % Risk Free asset. b. Construct an appropriate portfolio for your middle aged client and estimate the expected return and standard deviation of your middle aged client. 50 to 70 % Risky assets to 50 to 30 % Risk Free asset. c. Construct an appropriate portfolio for your old client and estimate the expected return and standard deviation of your old client. 30 to 60 % Risky assets to 70 to 40 % Risk Free asset. d. If your middle aged client requires a portfolio with a standard deviation of 14%, what is its expected rate of return? 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Problem 2 1 2 3 You are the financial adviser to three individuals, a Young person with high risk tolerance, a Middle aged person with medium risk tolerance and an old person with low risk tolerance. Here are the current conditions: 4 5 6 7 Risk free asset earning 4 % per year Risky asset, (or market portfolio), with expected return of 18% per year and standard deviation of 20%. Using the mutual fund theorem (Separation theorem), see my lecture notes for chapter 5: 8 a. Construct an appropriate portfolio for your young client and estimate the expected return and standard deviation of your young client for the coming year. 80 to 90 % Risky assets 20 to 10 % Risk Free asset. b. Construct an appropriate portfolio for your middle aged client and estimate the expected return and standard deviation of your middle aged client. 50 to 70 % Risky assets to 50 to 30 % Risk Free asset. c. Construct an appropriate portfolio for your old client and estimate the expected return and standard deviation of your old client. 30 to 60 % Risky assets to 70 to 40 % Risk Free asset. d. If your middle aged client requires a portfolio with a standard deviation of 14%, what is its expected rate of return? 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31